Answered step by step

Verified Expert Solution

Question

1 Approved Answer

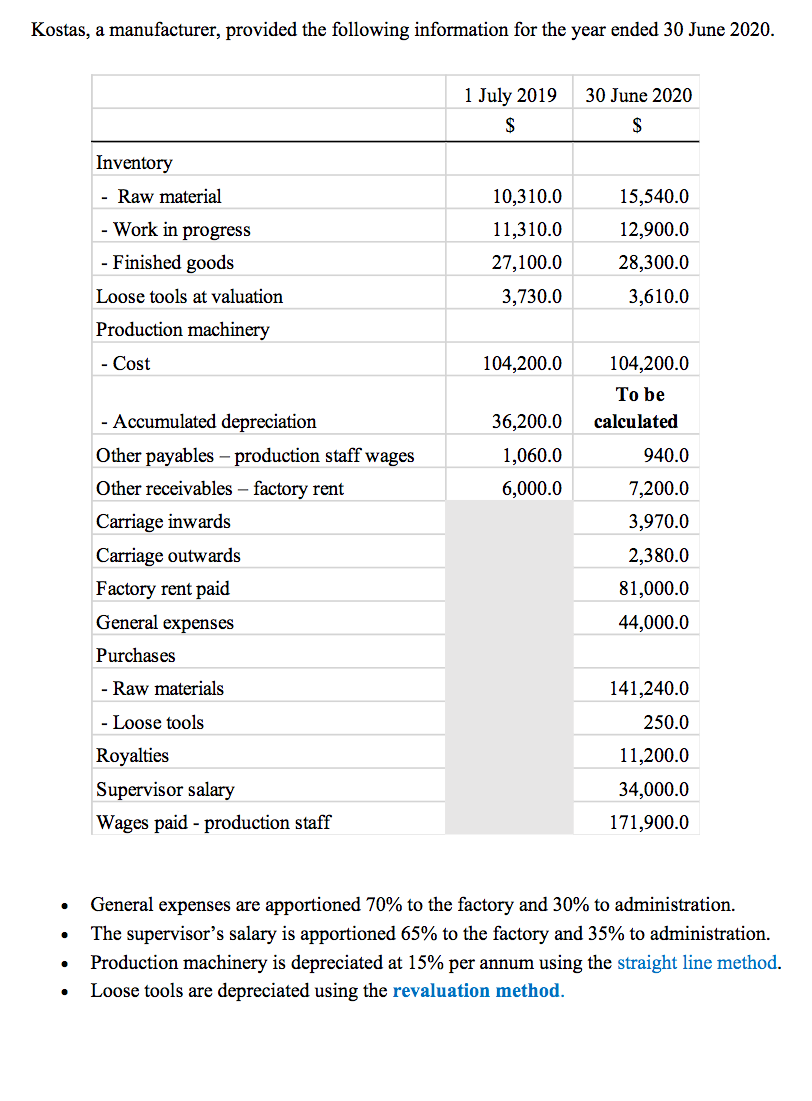

Kostas, a manufacturer, provided the following information for the year ended 30 June 2020. 1 July 2019 30 June 2020 $ $ Inventory Raw

Kostas, a manufacturer, provided the following information for the year ended 30 June 2020. 1 July 2019 30 June 2020 $ $ Inventory Raw material 10,310.0 15,540.0 - Work in progress 11,310.0 12,900.0 - Finished goods 27,100.0 28,300.0 Loose tools at valuation 3,730.0 3,610.0 Production machinery - Cost 104,200.0 104,200.0 To be - Accumulated depreciation 36,200.0 calculated Other payables - production staff wages 1,060.0 940.0 Other receivables - factory rent 6,000.0 7,200.0 Carriage inwards 3,970.0 Carriage outwards Factory rent paid General expenses Purchases Raw materials - Loose tools Royalties 2,380.0 81,000.0 44,000.0 Supervisor salary Wages paid production staff 141,240.0 250.0 11,200.0 34,000.0 171,900.0 General expenses are apportioned 70% to the factory and 30% to administration. The supervisor's salary is apportioned 65% to the factory and 35% to administration. Production machinery is depreciated at 15% per annum using the straight line method. Loose tools are depreciated using the revaluation method.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started