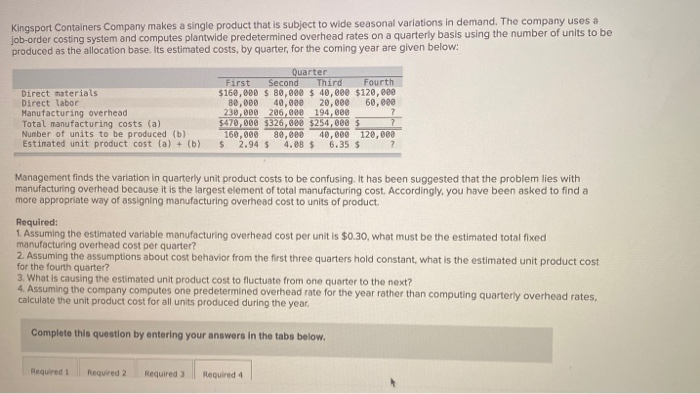

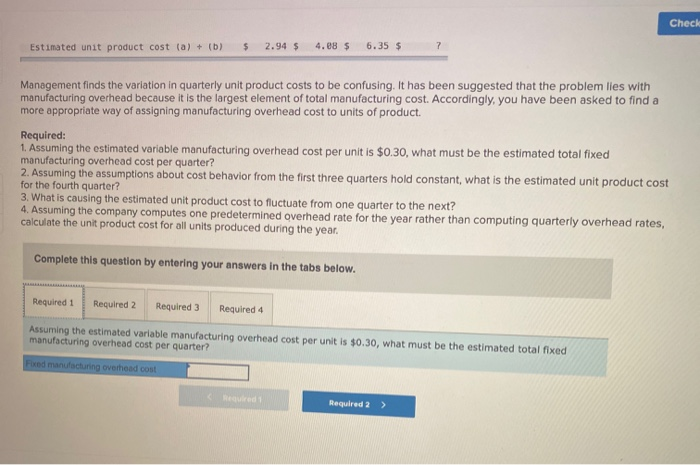

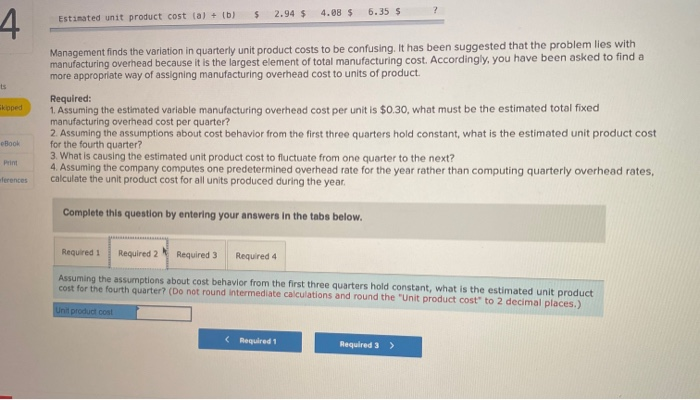

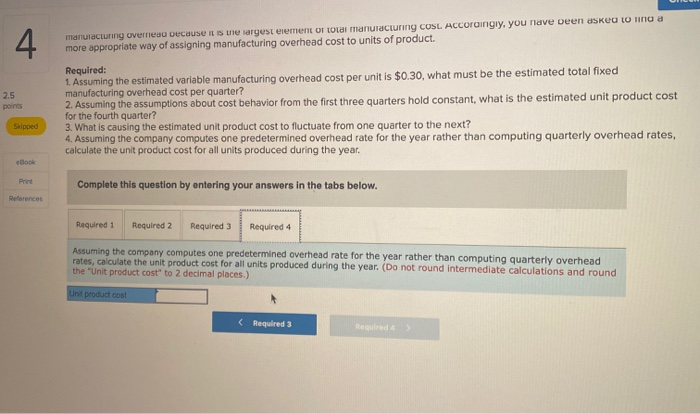

Kingsport Containers Company makes a single product that is subject to wide seasonal variations in demand. The company uses a job-order costing system and computes plantwide predetermined overhead rates on a quarterly basis using the number of units to be produced as the allocation base. Its estimated costs, by quarter, for the coming year are given below: Quarter First Second Third Fourth Direct materials $160,000 $ 80,000 $ 40,000 $120,000 Direct labor 80,000 40,000 20,000 60,000 Manufacturing overhead 230,000 206,600 194,000 2 Total manufacturing costs (a) $470,000 $326,000 $254,000 $ ? Number of units to be produced (b) 160,000 80,000 40,000 120,000 Estimated unit product cost (a) + (b) $ 2.945 4.08 $ 6.35 $ 2 Management finds the variation in quarterly unit product costs to be confusing. It has been suggested that the problem lies with manufacturing overhead because it is the largest element of total manufacturing cost. Accordingly, you have been asked to find a more appropriate way of assigning manufacturing overhead cost to units of product Required: 1. Assuming the estimated variable manufacturing overhead cost per unit is $0.30, what must be the estimated total fixed manufacturing overhead cost per quarter? 2. Assuming the assumptions about cost behavior from the first three quarters hold constant, what is the estimated unit product cost for the fourth quarter? 3. What is causing the estimated unit product cost to fluctuate from one quarter to the next? 4. Assuming the company computes one predetermined overhead rate for the year rather than computing quarterly overhead rates, calculate the unit product cost for all units produced during the year. Complete this question by entering your answers in the tabs below. Required Required 2 Required Required 4 Check Estimated unit product cost (a) + (b) $ 2.94 $ 4.08 $ 6.35 $ Management finds the variation in quarterly unit product costs to be confusing. It has been suggested that the problem lies with manufacturing overhead because it is the largest element of total manufacturing cost. Accordingly, you have been asked to find a more appropriate way of assigning manufacturing overhead cost to units of product. Required: 1. Assuming the estimated variable manufacturing overhead cost per unit is $0.30, what must be the estimated total fixed manufacturing overhead cost per quarter? 2. Assuming the assumptions about cost behavior from the first three quarters hold constant, what is the estimated unit product cost for the fourth quarter? 3. What is causing the estimated unit product cost to fluctuate from one quarter to the next? 4. Assuming the company computes one predetermined overhead rate for the year rather than computing quarterly overhead rates, calculate the unit product cost for all units produced during the year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Assuming the estimated variable manufacturing overhead cost per unit is $0.30, what must be the estimated total fixed manufacturing overhead cost per quarter? Fored manufacturing overhead cost Required 2 > $ 2.94 $ ? 4.08 $ 6.35 $ 4. Estimated unit product cost (a) + (b) ts koped Management finds the variation in quarterly unit product costs to be confusing. It has been suggested that the problem lies with manufacturing overhead because it is the largest element of total manufacturing cost. Accordingly, you have been asked to find a more appropriate way of assigning manufacturing overhead cost to units of product. Required: 1. Assuming the estimated variable manufacturing overhead cost per unit is $0.30, what must be the estimated total fixed manufacturing overhead cost per quarter? 2. Assuming the assumptions about cost behavior from the first three quarters hold constant, what is the estimated unit product cost for the fourth quarter? 3. What is causing the estimated unit product cost to fluctuate from one quarter to the next? 4. Assuming the company computes one predetermined overhead rate for the year rather than computing quarterly overhead rates, calculate the unit product cost for all units produced during the year Book ferences Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Assuming the assumptions about cost behavior from the first three quarters hold constant, what is the estimated unit product cost for the fourth quarter? (Do not round intermediate calculations and round the "Unit product cost" to 2 decimal places.) Unit product cost 4. manulacturing overeat because it is the largest element or total manuacturing COSL ACCOraingly, you have been asko O Inca more appropriate way of assigning manufacturing overhead cost to units of product. 2.5 points Required: 1. Assuming the estimated variable manufacturing overhead cost per unit is $0.30, what must be the estimated total fixed manufacturing overhead cost per quarter? 2. Assuming the assumptions about cost behavior from the first three quarters hold constant, what is the estimated unit product cost for the fourth quarter? 3. What is causing the estimated unit product cost to fluctuate from one quarter to the next? 4. Assuming the company computes one predetermined overhead rate for the year rather than computing quarterly overhead rates, calculate the unit product cost for all units produced during the year. Skipped Book Print Complete this question by entering your answers in the tabs below. References Required 1 Required 2 Required 3 Required 4 Assuming the company computes one predetermined overhead rate for the year rather than computing quarterly overhead rates, calculate the unit product cost for all units produced during the year. (Do not round Intermediate calculations and round the "Unit product cost to 2 decimal places.) Un product cost