Question

Knob, Incorporated, is a nationwide distributor of furniture hardware. The company now uses a central billing system for credit sales of $219.60 million annually. First

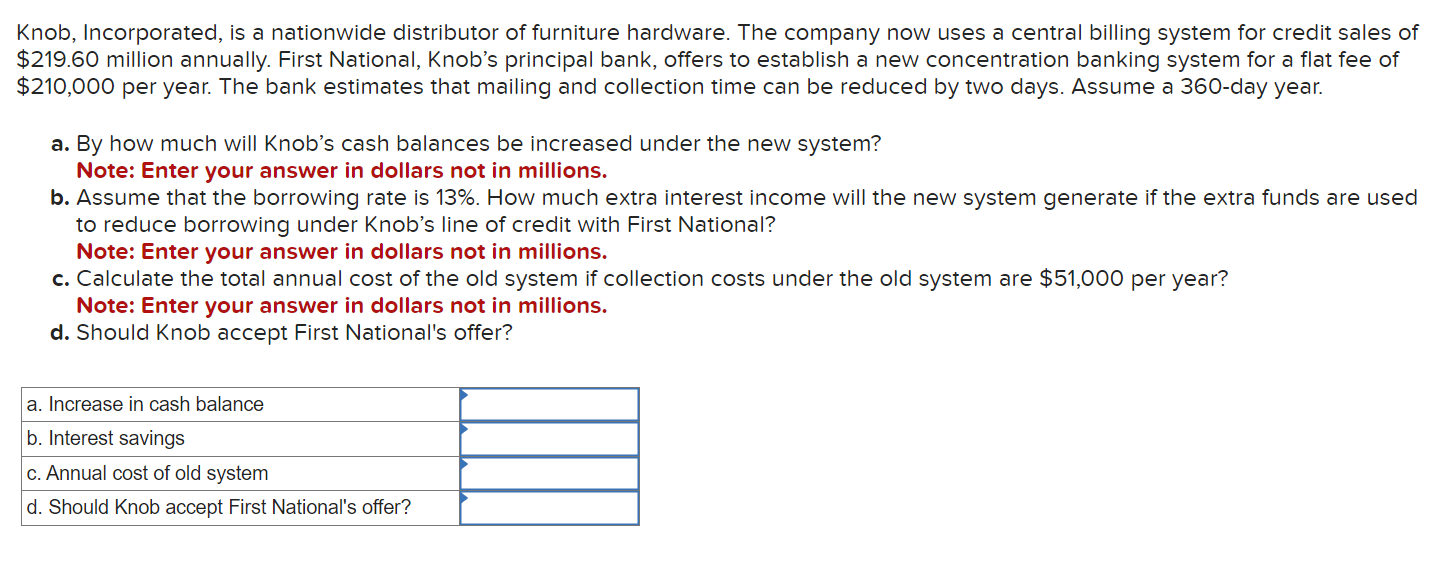

Knob, Incorporated, is a nationwide distributor of furniture hardware. The company now uses a central billing system for credit sales of $219.60 million annually. First National, Knobs principal bank, offers to establish a new concentration banking system for a flat fee of $210,000 per year. The bank estimates that mailing and collection time can be reduced by two days. Assume a 360-day year.

By how much will Knobs cash balances be increased under the new system?

Note: Enter your answer in dollars not in millions.

Assume that the borrowing rate is 13%. How much extra interest income will the new system generate if the extra funds are used to reduce borrowing under Knobs line of credit with First National?

Note: Enter your answer in dollars not in millions.

Calculate the total annual cost of the old system if collection costs under the old system are $51,000 per year?

Note: Enter your answer in dollars not in millions.

Should Knob accept First National's offer?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started