Question

1. If you are an investor who is looking for a bond to invest in, which bond would you choose to invest? Why? Take a

1. If you are an investor who is looking for a bond to invest in, which bond would you choose to invest? Why? Take a look at the balance sheet and income statement of the company. What data or ratios support your decision to buy this bond or not?

2. Being the bond callable, does it change your decision to buy them?

KO.GO Bond: 101.060% * 1000 = $1010.60

KO.GU Bond: 102.533% * 1000 = $1025.33

The Annual Coupon Interest Payment:

KO.GO Bond:

Coupon rate: 3.15/100 = .0315

.0315 * 1000 = $31.50

KO.GU Bond:

Coupon rate: 3.30/100 = .0330

.0330 * 1000 = $33.00

The Current Yield of the Bonds:

KO.GO Bond: (1000*0.0315)/(101.060*10) = 0.031169

0.031169 * 100 = 3.12%

KO.GU Bond: (1000*0.0330)/(102.533*10) = 0.032184

0.032184 * 100 = 3.22%

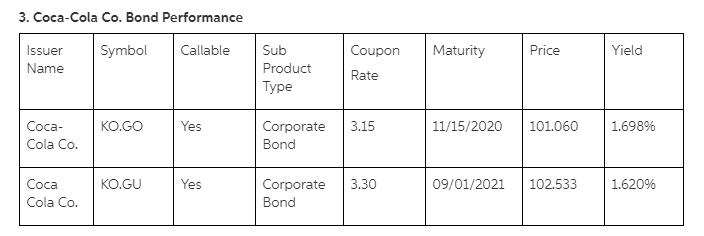

3. Coca-Cola Co. Bond Performance Issuer Symbol Callable Name Coca- Cola Co. Coca Cola Co. KO.GO KO.GU Yes Yes Sub Product Type Coupon Rate Corporate 3.15 Bond Corporate Bond 3.30 Maturity Price Yield 11/15/2020 101.060 1.698% 09/01/2021 102.533 1.620%

Step by Step Solution

3.39 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

To decide which bond to invest in between KOGO Bond and KOGU Bond lets analyze the data provided and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started