Answered step by step

Verified Expert Solution

Question

1 Approved Answer

KM Case Study #1 [LO 6-5, LO 6-9] Susan Lo picked up the phone and called her boss, Phil Takata, the vice president of marketing

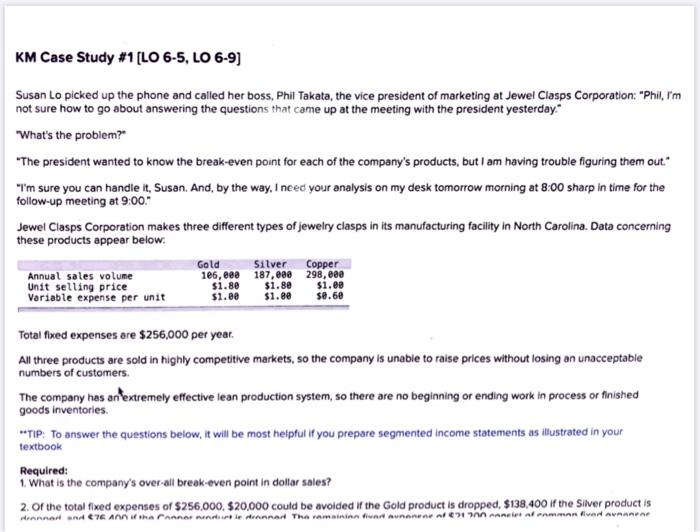

KM Case Study #1 [LO 6-5, LO 6-9]

Susan Lo picked up the phone and called her boss, Phil Takata, the vice president of marketing at Jewel Clasps Corporation: Phil, Im not sure how to go about answering the questions that came up at the meeting with the president yesterday.

"What's the problem?"

The president wanted to know the break-even point for each of the companys products, but I am having trouble figuring them out.

Im sure you can handle it, Susan. And, by the way, I need your analysis on my desk tomorrow morning at 8:00 sharp in time for the follow-up meeting at 9:00.

Jewel Clasps Corporation makes three different types of jewelry clasps in its manufacturing facility in North Carolina. Data concerning these products appear below:

Gold Silver Copper

Annual sales volume 106,000 187,000 298,000

Unit selling price $ 1.80 $ 1.80 $ 1.00

Variable expense per unit $ 1.00 $ 1.00 $ 0.60

Total fixed expenses are $256,000 per year.

All three products are sold in highly competitive markets, so the company is unable to raise prices without losing an unacceptable numbers of customers.

The company has an extremely effective lean production system, so there are no beginning or ending work in process or finished goods inventories.

**TIP: To answer the questions below, it will be most helpful if you prepare segmented income statements as illustrated in your textbook

Required:

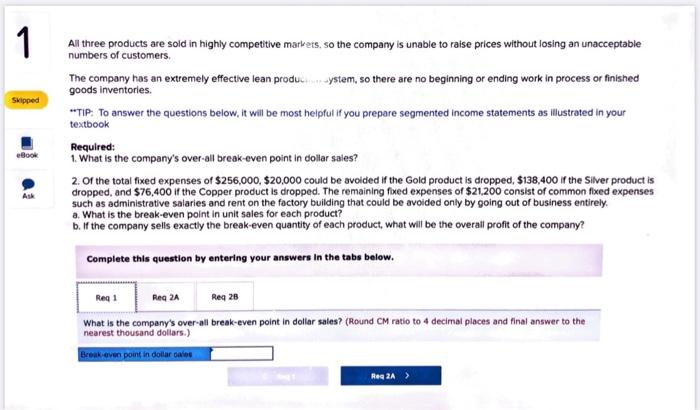

1. What is the companys over-all break-even point in dollar sales?

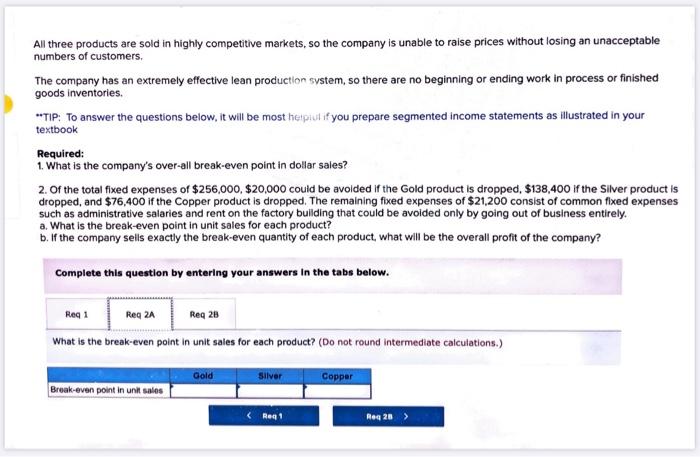

2. Of the total fixed expenses of $256,000, $20,000 could be avoided if the Gold product is dropped, $138,400 if the Silver product is dropped, and $76,400 if the Copper product is dropped. The remaining fixed expenses of $21,200 consist of common fixed expenses such as administrative salaries and rent on the factory building that could be avoided only by going out of business entirely.

a. What is the break-even point in unit sales for each product?

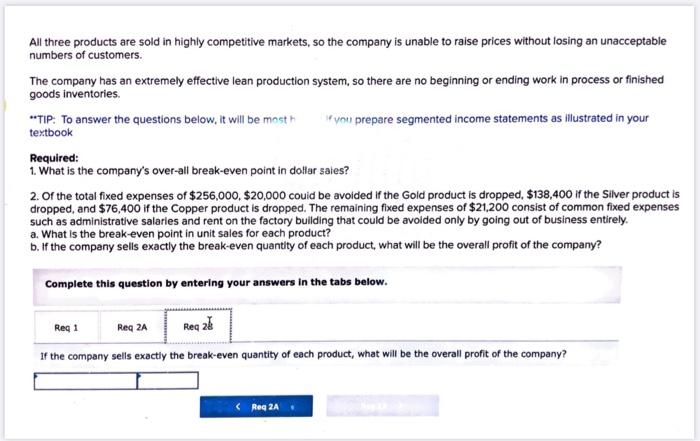

b. If the company sells exactly the break-even quantity of each product, what will be the overall profit of the company?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started