Question

Konawalskis Kustom Erdapfel Chips, Inc., is the maker of gourmet German-style potato chips. The company began business three years ago in rural North Carolina and

Konawalskis Kustom Erdapfel Chips, Inc., is the maker of gourmet German-style potato chips. The company began business three years ago in rural North Carolina and grew quickly as the product became known. Konawalski is now poised for national growth. Some analysts call the firm the next Krispy Kreme. The company pays a dividend of $0.10 per share. Earnings per share are currently $0.40, and analysts expect both earnings and dividends to grow at 24 percent per year for the next 5 years. The stock price is expected to increase in value by 80 percent over the next 3 years. If you believe that investors require a 24 percent rate of return on a stock of this risk, what price would you recommend as the IPO price for Konawalski? Use Table II to answer the question. Do not round intermediate calculations. Round your answer to the nearest cent.

Konawalskis Kustom Erdapfel Chips, Inc., is the maker of gourmet German-style potato chips. The company began business three years ago in rural North Carolina and grew quickly as the product became known. Konawalski is now poised for national growth. Some analysts call the firm the next Krispy Kreme. The company pays a dividend of $0.10 per share. Earnings per share are currently $0.40, and analysts expect both earnings and dividends to grow at 24 percent per year for the next 5 years. The stock price is expected to increase in value by 80 percent over the next 3 years. If you believe that investors require a 24 percent rate of return on a stock of this risk, what price would you recommend as the IPO price for Konawalski? Use Table II to answer the question. Do not round intermediate calculations. Round your answer to the nearest cent.

$

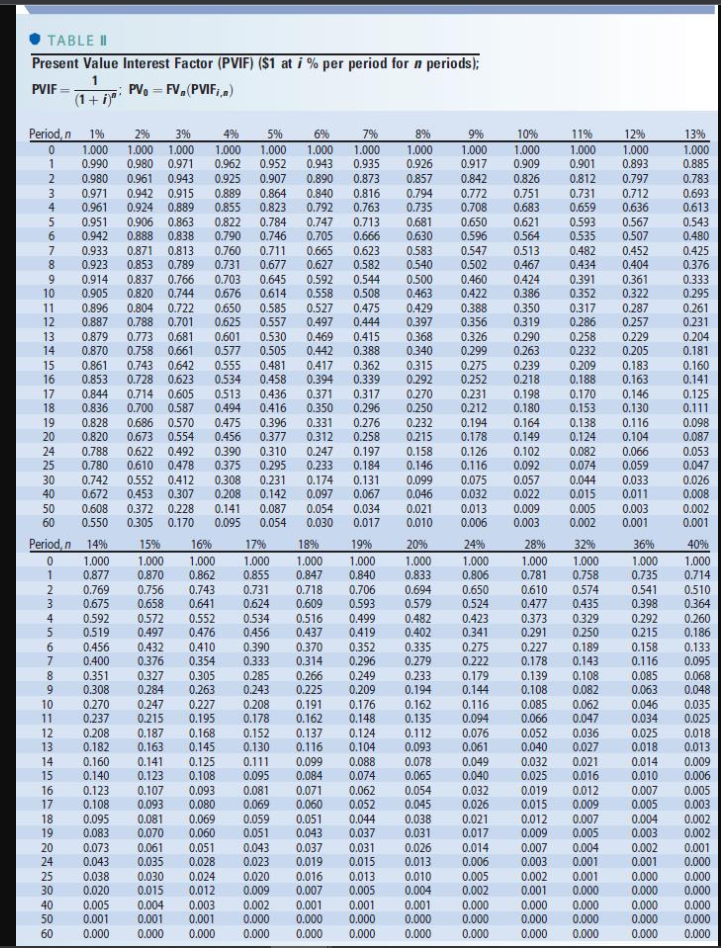

PresentValueInterestFactor(PVIF)($1ati%perperiodfornperiods); PVIF=11PVn=FV(PVIFF)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started