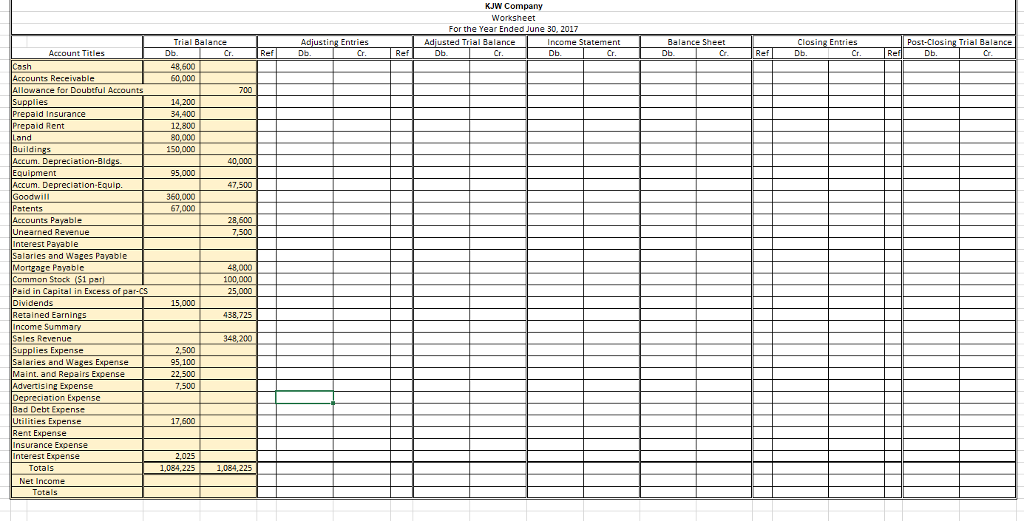

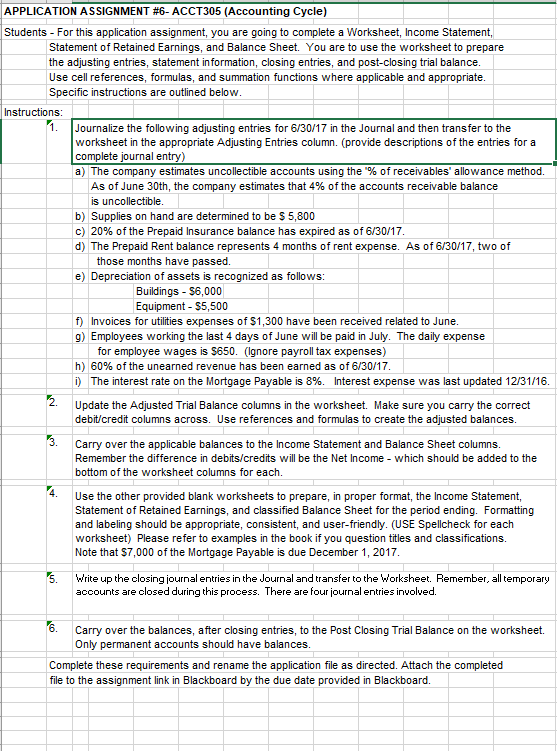

KJW Company Worksheet For the Year Ended June 30, 2017 Trial Balance Adjusting Entries Cr Adjusted Trial Balance Income Statement Db Balence Sheet Cr Closing Entries Db Post-Closing Trial Balance Account Titles Cr Ref Db Cr Cr Db Ref Db Cr. 48,600 60,000 Accounts Receivable Allowance for Doubtful Accounts 700 14,200 34,400 12,800 80,000 150,000 Prepaid Insurance Prepaid Rent and Buildi Accum. Depreciation-Bld 40,000 95,000 Accum. Depreciation-Equip 47,500 360,000 67,000 Patents Accounts Payable Unearned Revenue 2B,600 7,500 nterest Payable Salaries and Wages Payable 48,000 100,000 25,000 bic Common Stock ($1 Paid in Capital in Excess of Dividends Retained Earnings Income Summa Soles Revenue 15,000 438,725 2,500 95,100 Salaries and Wages Ex Maint. and Repairs Expense Advertising Expense Depreciation Expense Bad Debt Expense Utilities Expense ,500 17,600 Insurance Expense Interest Expense Totals 1,084,225 1,084,225 Net Income Totals APPLICATION ASSIGNMENT #6-ACCT305 (Accounting Cycle) Students For this application assignment, you are going to complete a Worksheet, Income Statement Statement of Retained Earnings, and Balance Sheet. You are to use the worksheet to prepare the adjusting entries, statement information, closing entries, and post-closing trial balance Use cell references, formulas, and summation functions where applicable and appropriate Specific instructions are outlined below Instructions 1 Journalize the following adjusting entries for 6/30/17 in the Journal and then transfer to the worksheet in the appropriate Adjusting Entries column. (provide descriptions of the entries for a complete journal entry) a) The company estimates uncollectible accounts using the % of receivables, allowance method. As of June 30th, the company estimates that 4% of the accounts receivable balance is uncollectible b) Supplies on hand are determined to be S 5,800 c) 20% of the Prepaid insurance balance has expired as of 6/30/17 d) The Prepaid Rent balance represents 4 months of rent expense. As of 6/30/17, two of those months have passed e) Depreciation of assets is recognized as follows Buildings $6,000 Equipment $5,500 f) Invoices for utilities expenses of S1,300 have been received related to June g) Employees working the last 4 days of June will be paid in July. The daily expense for employee wages is S650. (lgnore payroll tax expenses) h) 60% of the unearned revenue has been earned as of 6/30/17 i) The interest rate on the Mortgage Payable is 8%. Interest expense was last updated 12/31/16 Update the Adjusted Trial Balance columns in the worksheet. Make sure you carry the correct debit/credit columns across. Use references and formulas to create the adjusted balances Carry over the applicable balances to the Income Statement and Balance Sheet columns Remember the difference in debits/credits will be the Net Income which should be added to the bottom of the worksheet columns for each. 4. Use the other provided blank worksheets to prepare, in proper format, the Income Statement, Statement of Retained Earnings, and classified Balance Sheet for the period ending. Formatting and labeling should be appropriate, consistent, and user-friendly. (USE Spellcheck for each worksheet) Please refer to examples in the book if you question titles and classifications Note that $7,000 of the Mortgage Payable is due December 1, 2017 Write up the closing journal entries in the Journal and transfer to the Worksheet. Remember, all temporary accounts are closed during this process. There are four journal entries involved. 5. Carry over the balances, after closing entries, to the Post Closing Trial Balance on the worksheet. Only permanent accounts should have balances Complete these requirements and rename the application file as directed. Attach the completed file to the assignment link in Blackboard by the due date provided in Blackboard