Question

Kindness Inc. operates in the emotions industry. It found a market need for happiness and opened its doors in 1972. This was after most younger

Kindness Inc. operates in the emotions industry. It found a market need for happiness and opened its doors in 1972. This was after most younger Americans realized that other things existed. Kindness Inc., sold and still has one main product, but is looking into expending its product offerings within the next ten years. Its current source of happiness is selling HappyBits. HappyBits provide "1 smile per second for up to 4 hours" (based on current levels of vitamin C). These are not regulated by the FDA because they are not internally ingested.

After operating the last two years with losses, Kindness Inc is investigating new ways to increase profit and level the fluctuations in Quarantine vs. regular sales periods. These fluctuations are mainly based on the need and desire to make others happy during certain seasons.

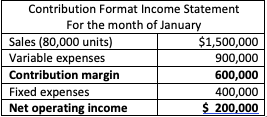

You have recently joined the organization (about 6 months ago) as a strategic business professional. Kindness Company's contribution format income statement for January is given below:

Recently, a startup technology company from Richardson, Texas, released new equipment into the emotions production market, which would allow Kindness, Inc. to automate a portion of its current operations. Variable expenses would be reduced ($2.00) per unit. However, fixed expenses would increase to a total of $560,000 each month. The contribution format income statement showing October actuals (without any new equipment) is presented above.

1. Prepare the contribution format income statement if the new equipment is purchased. Show an Amount column, a Per Unit column, and a Percent column on each statement for both current and proposed. Do not show percentages for the fixed expenses.

2. Refer to the contribution format income statements in (1) (with the new equipment) above and (2) the provided information for January actual operations, compute the following for with the new equipment and actuals as provided

a. the degree of operating leverage,

b. the break-even point in dollars, and

c. the margin of safety in both dollar and percentage terms.

3. Refer again to the data in (2) above. As the decision maker, what are you going to be considering when determining if you should purchase the new equipment (using results from your analysis above). Assume that funds are available and allocated for use of a capital project during the year (so the financial ability to purchase the equipment is not an area of concern). [you are not making a recommendation at this point]

Refer to the original January data (without the purchase of the new equipment). The VP -Operations, Mr. Milli Vanilli, makes a very moving argument to management that things are just fine with product, and that the problem is the company's strategy. The Mr. Vanilli recommends instead of purchasing additional equipment, the company's compensation marketing and sales strategy should be changed and increased funds should be allocated for advertising and promotion.

Mr. Vanilli suggest the two following items be implemented:

Instead of paying sales commissions, which are included in variable expenses, Mr. Vanilli suggests that salespersons be paid fixed salaries.

With the savings from the change in compensation structure, the company should invest in a revised advertising and promotion program.

He claims that this new approach would increase unit sales by 40 % without any change in selling price; the company's new monthly fixed expenses would be $425,000; new net operating income would increase by 20%. Mr. Vanilli ended his presentation by looking at the CEO and exclaiming, "Girl, you know it's true!"

4. Ready a revised contribution format income statement with this new information and compute the break-even point in dollar sales for the company under the new strategy. Calculate the level of sales that would be needed under the new method to generate at least the net operating income in the current January actuals.

5. Do you agree with the Mr. Vanilli's recommendation to alter the compensation plan and advertising and forego the opportunity to purchase the equipment (assume that only one of the two options can be chosen). Be sure to support your answer with concepts and terminology from the textbook/course materials. Make any relevant assumptions about the business to support your recommendation

The CEO comes to you after the meeting and is concerned that maybe neither the purchasing of the new equipment or Mr. Vanilli's strategies is the best thing for the company. She asks you, since you are new to the company and recently received your MBA from UT Dallas, to provide an additional alternative to improve the company's financial performance.

6. Based on the understanding of business and managerial accounting, what ONE additional recommendation would offer? Consider current political position as you have only been with the company for 6 months, the overall needs of the company and your personal bonus in your recommendation. Make any relevant assumptions about the business to support your recommendation.

Contribution Format Income Statement For the month of January Sales (80,000 units) $1,500,000 Variable expenses 900,000 Contribution margin 600,000 Fixed expenses 400,000 Net operating income $ 200,000 Contribution Format Income Statement For the month of January Sales (80,000 units) $1,500,000 Variable expenses 900,000 Contribution margin 600,000 Fixed expenses 400,000 Net operating income $ 200,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started