Question

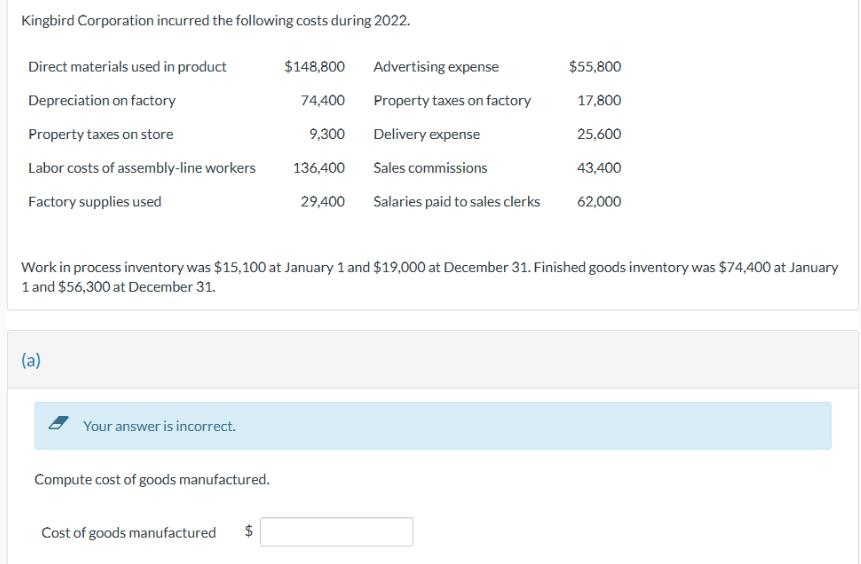

Kingbird Corporation incurred the following costs during 2022. Direct materials used in product Depreciation on factory Property taxes on store Labor costs of assembly-line

Kingbird Corporation incurred the following costs during 2022. Direct materials used in product Depreciation on factory Property taxes on store Labor costs of assembly-line workers Factory supplies used (a) Your answer is incorrect. Compute cost of goods manufactured. $148,800 74,400 9,300 Cost of goods manufactured $ 136,400 Work in process inventory was $15,100 at January 1 and $19,000 at December 31. Finished goods inventory was $74,400 at January 1 and $56,300 at December 31. 29,400 Advertising expense Property taxes on factory Delivery expense Sales commissions Salaries paid to sales clerks $55,800 17,800 25,600 43,400 62,000

Step by Step Solution

3.22 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Cost of goods manufactured Direct material...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting Tools For Business Decision Making

Authors: Jerry J. Weygandt, Paul D. Kimmel, Jill E. Mitchell

9th Edition

111970958X, 9781119709589

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App