Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kofi Enterprise employed a book-keeper who uses accounting software to produce a trial balance. At the year end, the Accountant manually prepares journal entries

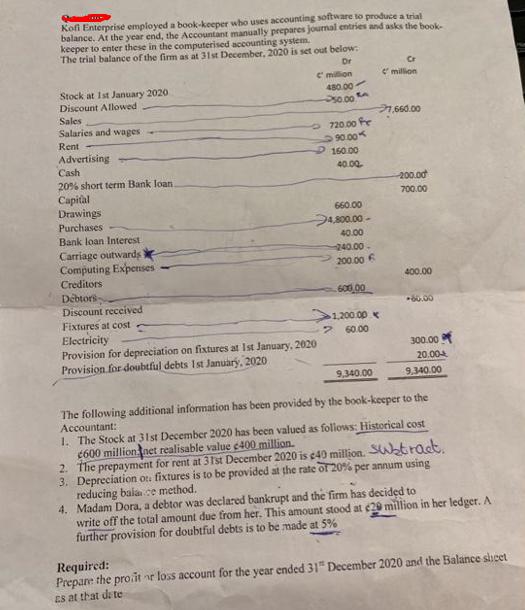

Kofi Enterprise employed a book-keeper who uses accounting software to produce a trial balance. At the year end, the Accountant manually prepares journal entries and asks the book- keeper to enter these in the computerised accounting system. The trial balance of the firm as at 31st December, 2020 is set out below. Dr Stock at 1st January 2020 Discount Allowed Sales Salaries and wages Rent Advertising Cash 20% short term Bank loan. Capital Drawings Purchases Bank loan Interest Carriage outwards Computing Expenses Creditors Debtors- Discount received Fixtures at cost Electricity Provision for depreciation on fixtures at 1st January, 2020 Provision for doubtful debts 1st January, 2020 c' milion 480.00- 550.00 720.00 Fr 90.00 160.00 40.00 660.00 4,800.00- 40.00 -240.00- 200.00 600,00 1,200.00 2 60.00 9,340.00 Cr million 7,660.00 200.00 700.00 400.00 -60.00 300.00 20.00 9.340.00 The following additional information has been provided by the book-keeper to the Accountant: 1. The Stock at 31st December 2020 has been valued as follows: Historical cost $600 million net realisable value $400 million. 2. The prepayment for rent at 31st December 2020 is $40 million. Subtract. 3. Depreciation ot. fixtures is to be provided at the rate of 20% per annum using reducing balance method. 4. Madam Dora, a debtor was declared bankrupt and the firm has decided to write off the total amount due from her. This amount stood at $20 million in her ledger. A further provision for doubtful debts is to be made at 5% Required: Prepare the profit or loss account for the year ended 31 December 2020 and the Balance sheet ES at that de te

Step by Step Solution

★★★★★

3.42 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started