Answered step by step

Verified Expert Solution

Question

1 Approved Answer

KING COMPANY issued 96,000 shares of P25 par ordinary shares for all the outstanding stock of FISHER CORPORATION in a business combination consummated on

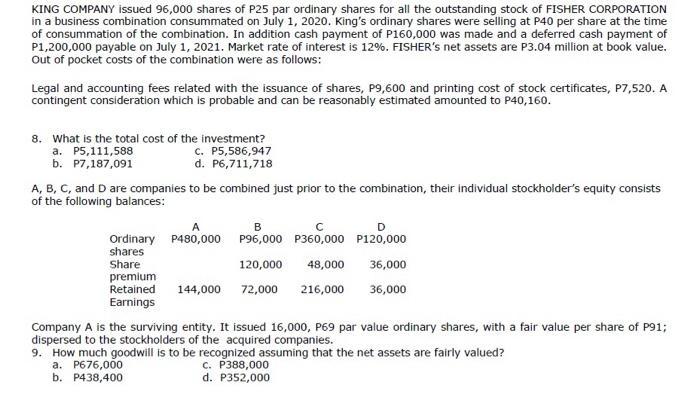

KING COMPANY issued 96,000 shares of P25 par ordinary shares for all the outstanding stock of FISHER CORPORATION in a business combination consummated on July 1, 2020. King's ordinary shares were selling at P40 per share at the time of consummation of the combination. In addition cash payment of P160,000 was made and a deferred cash payment of P1,200,000 payable on July 1, 2021. Market rate of interest is 12%. FISHER's net assets are P3.04 million at book value. Out of pocket costs of the combination were as follows: Legal and accounting fees related with the issuance of shares, P9,600 and printing cost of stock certificates, P7,520. A contingent consideration which is probable and can be reasonably estimated amounted to P40,160. 8. What is the total cost of the investment? a. P5,111,588 C. P5,586,947 b. P7,187,091 d. P6,711,718 A, B, C, and D are companies to be combined just prior to the combination, their individual stockholder's equity consists of the following balances: A B D Ordinary P480,000 P96,000 P360,000 P120,000 shares Share 120,000 48,000 36,000 premium Retained 144,000 72,000 216,000 36,000 Earnings Company A is the surviving entity. It issued 16,000, P69 par value ordinary shares, with a fair value per share of P91; dispersed to the stockholders of the acquired companies. 9. How much goodwill is to be recognized assuming that the net assets are fairly valued? a. P676,000 c. P388,000 b. P438,400 d. P352,000

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

5111588 Totat Cost of investment Orinary shares issued 96000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started