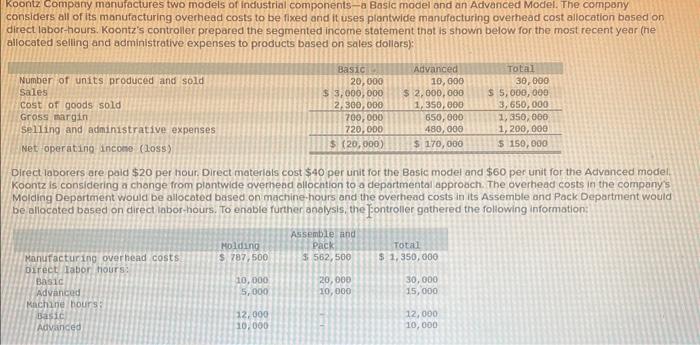

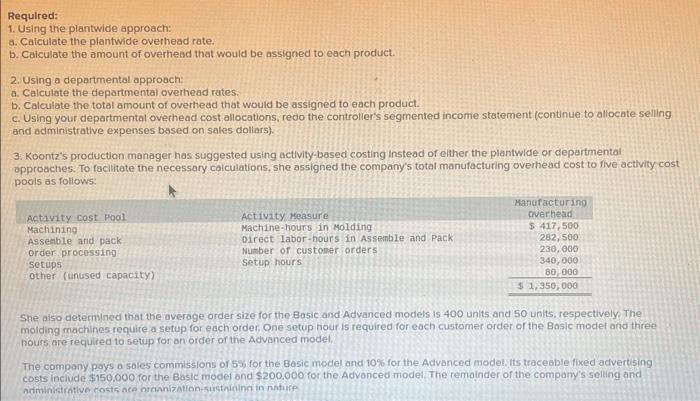

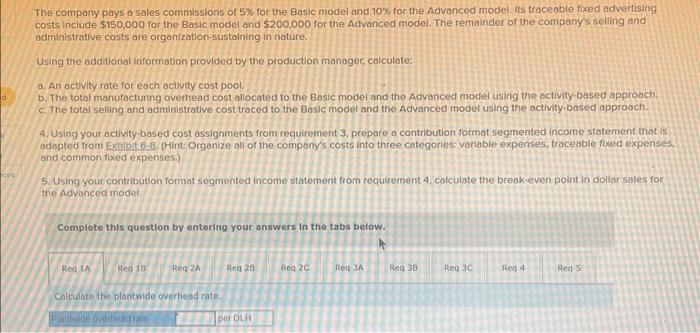

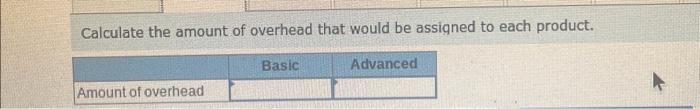

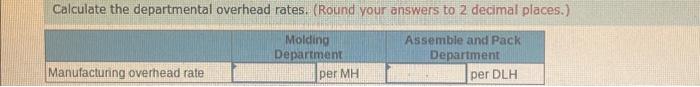

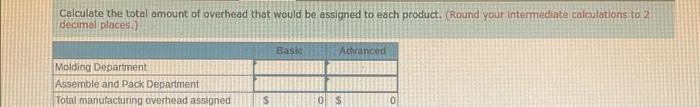

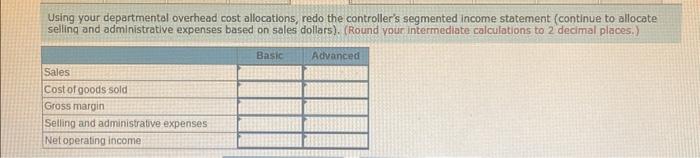

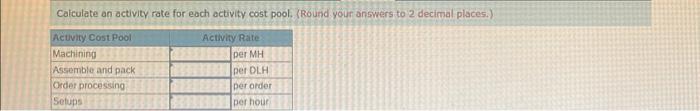

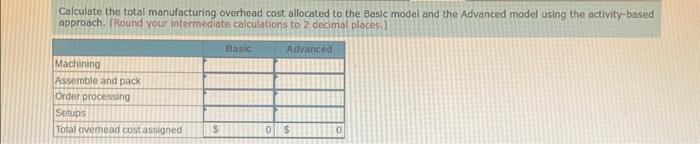

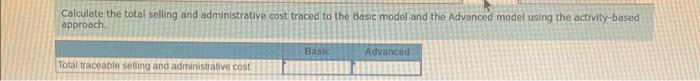

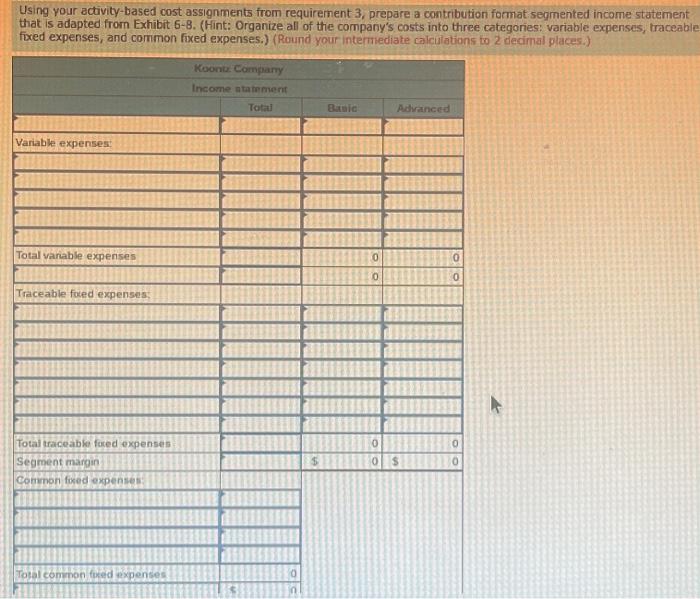

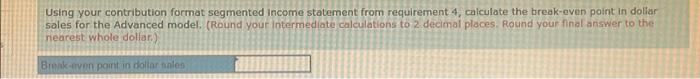

Koontz Company manufactures two models of industrial components - a Basic model and an Advanced Model. The compony considers all of its manufacturing overhead costs to be fixed and it uses plantwide manufacturing overhead cost allocation bosed on direct labor-hours. Koontz's controller prepared the segmented income statement that is shown below for the most recent year (he allocated selling and administrative expenses to products based on sales dollars): Direct laborers are paid $20 per hour. Direct materials cost $40 per unit for the Basic model and $60 per unit for the Advanced model. Koontz is considering a chonge from piontwide ovemead ollocntion to o deportmental approach. The overhead costs in the companys Molding Department would be allocoted based on machine-hours and the overhead costs in its Assemble and Pack Department would be allocoted based on direct iabor-hours. To enable further analysis, the Eontroller gathered the following information: Requlred: 1. Using the plantwide approach: a. Calculate the plantwide overhead rate. b. Calculate the amount of overhead that would be assigned to each product. 2. Using a departmental approach: a. Calculate the departmental overhead rates. b. Calculate the total amount of overhead that would be assigned to each product. c. Using your departmental overhead cost allocations, redo the controller's segmented income statement (continue to allocate-seling rand administrative expenses based on sales dollars). 3. Koontz's production manager has suggested using activity-based costing instead of elther the plantwide or departmentai approaches. To faclitate the necessary caiculations, she assigned the company's total manufacturing overhead cost to flve activity cost. pools as foliows: She aiso detemined that the averoge order size for the Basic and Advanced models is 400 units and 50 units, respectively. The molding machines require a setup for each order. One setup hour is required for eoch customer order or the Basic model and three houts are required to setup for an order of the Advanced model. The company pays a soles commissions of 5 w for the Basic model and 10% for the Advanced model. Its traceable foced advertising costs include $150.000 for the Basic modet ond 5200.000 fot the Advanced model The remainder of the company's selling and ariminictratlve costs ore orasnizatlon-sustanding in rhture The company pays a sales commissions of 5% for the Basic model and 10% for the Advanced model. its traceable fixed advertising costs include $150,000 for the Basic model and $200,000 for the Advanced model. The remainder of the company's selling and administrative costs are organization-sustaining in noture. Using the additional information provided by the production manager, calculate: a. An octivity rate for each activity cost pool. b. The tofol manufacturing overhead cost allocated to the Bastc model and the Advanced model using the activity-based approach. c. The total seling and administrotive cost traced to the Basic model and the Advanced model using the activity-based approach. 4. Using your activity-based cost assignments from requirement 3, prepare a contribution format segmented income statement that is adapted from Extibit 6-8. (Hint: Organize all of the company's costs into three categories: variable expenses, traceable fixed expenses, and common tixed expensesi) 5. Using your contribution format segmented income statement from requirement 4, calculate the break-even point in dollar sales for the Advanced model. Complete this question by entering your answers in the tabs below. Calculate the blantwide overhead rate. Calculate the amount of overhead that would be assigned to each product. Calculate the departmental overhead rates. (Round your answers to 2 decimal places. Celculate the total amount of overhead that would be assigned to each product. (Round your intermediate calculations to 2 decimal places.) Using your departmental overhead cost allocations, redo the controller's segmented income statement (continue to allocate selling and administrative expenses based on sales dollars). (Round your intermediate calculations to 2 decimal places. ) Calculate an activity rate for each activity cost pool. (Round your answers to 2 decimal places.) Calculate the totai manufacturing overhead cost allocated to the Basic model and the Advanced model using the activity-based approach. (Round vour intermediate calculations to 2 decimol placesi.) Calculate the total selling and administrative cost troced to the Basie model and the Advanced model using the activity-based approach. Using your activity-based cost assignments from requirement 3 , prepare a contribution format segmented income statement that is adapted from Exhibit 6-8. (Hint: Organize all of the company's costs into three categories: variable expenses, traceable fixed expenses, and common fixed expenses.) (Round your intermiediate calculations to 2 decimal places.) Using your contribution format segmented income statement from requirement 4 , caiculate the break-even point in doliar sales for the Advanced model. (Round your Intermediate calculations to 2 decimal ploces. Round your final ansiver to the nearest whole dollar.)