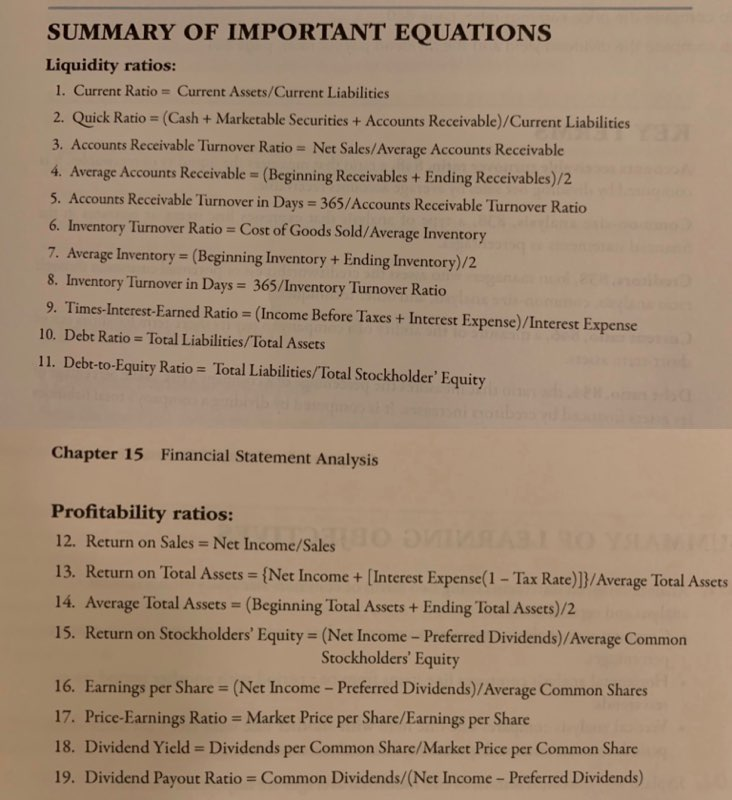

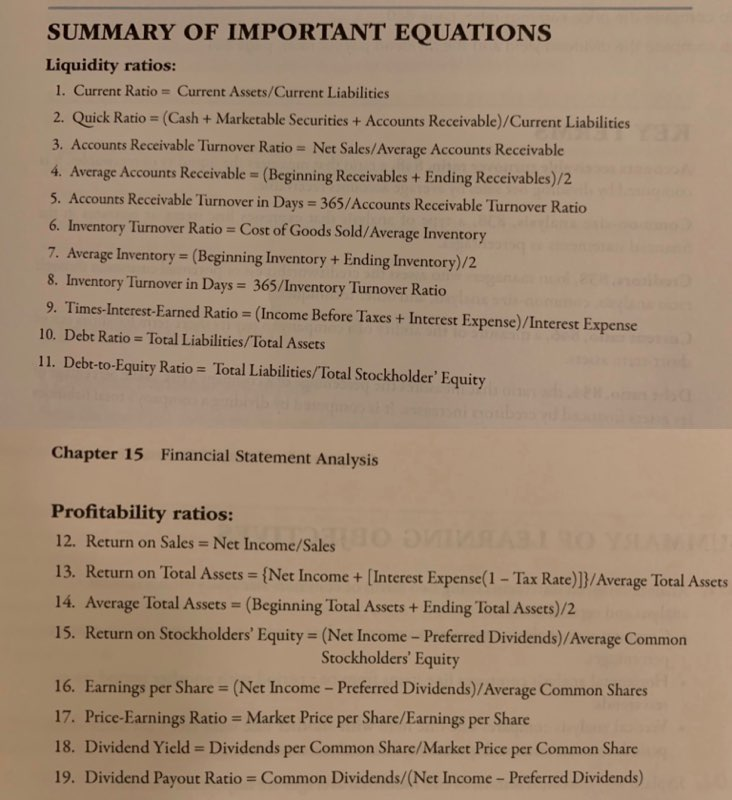

Knowing how to read financial statements and computing/analyzing financial ratios is an an important skill in business. Perform the following analysis: 1. Choose a publicly traded American Company. 2. Using your publicly traded American Company's latest financial statements, calculate at least two financial ratios (one from the Liquidity Ratios, one from the Profitability Ratios). A summary of the ratios are shown on page 863-864 in the textbook. [Pictures of the pages are attached below] 3. Interpret your calculations and discuss what the calculation might mean for the company. 4. Attach a copy of the company's financial statements to your discussion post. ***Please exclude the following companies: Amazon, Apple, Microsoft, Starbucks, Tesla, Facebook, Snap, Target, Walmart, Chevron, Coke, Pepsi, Nike, Disney and Google***

4. Attach a copy of the company's financial statements to your discussion post. ***Please exclude the following companies: Amazon, Apple, Microsoft, Starbucks, Tesla, Facebook, Snap, Target, Walmart, Chevron, Coke, Pepsi, Nike, Disney and Google***

SUMMARY OF IMPORTANT EQUATIONS Liquidity ratios: 1. Current Ratio - Current Assets/Current Liabilities 2. Quick Ratio = (Cash + Marketable Securities + Accounts Receivable)/Current Liabilities 3. Accounts Receivable Turnover Ratio = Net Sales/Average Accounts Receivable 4. Average Accounts Receivable = (Beginning Receivables + Ending Receivables)/2 5. Accounts Receivable Turnover in Days = 365/Accounts Receivable Turnover Ratio 6. Inventory Turnover Ratio = Cost of Goods Sold/Average Inventory 7. Average Inventory = (Beginning Inventory + Ending Inventory)/2 8. Inventory Turnover in Days = 365/Inventory Turnover Ratio 9. Times Interest-Earned Ratio = (Income Before Taxes + Interest Expense)/Interest Expense 10. Debt Ratio = Total Liabilities/Total Assets 11. Debt-to-Equity Ratio = Total Liabilities/Total Stockholder' Equity Chapter 15 Financial Statement Analysis Profitability ratios: 12. Return on Sales = Net Income/Sales 13. Return on Total Assets = {Net Income + [Interest Expense(1 - Tax Rate)]}/Average Total Assets 14. Average Total Assets = (Beginning Total Assets + Ending Total Assets)/2! 15. Return on Stockholders' Equity = (Net Income - Preferred Dividends)/Average Common Stockholders' Equity 16. Earnings per Share = (Net Income - Preferred Dividends)/Average Common Shares 17. Price-Earnings Ratio = Market Price per Share/Earnings per Share 18. Dividend Yield = Dividends per Common Share/Market Price per Common Share 19. Dividend Payout Ratio = Common Dividends/(Net Income - Preferred Dividends) SUMMARY OF IMPORTANT EQUATIONS Liquidity ratios: 1. Current Ratio - Current Assets/Current Liabilities 2. Quick Ratio = (Cash + Marketable Securities + Accounts Receivable)/Current Liabilities 3. Accounts Receivable Turnover Ratio = Net Sales/Average Accounts Receivable 4. Average Accounts Receivable = (Beginning Receivables + Ending Receivables)/2 5. Accounts Receivable Turnover in Days = 365/Accounts Receivable Turnover Ratio 6. Inventory Turnover Ratio = Cost of Goods Sold/Average Inventory 7. Average Inventory = (Beginning Inventory + Ending Inventory)/2 8. Inventory Turnover in Days = 365/Inventory Turnover Ratio 9. Times Interest-Earned Ratio = (Income Before Taxes + Interest Expense)/Interest Expense 10. Debt Ratio = Total Liabilities/Total Assets 11. Debt-to-Equity Ratio = Total Liabilities/Total Stockholder' Equity Chapter 15 Financial Statement Analysis Profitability ratios: 12. Return on Sales = Net Income/Sales 13. Return on Total Assets = {Net Income + [Interest Expense(1 - Tax Rate)]}/Average Total Assets 14. Average Total Assets = (Beginning Total Assets + Ending Total Assets)/2! 15. Return on Stockholders' Equity = (Net Income - Preferred Dividends)/Average Common Stockholders' Equity 16. Earnings per Share = (Net Income - Preferred Dividends)/Average Common Shares 17. Price-Earnings Ratio = Market Price per Share/Earnings per Share 18. Dividend Yield = Dividends per Common Share/Market Price per Common Share 19. Dividend Payout Ratio = Common Dividends/(Net Income - Preferred Dividends)

4. Attach a copy of the company's financial statements to your discussion post. ***Please exclude the following companies: Amazon, Apple, Microsoft, Starbucks, Tesla, Facebook, Snap, Target, Walmart, Chevron, Coke, Pepsi, Nike, Disney and Google***

4. Attach a copy of the company's financial statements to your discussion post. ***Please exclude the following companies: Amazon, Apple, Microsoft, Starbucks, Tesla, Facebook, Snap, Target, Walmart, Chevron, Coke, Pepsi, Nike, Disney and Google***