Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kingston Corporation's accumulated depreciation-equipment account increased by $6,700, while $4,300 of patent amortization was recognized between balance sheet dates. There were no purchases or

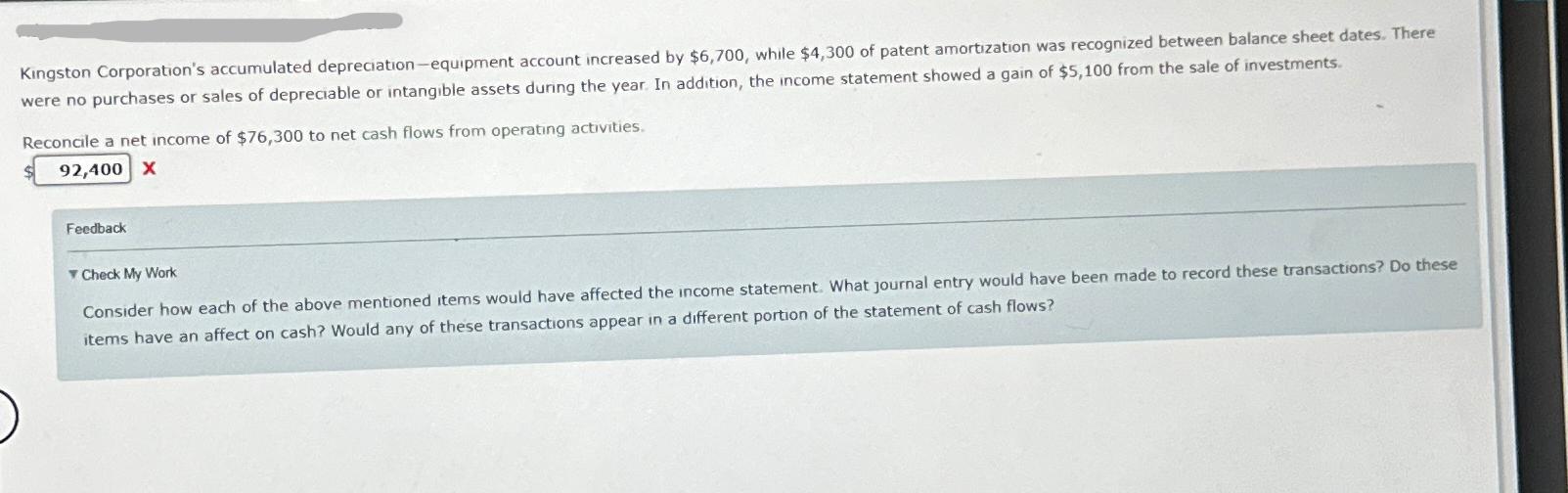

Kingston Corporation's accumulated depreciation-equipment account increased by $6,700, while $4,300 of patent amortization was recognized between balance sheet dates. There were no purchases or sales of depreciable or intangible assets during the year. In addition, the income statement showed a gain of $5,100 from the sale of investments. Reconcile a net income of $76,300 to net cash flows from operating activities. 92,400 X Feedback Check My Work Consider how each of the above mentioned items would have affected the income statement. What journal entry would have been made to record these transactions? Do these items have an affect on cash? Would any of these transactions appear in a different portion of the statement of cash flows?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started