Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kofas firms are always looking for methods to improve efficiency and effectiveness to compete globally. Some turn to mergers and acquisitions to survive. Thus,

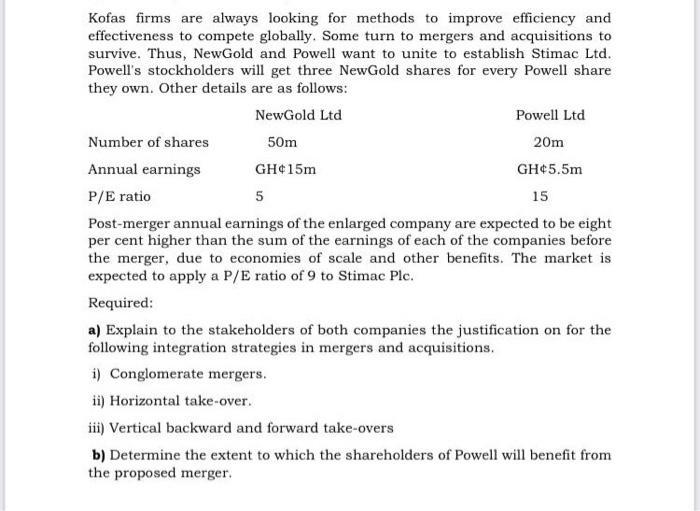

Kofas firms are always looking for methods to improve efficiency and effectiveness to compete globally. Some turn to mergers and acquisitions to survive. Thus, NewGold and Powell want to unite to establish Stimac Ltd. Powell's stockholders will get three NewGold shares for every Powell share they own. Other details are as follows: Powell Ltd NewGold Ltd Number of shares 50m Annual earnings GH15m P/E ratio 5 20m GH5.5m 15 Post-merger annual earnings of the enlarged company are expected to be eight per cent higher than the sum of the earnings of each of the companies before the merger, due to economies of scale and other benefits. The market is expected to apply a P/E ratio of 9 to Stimac Plc. Required: a) Explain to the stakeholders of both companies the justification on for the following integration strategies in mergers and acquisitions. i) Conglomerate mergers. ii) Horizontal take-over. iii) Vertical backward and forward take-overs b) Determine the extent to which the shareholders of Powell will benefit from the proposed merger.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Justification for Integration Strategies in Mergers and Acquisitions i Conglomerate Mergers A conglomerate merger occurs when two companies from unrelated industries or business sectors come togethe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started