Answered step by step

Verified Expert Solution

Question

1 Approved Answer

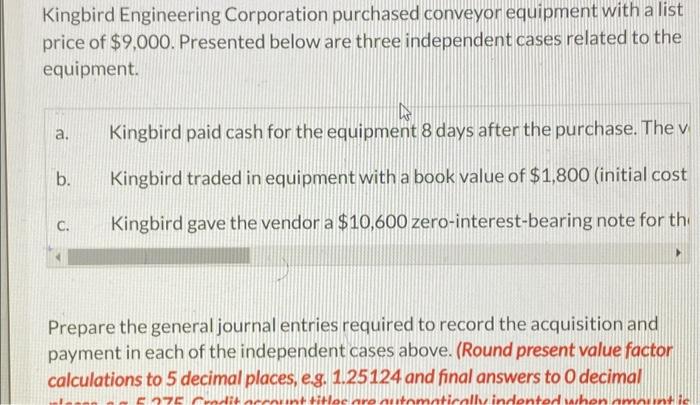

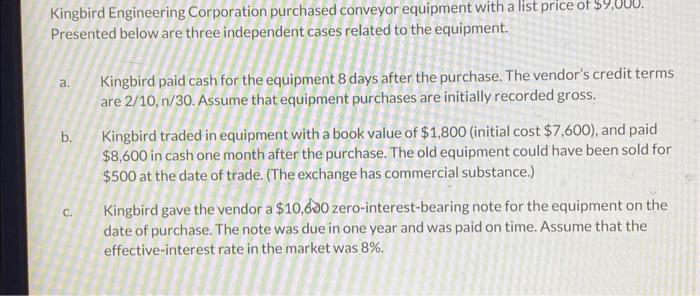

Kingbird Engineering Corporation purchased conveyor equipment with a list price of $9,000. Presented below are three independent cases related to the equipment. a. b. C.

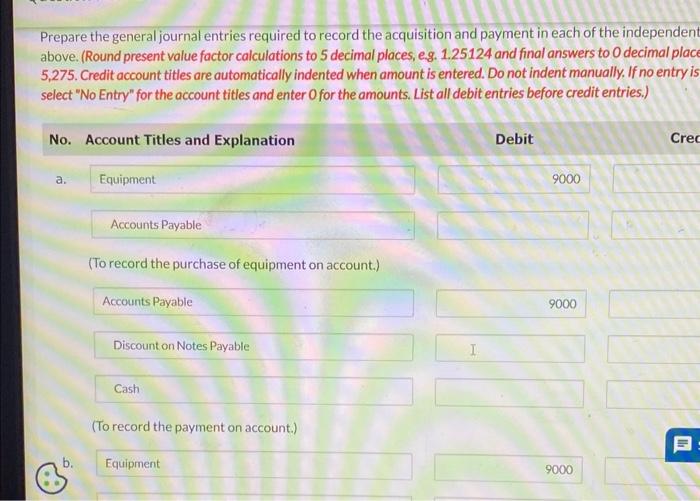

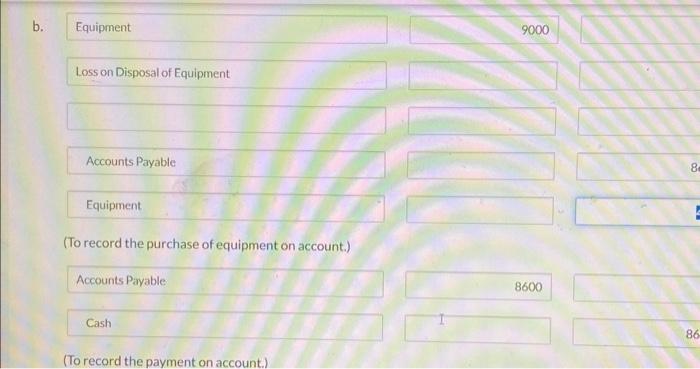

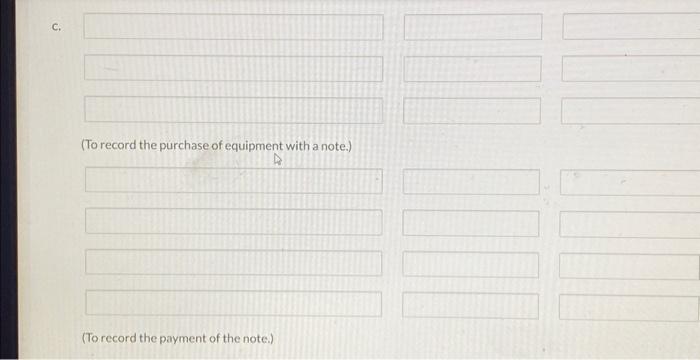

Kingbird Engineering Corporation purchased conveyor equipment with a list price of $9,000. Presented below are three independent cases related to the equipment. a. b. C. Kingbird paid cash for the equipment 8 days after the purchase. The v Kingbird traded in equipment with a book value of $1,800 (initial cost Kingbird gave the vendor a $10,600 zero-interest-bearing note for the Prepare the general journal entries required to record the acquisition and payment in each of the independent cases above. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and final answers to O decimal 5 275 dit count titles are automatically indented when ama

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started