Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kingbird Enterprises is a large Canadian company traded on the Toronto Stock Exchange. Kingbird purchased two copyrights during 2017. The first copyright was purchased

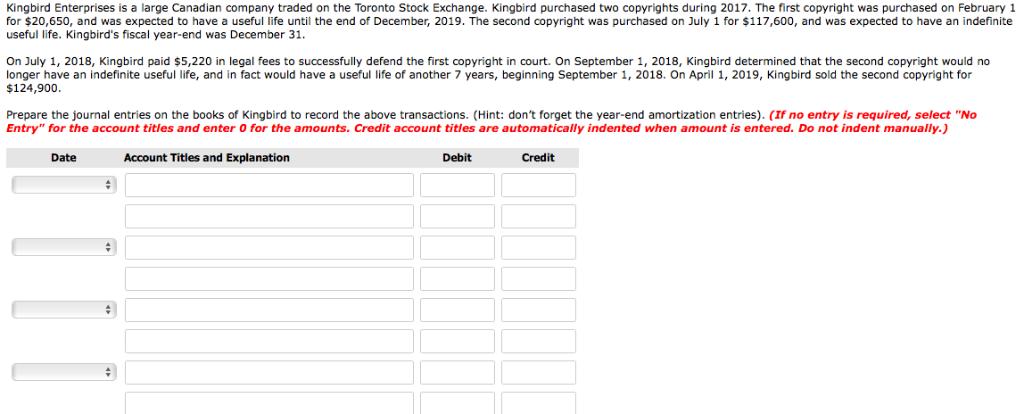

Kingbird Enterprises is a large Canadian company traded on the Toronto Stock Exchange. Kingbird purchased two copyrights during 2017. The first copyright was purchased on February 1 for $20,650, and was expected to have a useful life until the end of December, 2019. The second copyright was purchased on July 1 for $117,600, and was expected to have an indefinite useful life. Kingbird's fiscal year-end was December 31. On July 1, 2018, Kingbird paid $5,220 in legal fees to successfully defend the first copyright in court. On September 1, 2018, Kingbird determined that the second copyright would no longer have an indefinite useful life, and in fact would have a useful life of another 7 years, beginning September 1, 2018. On April 1, 2019, Kingbird sold the second copyright for $124,900. Prepare the journal entries on the books of Kingbird to record the above transactions. (Hint: don't forget the year-end amortization entries). (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Apr. 1, 2019 (To record amortization of copyrights) Apr. 1, 2019 (To record the sale of copyright 2)

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

DA Date 1 Feb 2018 20650 b cos Alc 117600 117600 Towenal enteries der Past...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started