Answered step by step

Verified Expert Solution

Question

1 Approved Answer

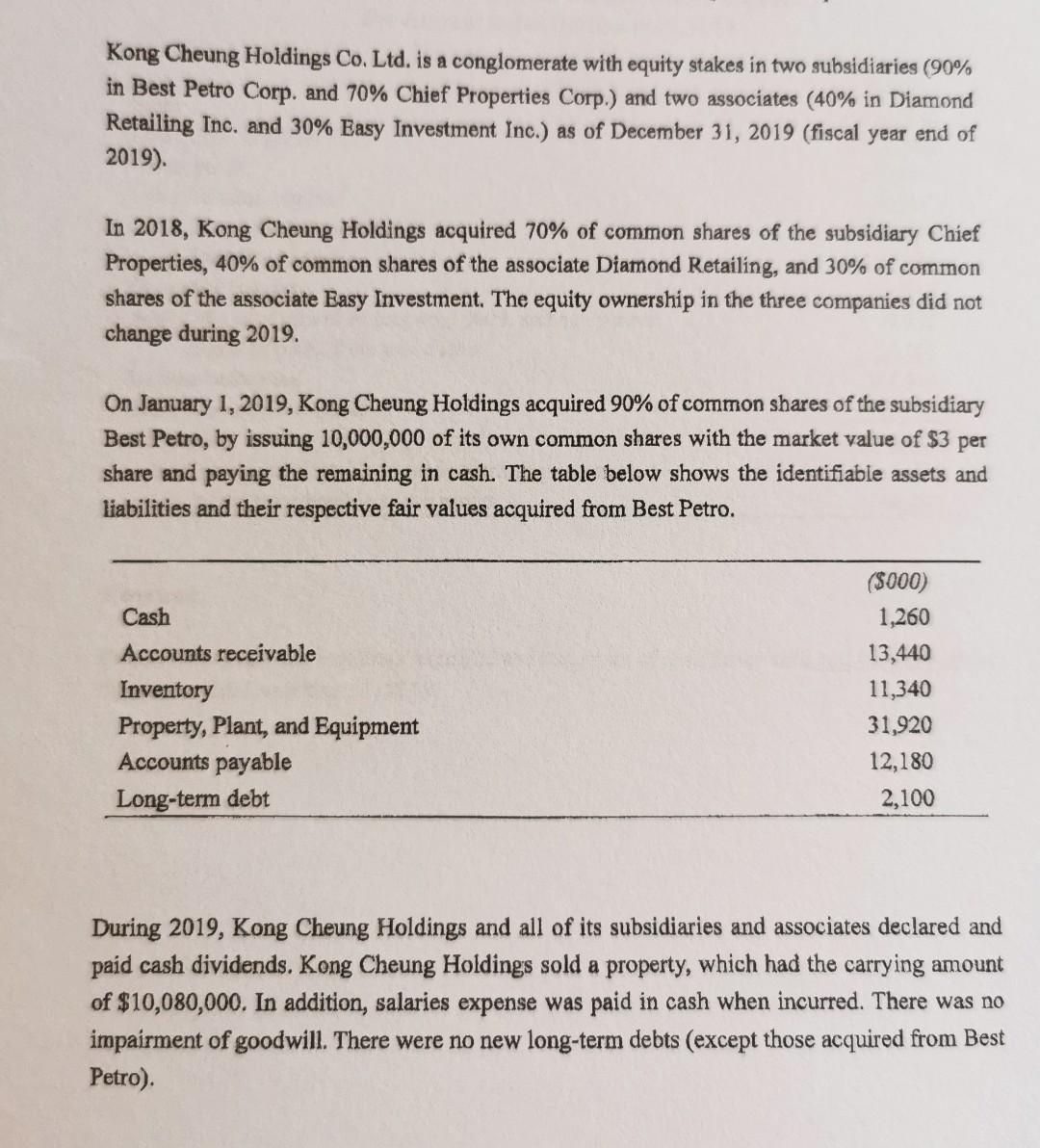

Kong Cheung Holdings Co. Ltd. is a conglomerate with equity stakes in two subsidiaries (90% in Best Petro Corp. and 70% Chief Properties Corp.) and

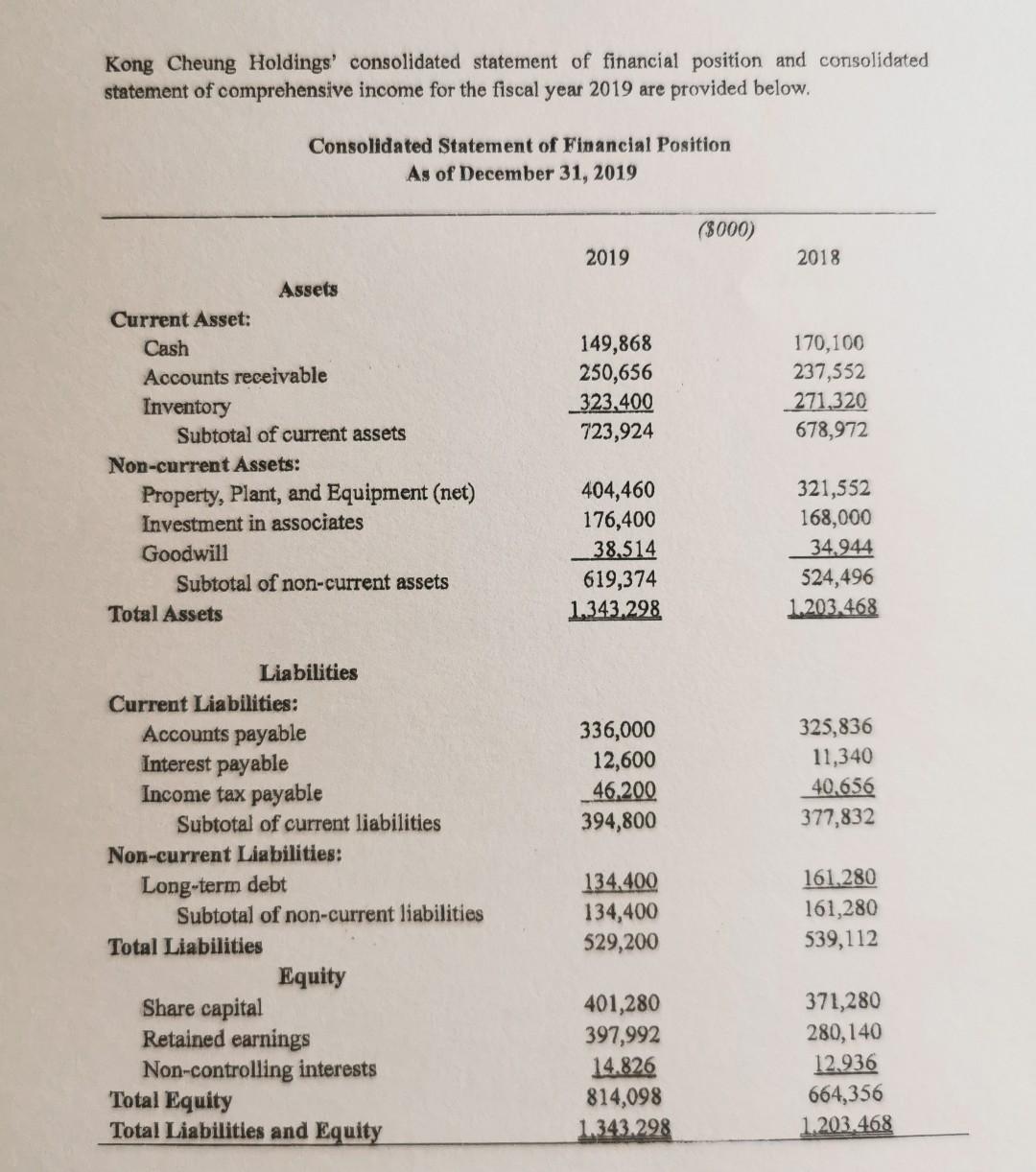

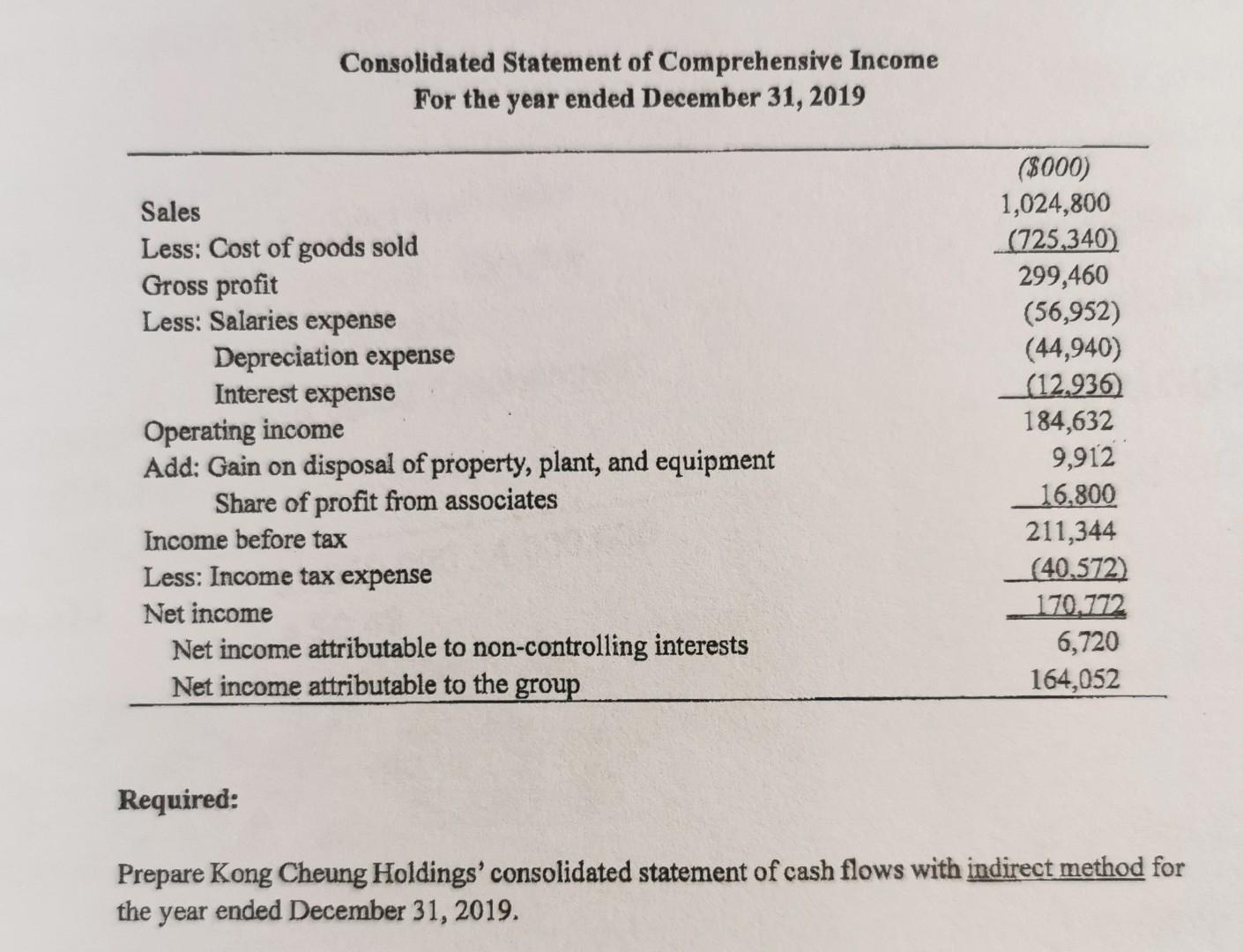

Kong Cheung Holdings Co. Ltd. is a conglomerate with equity stakes in two subsidiaries (90% in Best Petro Corp. and 70% Chief Properties Corp.) and two associates (40% in Diamond Retailing Inc. and 30% Easy Investment Inc.) as of December 31, 2019 (fiscal year end of 2019). In 2018, Kong Cheung Holdings acquired 70% of common shares of the subsidiary Chief Properties, 40% of common shares of the associate Diamond Retailing, and 30% of common shares of the associate Easy Investment. The equity ownership in the three companies did not change during 2019. On January 1, 2019, Kong Cheung Holdings acquired 90% of common shares of the subsidiary Best Petro, by issuing 10,000,000 of its own common shares with the market value of $3 per share and paying the remaining in cash. The table below shows the identifiable assets and liabilities and their respective fair values acquired from Best Petro. Cash Accounts receivable Inventory Property, Plant, and Equipment Accounts payable Long-term debt (5000) 1,260 13,440 11,340 31,920 12,180 2,100 During 2019, Kong Cheung Holdings and all of its subsidiaries and associates declared and paid cash dividends. Kong Cheung Holdings sold a property, which had the carrying amount of $10,080,000. In addition, salaries expense was paid in cash when incurred. There was no impairment of goodwill. There were no new long-term debts (except those acquired from Best Petro). Kong Cheung Holdings' consolidated statement of financial position and consolidated statement of comprehensive income for the fiscal year 2019 are provided below. Consolidated Statement of Financial Position As of December 31, 2019 (8000) 2019 2018 149,868 250,656 _323,400 723,924 170,100 237,552 271,320 678,972 Assets Current Asset: Cash Accounts receivable Inventory Subtotal of current assets Non-current Assets: Property, Plant, and Equipment (net) Investment in associates Goodwill Subtotal of non-current assets Total Assets 404,460 176,400 38,514 619,374 1.343.298 321,552 168,000 34.944 524,496 1.203.468 336,000 12,600 46.200 394,800 325,836 11,340 40.656 377,832 Liabilities Current Liabilities: Accounts payable Interest payable Income tax payable Subtotal of current liabilities Non-current Liabilities: Long-term debt Subtotal of non-current liabilities Total Liabilities Equity Share capital Retained earnings Non-controlling interests Total Equity Total Liabilities and Equity 134,400 134,400 529,200 161.280 161,280 539,112 401,280 397,992 14.826 814,098 1.343.298 371,280 280,140 12.936 664,356 1.203.468 Consolidated Statement of Comprehensive Income For the year ended December 31, 2019 Sales Less: Cost of goods sold Gross profit Less: Salaries expense Depreciation expense Interest expense Operating income Add: Gain on disposal of property, plant, and equipment Share of profit from associates Income before tax Less: Income tax expense Net income Net income attributable to non-controlling interests Net income attributable to the group ($000) 1,024,800 (725,340) 299,460 (56,952) (44,940) _(12.936) 184,632 9,912 16.800 211,344 (40.572) 170,772 6,720 164,052 Required: Prepare Kong Cheung Holdings' consolidated statement of cash flows with indirect method for the year ended December 31, 2019

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started