Question

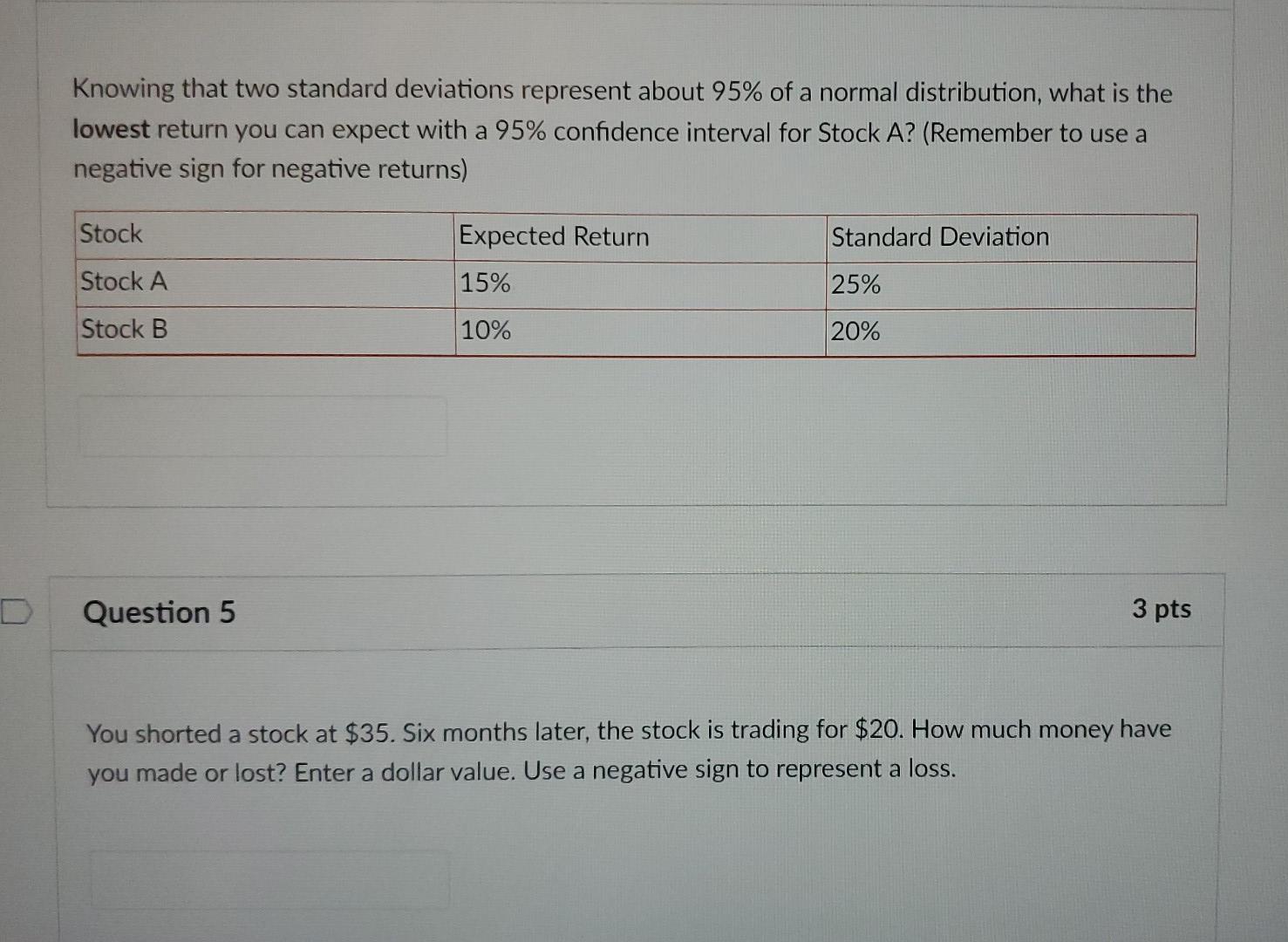

Knowing that two standard deviations represent about 95% of a normal distribution, what is the lowest return you can expect with a 95% confidence

Knowing that two standard deviations represent about 95% of a normal distribution, what is the lowest return you can expect with a 95% confidence interval for Stock A? (Remember to use a negative sign for negative returns) Stock Stock A Stock B Question 5 Expected Return Standard Deviation 15% 10% 25% 20% 3 pts You shorted a stock at $35. Six months later, the stock is trading for $20. How much money have you made or lost? Enter a dollar value. Use a negative sign to represent a loss.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Making Hard Decisions with decision tools

Authors: Robert Clemen, Terence Reilly

3rd edition

538797576, 978-0538797573

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App