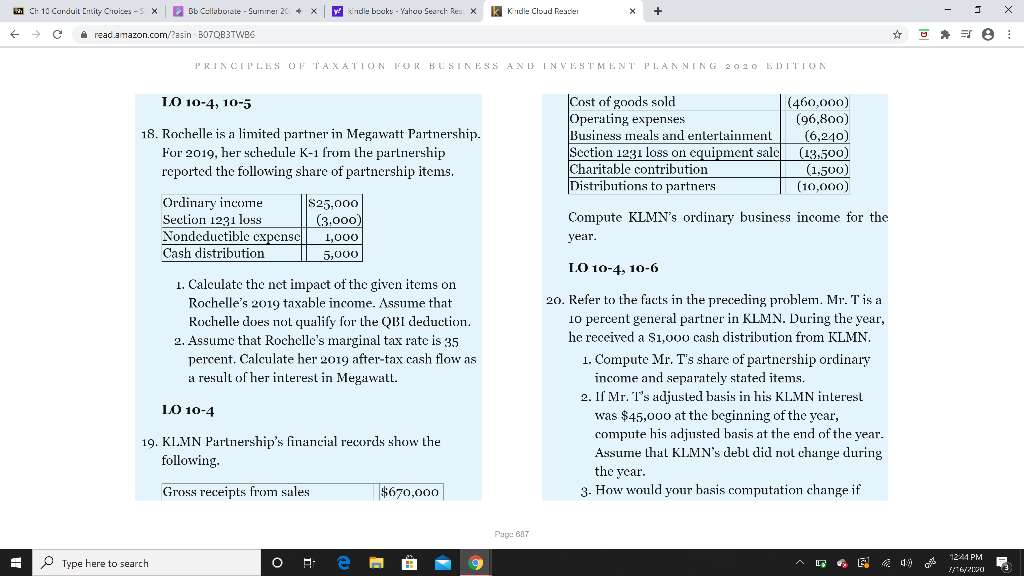

KLMN Partnerships financial records show the following: KLMN Partnerships financial records show the following: | | sales revenue | $ 500,000.00 | | | selling expenses | $ 200,000.00 | | | depreciation | $ 30,000.00 | | | long term capital gain | $ 9,000.00 | | | nondeductible expenses | $ 2,000.00 | | | partnership debts beginning of year | $ 100,000.00 | | | partnership debts end of year | $ 120,000.00 | | | | | | | | | | | | | | | | | |

| Refer to the facts in the preceding problem. Mr. T is a 10 percent general partner in KLMN. During the year, he received a $1000 cash distribution from KLMN. | | | |

| | | | | | | | | | | | | | | | |

| A. Compute Mr. T's share of partnership ordinary income and seperately stated items. | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| B. If Mr. T's adjusted basis in his KLMN interest was $45000 at the beginning of the year, compute his adjusted basis at the end of the year. Assume that KLMN's debt did not change during the year. |

| | | | | | | | | | | | | | | | |

| C. How would your basis computation change if KLMN's debt at the end of the year was $28000 more than its debt at the beginning of the year? | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Ci 10 CorduitEntity Choices - S X Bb Collaborale - Suinner 20 + x Y? Kindle books - Yahoo Search Res K Kudle Cloud Pescer I e read.amazon.com/?asin-B07QB3TWB6 =; PRINCIPLES OF TAXATION FOR BUSINESS AND INVESTMENT PLANNING 2020 EDITION LO 10-4, 10-5 18. Rochelle is a limited partner in Megawatt Partnership. For 2019, her schedule K-1 from the partnership reported the following share of partnership items. Cost of goods sold Operating expenses Business meals and entertainment Section 1231 loss on equipment sale Charitable contribution Distributions to partners (460,000) (96,800) (6,240) (13,500) (1.500) (10,000) Ordinary income ||$25,000 Section 1231 loss (3.000) Nondeductible expense 1,000 Cash distribution 5,000 Compute KLMN's ordinary business income for the year. LO 10-4, 10-6 1. Calculate the nct impact of the given items on Rochelle's 2019 taxable income. Assume that Rochelle does not qualify for the QBI deduction. 2. Assume that Rochelle's marginal tax rate is 35 percent. Calculate her 2019 after-tax cash flow as a result of her interest in Megawatt. 20. Refer to the facts in the preceding problem. Mr. T is a 10 percent general partner in KLMN. During the year, he received a $1,000 cash distribution from KLMN. 1. Compute Mr. T's share of partnership ordinary income and separately stated items. 2. Il Mr. Ts adjusted basis in his KLMN interest was $45,000 at the beginning of the year, compute his adjusted basis at the end of the year. Assume that KLMN's debt did not change during the year. 3. How would your basis computation change if 10 10-4 19. KLMN Partnership's financial records show the following Gross receipts from sales $670,000 Page 607 12:44 PM Type here to search O - L 19 os P 1/16/21 Ci 10 CorduitEntity Choices - S X Bb Collaborale - Suinner 20 + x Y? Kindle books - Yahoo Search Res K Kudle Cloud Pescer I e read.amazon.com/?asin-B07QB3TWB6 =; PRINCIPLES OF TAXATION FOR BUSINESS AND INVESTMENT PLANNING 2020 EDITION LO 10-4, 10-5 18. Rochelle is a limited partner in Megawatt Partnership. For 2019, her schedule K-1 from the partnership reported the following share of partnership items. Cost of goods sold Operating expenses Business meals and entertainment Section 1231 loss on equipment sale Charitable contribution Distributions to partners (460,000) (96,800) (6,240) (13,500) (1.500) (10,000) Ordinary income ||$25,000 Section 1231 loss (3.000) Nondeductible expense 1,000 Cash distribution 5,000 Compute KLMN's ordinary business income for the year. LO 10-4, 10-6 1. Calculate the nct impact of the given items on Rochelle's 2019 taxable income. Assume that Rochelle does not qualify for the QBI deduction. 2. Assume that Rochelle's marginal tax rate is 35 percent. Calculate her 2019 after-tax cash flow as a result of her interest in Megawatt. 20. Refer to the facts in the preceding problem. Mr. T is a 10 percent general partner in KLMN. During the year, he received a $1,000 cash distribution from KLMN. 1. Compute Mr. T's share of partnership ordinary income and separately stated items. 2. Il Mr. Ts adjusted basis in his KLMN interest was $45,000 at the beginning of the year, compute his adjusted basis at the end of the year. Assume that KLMN's debt did not change during the year. 3. How would your basis computation change if 10 10-4 19. KLMN Partnership's financial records show the following Gross receipts from sales $670,000 Page 607 12:44 PM Type here to search O - L 19 os P 1/16/21

KLMN Partnerships financial records show the following:

KLMN Partnerships financial records show the following: