Answered step by step

Verified Expert Solution

Question

1 Approved Answer

KitchenPaid (KP) is a U.S. manufacturer of upscale small kitchen appliances. As a result of an acquisition made in 2013 KP also has a

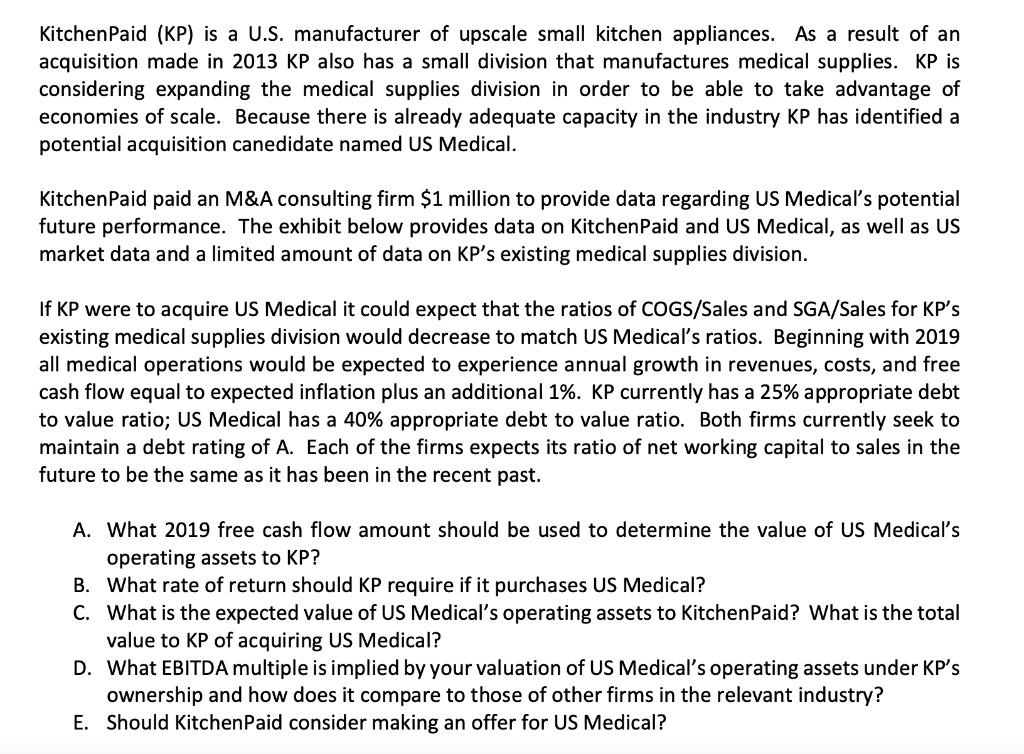

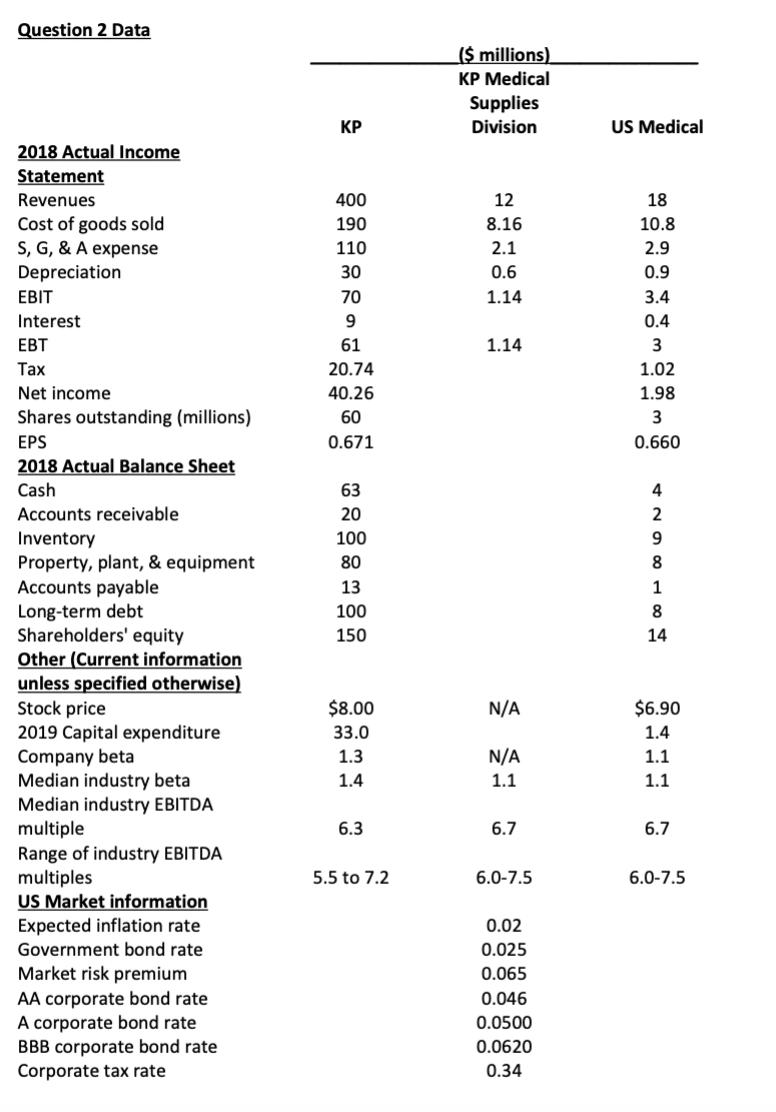

KitchenPaid (KP) is a U.S. manufacturer of upscale small kitchen appliances. As a result of an acquisition made in 2013 KP also has a small division that manufactures medical supplies. KP is considering expanding the medical supplies division in order to be able to take advantage of economies of scale. Because there is already adequate capacity in the industry KP has identified a potential acquisition canedidate named US Medical. KitchenPaid paid an M&A consulting firm $1 million to provide data regarding US Medical's potential future performance. The exhibit below provides data on Kitchen Paid and US Medical, as well as US market data and a limited amount of data on KP's existing medical supplies division. If KP were to acquire US Medical it could expect that the ratios of COGS/Sales and SGA/Sales for KP's existing medical supplies division would decrease to match US Medical's ratios. Beginning with 2019 all medical operations would be expected to experience annual growth in revenues, costs, and free cash flow equal to expected inflation plus an additional 1%. KP currently has a 25% appropriate debt to value ratio; US Medical has a 40% appropriate debt to value ratio. Both firms currently seek to maintain a debt rating of A. Each of the firms expects its ratio of net working capital to sales in the future to be the same as it has been in the recent past. A. What 2019 free cash flow amount should be used to determine the value of US Medical's operating assets to KP? B. What rate of return should KP require if it purchases US Medical? C. What is the expected value of US Medical's operating assets to KitchenPaid? What is the total value to KP of acquiring US Medical? D. What EBITDA multiple is implied by your valuation of US Medical's operating assets under KP's ownership and how does it compare to those of other firms in the relevant industry? E. Should Kitchen Paid consider making an offer for US Medical? Question 2 Data 2018 Actual Income Statement Revenues Cost of goods sold S, G, & A expense Depreciation EBIT Interest EBT Tax Net income Shares outstanding (millions) EPS 2018 Actual Balance Sheet Cash Accounts receivable Inventory Property, plant, & equipment Accounts payable Long-term debt Shareholders' equity Other (Current information unless specified otherwise) Stock price 2019 Capital expenditure Company beta Median industry beta Median industry EBITDA multiple Range of industry EBITDA multiples US Market information Expected inflation rate Government bond rate Market risk premium AA corporate bond rate A corporate bond rate BBB corporate bond rate Corporate tax rate KP 400 190 110 30 70 9 61 20.74 40.26 60 0.671 63 20 100 80 13 100 150 $8.00 33.0 1.3 1.4 6.3 5.5 to 7.2 ($ millions) KP Medical Supplies Division 12 8.16 2.1 0.6 1.14 1.14 N/A N/A 1.1 6.7 6.0-7.5 0.02 0.025 0.065 0.046 0.0500 0.0620 0.34 US Medical 18 10.8 2.9 0.9 3.4 0.4 3 1.02 1.98 3 0.660 42981H $6.90 1.4 1.1 1.1 6.7 6.0-7.5

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

A The 2019 free cash flow amount that should be used to determine the value of US Medicals operating ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started