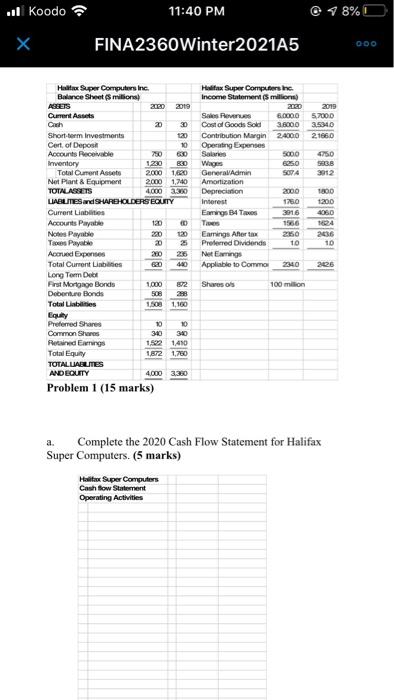

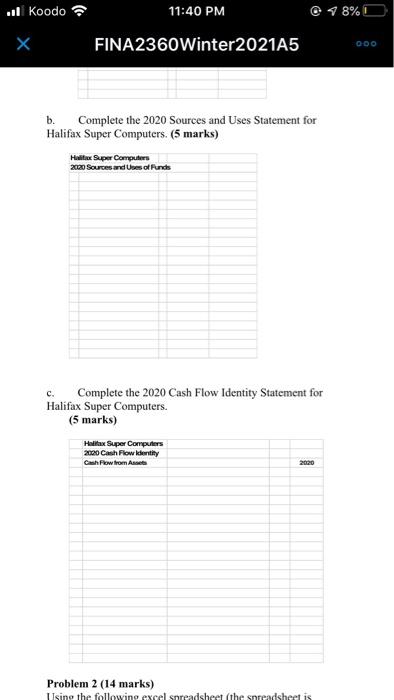

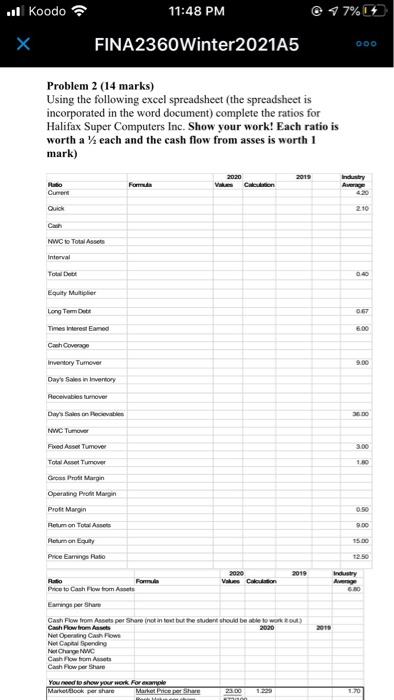

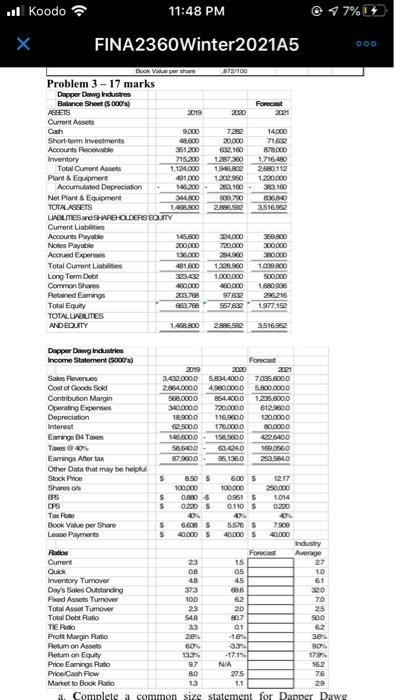

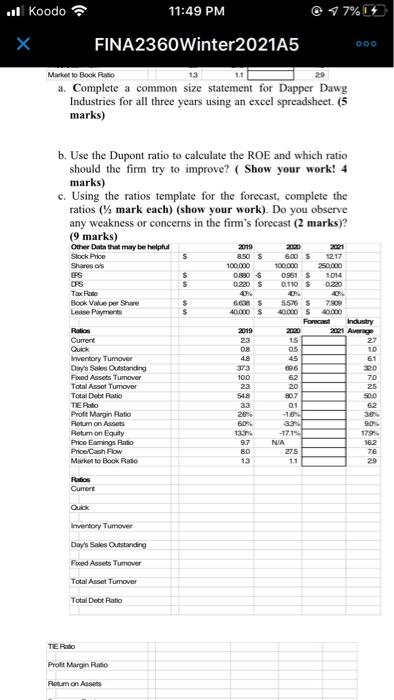

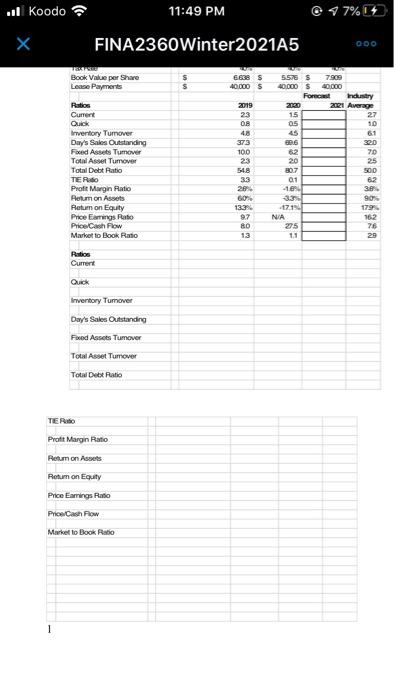

.. Koodo 11:40 PM 18% FINA2360 Winter2021A5 OOO Cich 2016 Haltex Super Computers Inc. Halifax Super Computers Inc. Balance Sheet( millions Income Statement (Smilion) ASEETS 2020 2019 2120 2019 Current Assets Sales Revue 6.0000 5700D 20 3p Cost al Goods Sold 35000 3.5340 Short-term Investments Contribution Margin 24000 21860 Cert, of Depost 10 Operating Expenses Accounts Receivable 750 Sale 5000 4950 Inventory 1230 BO Wages 6250 SEBB Total Current Assets 2.000 1,620 General Admin 3012 Net Plant & Equipment 2000 1,740 Amortization TOTALASSETS 4.000 3.300 Depreciation 2000 TBD LIABLES and SWROLDEPSELITY Interest 1750 1200 Current Limits EmgTS 4060 Accounts Payable 120 D 1566 Notes Pants 120 Earnings Altertex 2036 Tas Payable 3 Preferred Dividends 10 10 Accrued Expenses 200 Netags Total Current Limites 620 400 Appliable to commo 234.0 2026 Long Term Debat First Mortgage Bonds 1.000 872 Shares 100 million Denture Bonds 508 288 Total Liabilities 1.508 1,100 Equity Preferred Shares 10 Common Shares 340 340 Retained Earnings 1,522 1410 Total Equity 1872 1,780 TOTALLABLES AND EQUITY 4.000 3360 Problem 1 (15 marks) 20 a. Complete the 2020 Cash Flow Statement for Halifax Super Computers. (5 marks) Halifax Super Computers Cash flow Statement Operating Activities Koodo 11:40 PM 18% FINA2360 Winter 2021A5 OOO b. Complete the 2020 Sources and Uses Statement for Halifax Super Computers. (5 marks) Holtex Super Computers 2020 Sources and Uses of Funds c. Complete the 2020 Cash Flow Identity Statement for Halifax Super Computers. (5 marks) Halifax Super Computers 2000 Cash Flow witty Cash Flow from Asset 2020 Problem 2 (14 marks) Ising the following excel spreadsheet (the spreadsheet is .. Koodo 11:48 PM 47% FINA2360Winter2021A5 Problem 2 (14 marks) Using the following excel spreadsheet (the spreadsheet is incorporated in the word document) complete the ratios for Halifax Super Computers Inc. Show your work! Each ratio is worth a ' each and the cash flow from asses is worth 1 mark) 2013 Foto Form 2020 Vie Cotton Indy A Current Od 210 NWCTotal Assets Interval DAD Equity Multiplier Long Terme 0167 Tmes interest and 9.00 Cash Cover Inventory Tumover Days Sales In Inventory Receives mover Days on Movie NWT Fred Asset Tume 3.00 1. Total Tumor Groms Pro Margin Operating Pro Mergin Profit Margin Retumon Total Assets 15.00 duty A BRO Ploumon Equity Price Earnings Ratio 2020 2019 Ratio Ford Vakum Cation Price to Cash Flow from Acts Ewroper Share Cash Flow from Assets per Share not in tout but the student should be able to work out) Cash Flow from sets 2020 Net Operating Cash Fow Nel cording No Chap 4: Cash Flow from Cash Flower Share You need to show your work For example Martlook per she 2011 23.00 1.2009 1.70 .. Koodo 11:48 PM @ 47% FINA2360 Winter2021A5 .6721100 Forcat 2001 2020 tock Value perture Problem 3 - 17 marks Dapper Daug Industres Balance Sheet(5000) AGETS 2010 Current Assets Cach Short-term investments 48.600 Accounts Peonable 351200 Inventory 715.200 Total Current Assets 1.134.000 Plant & Equipment 191.000 Accumulated Depreciation 166.200 Net Plant & Equipment 3800 TOTALASSETS 1 AGO LIABLITES and SHARE OLDERS BOUNTY Current Liabilities Accounts Payable 145,800 Notes Payable 200.000 Accrued Expenses 16.000 Total Current Liabilities 48100 Long Term Debt 323.432 Common Shares 480,000 Retained Emg 2.70 Total Equy 663.788 TOTALLBUTES AND EQUITY 1468.800 7280 20.000 632160 12:30 1.946.2 1.202.950 23.100 27 2886 14.000 71.600 878.000 1.746.430 2.680,112 1.220.000 33,00 BOMO 3.516.92 334.000 720000 23 1.300.000 1.000.000 460,000 976 350BCO 300.000 300000 1.000.000 SOLO 1680.336 226216 1977,152 557639 299682 3.516.96 Dapper Dang Industries Income Statement (5000s) Foreca 2019 2000 2021 Sales Revenues 3.22.0000 5834,4000 7036.600D Cost of Goods Sold 2.864.0000 4.980.0000 5.800.000 Contribution Margin 563.000D 8544000 1235.600D Operating Expenses 3600000 720,0000 612 000 Depreciation 189000 116.000 120,0000 Interest 62.5000 178.0000 80,000D Eings Be Tas 145.000 226000 To 40% 586400 BOLO MODO Earrings Aerox 87.9800 96.1360 253.5640 Other Date that may be helpful Stock Price $ 8.50 $ 6.00 $ 1217 Shares of 1000D 100.000 250.000 FS $ OVO 6 09615 1014 OPS $ 0.2205 0.110$ 0.220 Tau Book Value per Share $ 55285 Lease Payments $ 100005 40.000 $ 40.000 Industry Rados Force Average Current 15 27 QUIN OB 05 TO Inventory Turnover 48 45 61 Days Sales Outstanding 373 CRB 00 Fixed Assets Turnover 100 62 70 Total Asset Tumover 23 20 25 Total Debt Ratio 548 807 500 TER 33 01 Prolt Margin Ratio 20 Retum on Assets 3.3 90% Return on Equity 133 -17141 179 Price Eags Ratio NA 152 Price Cash Flow BO 275 76 Market to Book Ratio 13 29 Complete a common size statement for Dapper Dawe 30 OOO .. Koodo 11:49 PM @ 7% FINA2360 Winter2021A5 Market to Book Reso a. Complete a common size statement for Dapper Dawg Industries for all three years using an excel spreadsheet. (5 marks) 13 b. Use the Dupont ratio to calculate the ROE and which ratio should the firm try to improve? ( Show your work! 4 marks) c. Using the ratios template for the forecast, complete the ratios (% mark each) (show your work). Do you observe any weakness or concerns in the fim's forecast (2 marks)? (9 marks) Other Data that may be help Stock Price Sharesos 100.000 100.000 EPS 0961 $ UPS Tax Book Value per Share Le Payment 2019 850 S 2001 1217 s 6.00 $ $ $ 0880$ 0220$ 406 638 $ 40,000 $ $ $ 7909 2019 Current Quick Inventory Tumover Day's Sales Outstanding Food Assets Tumover Total Asset Tumover Total Debt Ratio TE Radio Proft Margin Ratio Rotum on Assets Retuimon Equity Price Emmings Rato Price Cash Flow Market to Book Radio 23 08 4.8 373 100 23 518 33 20% 60% 133 9.7 BO 13 1014 0.110$ 0.220 40 55705 40.000 $ 40.000 Forecast Industry 2020 2021 Average 15 27 05 10 45 6.1 PO 62 70 20 25 500 01 62 3.3 -17.15 NA 275 1791 16.2 76 29 Ratios Current Quick Inventory Tumove Dar's Sake Outstanding Foed Assets Tumover Total Asset Tumover Total Debt Ratio TER Profit Margin Ratio Retum on Assets .. Koodo 11:49 PM @ 7% FINA2360 Winter2021A5 OOO Book Value per Share Lease Payments 6.638 5 40.000 $ 55755 7.900 40.000 $ 40000 Forecast Industry 2020 2021 Average 15 27 05 10 2019 23 OS 06 373 100 Ratios Current Quick Inventory Turnover Day's Sales Outstanding Fixed Assets Tumover Total Asset Tumover Total Debt Ratio TERO Proft Margin Ratio Retum on Assets Return on Equity Price Eaugs Ratio Price Cash Flow Market to Book Ratio 320 70 25 500 62 3. 548 B07 01 -1.604 20 133 179 162 76 29 NA 275 1.1 BO 13 : Ratios Current Quick Inventory Turnover Day's Sales Outstanding Food Assets Tumover Total Asset Tumover Total Debt Ratio TE Radio Profit Margin Ratio Retum on Assets Rotum on Equity Price Earnings Ratio Price Cash Flow Market to Book Ratio 1 .. Koodo 11:40 PM 18% FINA2360 Winter2021A5 OOO Cich 2016 Haltex Super Computers Inc. Halifax Super Computers Inc. Balance Sheet( millions Income Statement (Smilion) ASEETS 2020 2019 2120 2019 Current Assets Sales Revue 6.0000 5700D 20 3p Cost al Goods Sold 35000 3.5340 Short-term Investments Contribution Margin 24000 21860 Cert, of Depost 10 Operating Expenses Accounts Receivable 750 Sale 5000 4950 Inventory 1230 BO Wages 6250 SEBB Total Current Assets 2.000 1,620 General Admin 3012 Net Plant & Equipment 2000 1,740 Amortization TOTALASSETS 4.000 3.300 Depreciation 2000 TBD LIABLES and SWROLDEPSELITY Interest 1750 1200 Current Limits EmgTS 4060 Accounts Payable 120 D 1566 Notes Pants 120 Earnings Altertex 2036 Tas Payable 3 Preferred Dividends 10 10 Accrued Expenses 200 Netags Total Current Limites 620 400 Appliable to commo 234.0 2026 Long Term Debat First Mortgage Bonds 1.000 872 Shares 100 million Denture Bonds 508 288 Total Liabilities 1.508 1,100 Equity Preferred Shares 10 Common Shares 340 340 Retained Earnings 1,522 1410 Total Equity 1872 1,780 TOTALLABLES AND EQUITY 4.000 3360 Problem 1 (15 marks) 20 a. Complete the 2020 Cash Flow Statement for Halifax Super Computers. (5 marks) Halifax Super Computers Cash flow Statement Operating Activities Koodo 11:40 PM 18% FINA2360 Winter 2021A5 OOO b. Complete the 2020 Sources and Uses Statement for Halifax Super Computers. (5 marks) Holtex Super Computers 2020 Sources and Uses of Funds c. Complete the 2020 Cash Flow Identity Statement for Halifax Super Computers. (5 marks) Halifax Super Computers 2000 Cash Flow witty Cash Flow from Asset 2020 Problem 2 (14 marks) Ising the following excel spreadsheet (the spreadsheet is .. Koodo 11:48 PM 47% FINA2360Winter2021A5 Problem 2 (14 marks) Using the following excel spreadsheet (the spreadsheet is incorporated in the word document) complete the ratios for Halifax Super Computers Inc. Show your work! Each ratio is worth a ' each and the cash flow from asses is worth 1 mark) 2013 Foto Form 2020 Vie Cotton Indy A Current Od 210 NWCTotal Assets Interval DAD Equity Multiplier Long Terme 0167 Tmes interest and 9.00 Cash Cover Inventory Tumover Days Sales In Inventory Receives mover Days on Movie NWT Fred Asset Tume 3.00 1. Total Tumor Groms Pro Margin Operating Pro Mergin Profit Margin Retumon Total Assets 15.00 duty A BRO Ploumon Equity Price Earnings Ratio 2020 2019 Ratio Ford Vakum Cation Price to Cash Flow from Acts Ewroper Share Cash Flow from Assets per Share not in tout but the student should be able to work out) Cash Flow from sets 2020 Net Operating Cash Fow Nel cording No Chap 4: Cash Flow from Cash Flower Share You need to show your work For example Martlook per she 2011 23.00 1.2009 1.70 .. Koodo 11:48 PM @ 47% FINA2360 Winter2021A5 .6721100 Forcat 2001 2020 tock Value perture Problem 3 - 17 marks Dapper Daug Industres Balance Sheet(5000) AGETS 2010 Current Assets Cach Short-term investments 48.600 Accounts Peonable 351200 Inventory 715.200 Total Current Assets 1.134.000 Plant & Equipment 191.000 Accumulated Depreciation 166.200 Net Plant & Equipment 3800 TOTALASSETS 1 AGO LIABLITES and SHARE OLDERS BOUNTY Current Liabilities Accounts Payable 145,800 Notes Payable 200.000 Accrued Expenses 16.000 Total Current Liabilities 48100 Long Term Debt 323.432 Common Shares 480,000 Retained Emg 2.70 Total Equy 663.788 TOTALLBUTES AND EQUITY 1468.800 7280 20.000 632160 12:30 1.946.2 1.202.950 23.100 27 2886 14.000 71.600 878.000 1.746.430 2.680,112 1.220.000 33,00 BOMO 3.516.92 334.000 720000 23 1.300.000 1.000.000 460,000 976 350BCO 300.000 300000 1.000.000 SOLO 1680.336 226216 1977,152 557639 299682 3.516.96 Dapper Dang Industries Income Statement (5000s) Foreca 2019 2000 2021 Sales Revenues 3.22.0000 5834,4000 7036.600D Cost of Goods Sold 2.864.0000 4.980.0000 5.800.000 Contribution Margin 563.000D 8544000 1235.600D Operating Expenses 3600000 720,0000 612 000 Depreciation 189000 116.000 120,0000 Interest 62.5000 178.0000 80,000D Eings Be Tas 145.000 226000 To 40% 586400 BOLO MODO Earrings Aerox 87.9800 96.1360 253.5640 Other Date that may be helpful Stock Price $ 8.50 $ 6.00 $ 1217 Shares of 1000D 100.000 250.000 FS $ OVO 6 09615 1014 OPS $ 0.2205 0.110$ 0.220 Tau Book Value per Share $ 55285 Lease Payments $ 100005 40.000 $ 40.000 Industry Rados Force Average Current 15 27 QUIN OB 05 TO Inventory Turnover 48 45 61 Days Sales Outstanding 373 CRB 00 Fixed Assets Turnover 100 62 70 Total Asset Tumover 23 20 25 Total Debt Ratio 548 807 500 TER 33 01 Prolt Margin Ratio 20 Retum on Assets 3.3 90% Return on Equity 133 -17141 179 Price Eags Ratio NA 152 Price Cash Flow BO 275 76 Market to Book Ratio 13 29 Complete a common size statement for Dapper Dawe 30 OOO .. Koodo 11:49 PM @ 7% FINA2360 Winter2021A5 Market to Book Reso a. Complete a common size statement for Dapper Dawg Industries for all three years using an excel spreadsheet. (5 marks) 13 b. Use the Dupont ratio to calculate the ROE and which ratio should the firm try to improve? ( Show your work! 4 marks) c. Using the ratios template for the forecast, complete the ratios (% mark each) (show your work). Do you observe any weakness or concerns in the fim's forecast (2 marks)? (9 marks) Other Data that may be help Stock Price Sharesos 100.000 100.000 EPS 0961 $ UPS Tax Book Value per Share Le Payment 2019 850 S 2001 1217 s 6.00 $ $ $ 0880$ 0220$ 406 638 $ 40,000 $ $ $ 7909 2019 Current Quick Inventory Tumover Day's Sales Outstanding Food Assets Tumover Total Asset Tumover Total Debt Ratio TE Radio Proft Margin Ratio Rotum on Assets Retuimon Equity Price Emmings Rato Price Cash Flow Market to Book Radio 23 08 4.8 373 100 23 518 33 20% 60% 133 9.7 BO 13 1014 0.110$ 0.220 40 55705 40.000 $ 40.000 Forecast Industry 2020 2021 Average 15 27 05 10 45 6.1 PO 62 70 20 25 500 01 62 3.3 -17.15 NA 275 1791 16.2 76 29 Ratios Current Quick Inventory Tumove Dar's Sake Outstanding Foed Assets Tumover Total Asset Tumover Total Debt Ratio TER Profit Margin Ratio Retum on Assets .. Koodo 11:49 PM @ 7% FINA2360 Winter2021A5 OOO Book Value per Share Lease Payments 6.638 5 40.000 $ 55755 7.900 40.000 $ 40000 Forecast Industry 2020 2021 Average 15 27 05 10 2019 23 OS 06 373 100 Ratios Current Quick Inventory Turnover Day's Sales Outstanding Fixed Assets Tumover Total Asset Tumover Total Debt Ratio TERO Proft Margin Ratio Retum on Assets Return on Equity Price Eaugs Ratio Price Cash Flow Market to Book Ratio 320 70 25 500 62 3. 548 B07 01 -1.604 20 133 179 162 76 29 NA 275 1.1 BO 13 : Ratios Current Quick Inventory Turnover Day's Sales Outstanding Food Assets Tumover Total Asset Tumover Total Debt Ratio TE Radio Profit Margin Ratio Retum on Assets Rotum on Equity Price Earnings Ratio Price Cash Flow Market to Book Ratio 1