Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Knight Corp. is a manufacturer of truck trailers. On January 1,20X0, Knight Corp. leases fifty trailers to Day Express Company under a six-year non-cancelable lease

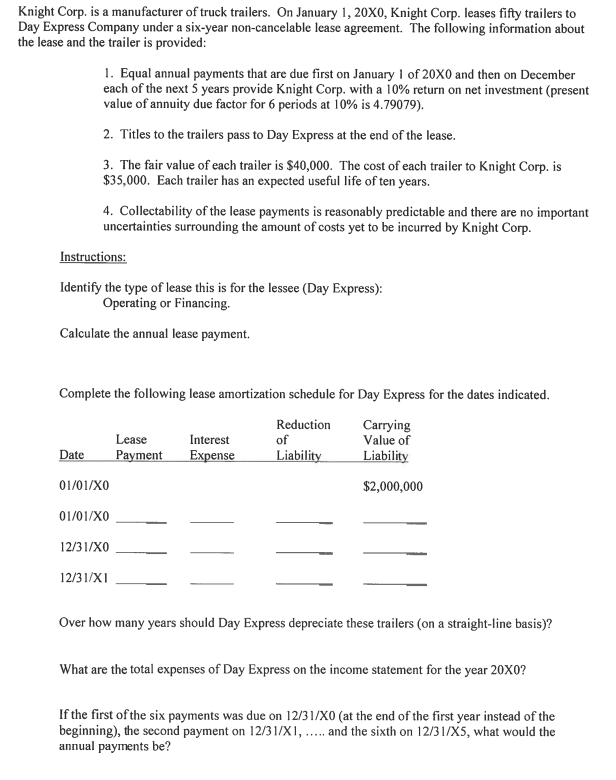

Knight Corp. is a manufacturer of truck trailers. On January 1,20X0, Knight Corp. leases fifty trailers to Day Express Company under a six-year non-cancelable lease agreement. The following information about the lease and the trailer is provided: 1. Equal annual payments that are due first on January 1 of 20X0 and then on December each of the next 5 years provide Knight Corp. with a 10% return on net investment (present value of annuity due factor for 6 periods at 10% is 4.79079 ). 2. Titles to the trailers pass to Day Express at the end of the lease. 3. The fair value of each trailer is $40,000. The cost of each trailer to Knight Corp. is $35,000. Each trailer has an expected useful life of ten years. 4. Collectability of the lease payments is reasonably predictable and there are no important uncertainties surrounding the amount of costs yet to be incurred by Knight Corp. Instructions: Identify the type of lease this is for the lessee (Day Express): Operating or Financing. Calculate the annual lease payment. Complete the following lease amortization schedule for Day Express for the dates indicated. Over how many years should Day Express depreciate these trailers (on a straight-line basis)? What are the total expenses of Day Express on the income statement for the year 200 ? If the first of the six payments was due on 12/31/X0 (at the end of the first year instead of the beginning), the second payment on 12/31/X1, and the sixth on 12/31/X5, what would the annual payments be

Knight Corp. is a manufacturer of truck trailers. On January 1,20X0, Knight Corp. leases fifty trailers to Day Express Company under a six-year non-cancelable lease agreement. The following information about the lease and the trailer is provided: 1. Equal annual payments that are due first on January 1 of 20X0 and then on December each of the next 5 years provide Knight Corp. with a 10% return on net investment (present value of annuity due factor for 6 periods at 10% is 4.79079 ). 2. Titles to the trailers pass to Day Express at the end of the lease. 3. The fair value of each trailer is $40,000. The cost of each trailer to Knight Corp. is $35,000. Each trailer has an expected useful life of ten years. 4. Collectability of the lease payments is reasonably predictable and there are no important uncertainties surrounding the amount of costs yet to be incurred by Knight Corp. Instructions: Identify the type of lease this is for the lessee (Day Express): Operating or Financing. Calculate the annual lease payment. Complete the following lease amortization schedule for Day Express for the dates indicated. Over how many years should Day Express depreciate these trailers (on a straight-line basis)? What are the total expenses of Day Express on the income statement for the year 200 ? If the first of the six payments was due on 12/31/X0 (at the end of the first year instead of the beginning), the second payment on 12/31/X1, and the sixth on 12/31/X5, what would the annual payments be Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started