Answered step by step

Verified Expert Solution

Question

1 Approved Answer

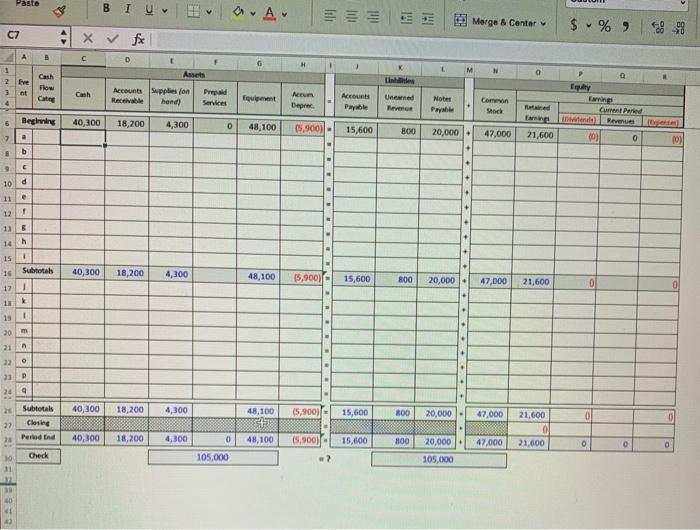

Koala Industries Inc. began business operations on January 1, 2021. Koala Industries Inc.s annual reporting period ends December 31. Some events have already occurred and

Koala Industries Inc. began business operations on January 1, 2021. Koala Industries Inc.’s annual reporting period ends December 31. Some events have already occurred and have been recorded; these are reflected in the beginning balances shown on the accounting equation grid. Analyze the following additional events during 2021 and complete the requirements on the other worksheets.

| 1) Record events a) through i) below in the accounting equation ("Grid" worksheet, rows 7-15) |

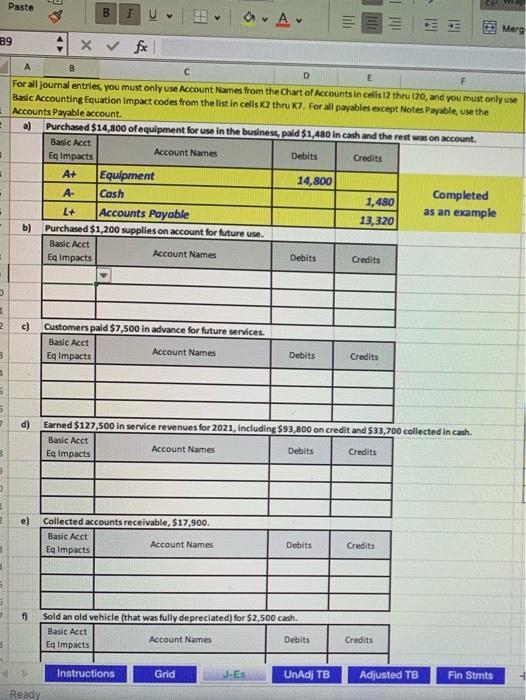

| 2) Record events a) through i) below as journal entries ("J-Es" worksheet, rows 1-46) |

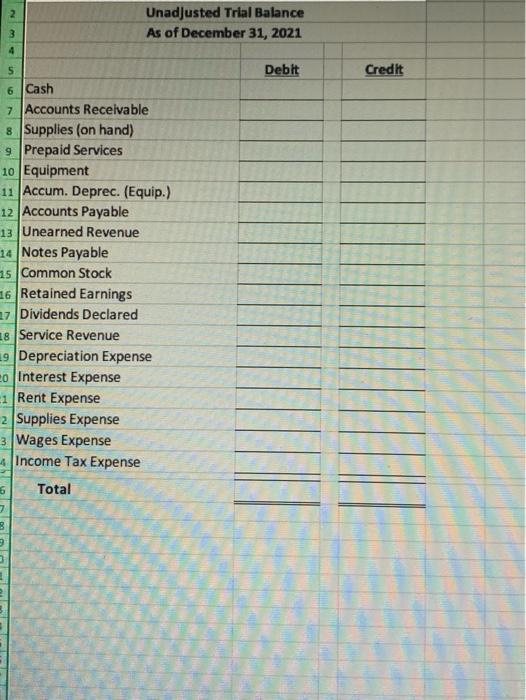

| 3) Prepare an Unadjusted Trial Balance ("UnAdj TB" worksheet) |

| 4) Record events i) through p) in the accounting equation ("Grid" worksheet, rows 17-24) |

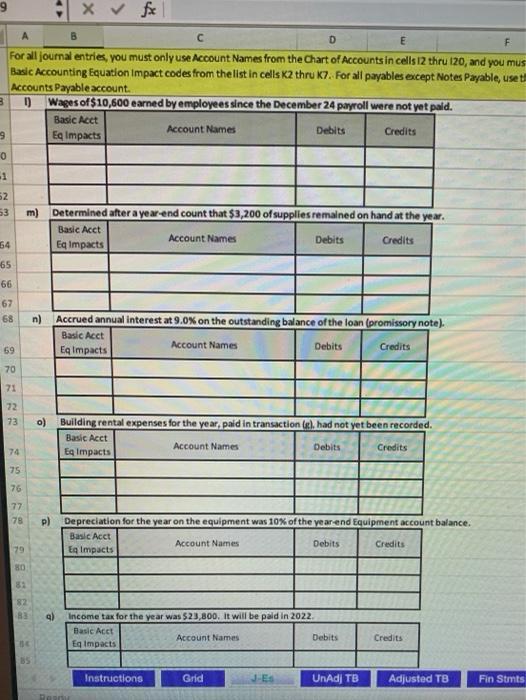

| 5) Record events i) through p) below as journal entries ("J-Es" worksheet, rows 48-87) |

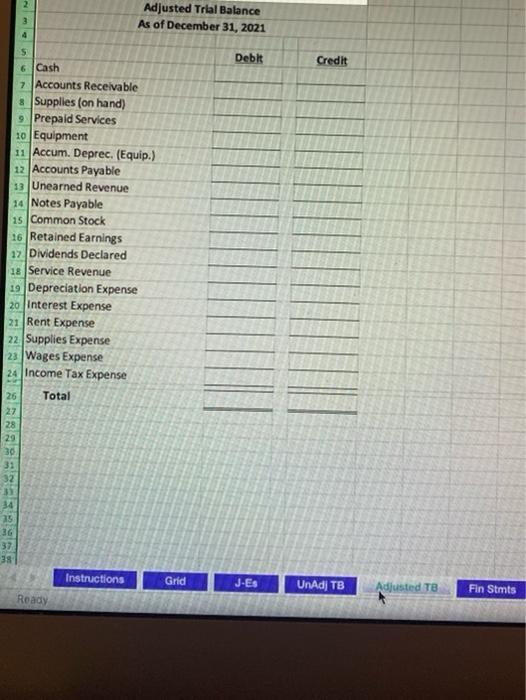

| 6) Prepare an Adjusted Trial Balance ("Adjusted TB" worksheet) |

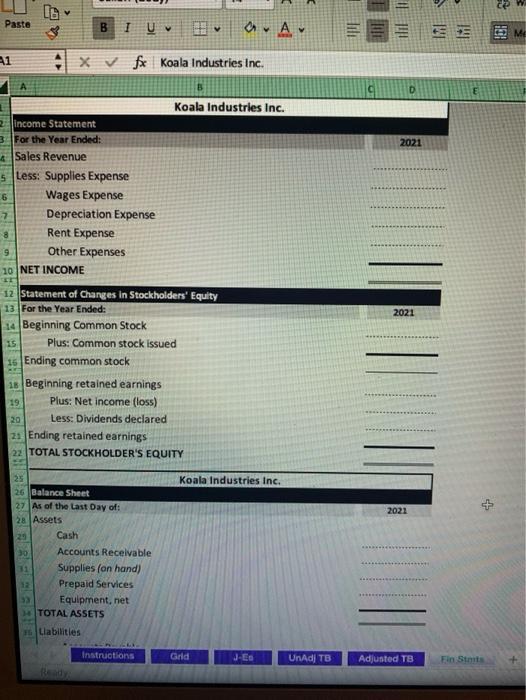

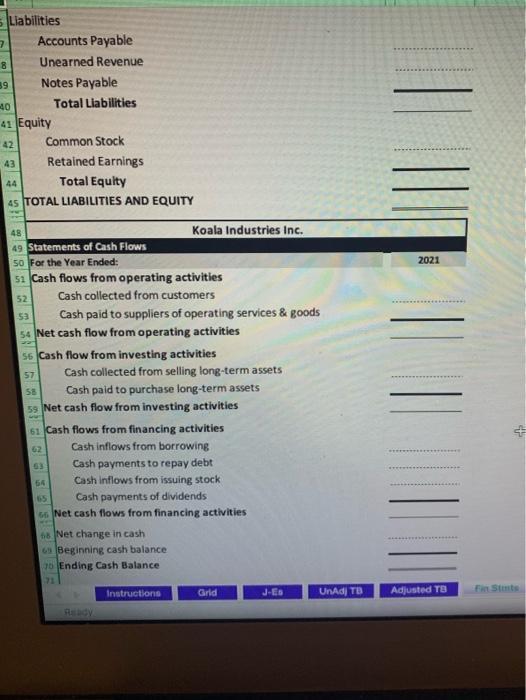

| 7) Prepare all four financial statements ("Fin Stmts" worksheet) |

| Events: |

| a) Purchased $14,800 of equipment for use in the business, paid $1,480 in cash and the rest was on account. |

| b) Purchased $1,200 supplies on account for future use. |

| c) Customers paid $7,500 in advance for future services. |

| d) Earned $127,500 in service revenues for 2021, including $93,800 on credit and $33,700 collected in cash. |

| e) Collected accounts receivable, $17,900. |

| f) Sold an old vehicle (that was fully depreciated) for $2,500 cash. |

| g) On Oct. 31, paid $9,600 to rent a building for 12 months, starting on Nov. 1. |

| h) Paid accounts payable, $12,400. |

| i) Declared and paid a $24,000 cash dividend. |

| Information for Adjustments: |

| j) Koala recorded $3,500 in service provided that had been collected in event (c), but had not yet been recorded. |

| k) During December, Koala accrued $4,740 in service that had been provided to customers on account. |

| l) Wages of $10,600 earned by employees since the December 24 payroll were not yet paid. |

| m) Determined after a year-end count that $3,200 of supplies remained on hand at the year. |

| n) Accrued annual interest at 9.0% on the outstanding balance of the loan (promissory note). |

| o) Building rental expenses for the year, paid in transaction (g), had not yet been recorded. |

| p) Depreciation for the year on the equipment was 10% of the year-end Equipment account balance. |

| q) Income tax for the year was $23,800. It will be paid in 2022. |

C7 1 2 Eve nt 6 8 Paste 15 16 10 11 e 12 f a b 13 6 14 h 26 27 Beginning C d 31 1 17 18 k 19 I 20 21 n 22 23 P 24 9 B Subtotals m Cash Flow Categ Subtotals Closing Period End Check x fx Cash 40,300 BI 40,300 D Accounts Supplies (on Receivable hand) 18,200 4,300 18,200 40,300 18,200 Assets 40,300 18,200 4,300 4,300 4,300 Prepaid Services 0 0 175 105,000 Equipment 48,100 Accum Deprec 48,100 (5,900) 48,100 (5,900) (5,900) 48,100 (5,900) . . . . . |. W N . E Lahdes Accounts Uneamed Payable Revenge 15,600 15,600 15,600 15,600 Notes Payable 800 20,000 E 800 20,000 800 800 20,000 105,000 + + + + . . + 1. + Merge & Center v Common Stock 47,000 21,600 47,000 Retained 20,000. 47,000 21,600 0 47,000 21,600 21,600 $%9 Equity Tamings vidends) Revenues (0) 0 0 0 Q Current Peried 0 0 8-98 (0) 0 0 0

Step by Step Solution

★★★★★

3.64 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Requirement 1 Accounting Equation Declaration of Dividends Paymen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started