Question

KOT Industries is worth $2,000 today. Equity is worth $1,000 and stockholders require a return of 10%. Debt (bonds) is also worth $1,000. The

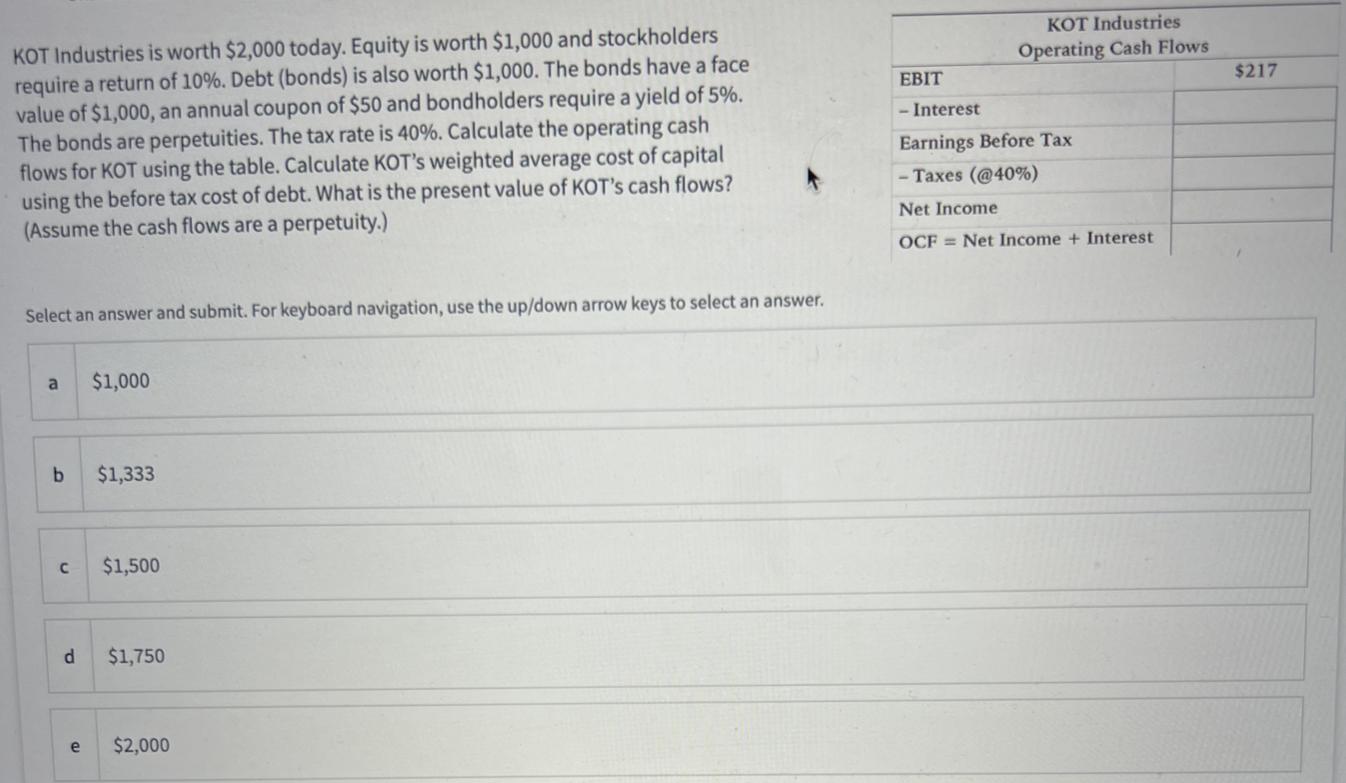

KOT Industries is worth $2,000 today. Equity is worth $1,000 and stockholders require a return of 10%. Debt (bonds) is also worth $1,000. The bonds have a face value of $1,000, an annual coupon of $50 and bondholders require a yield of 5%. The bonds are perpetuities. The tax rate is 40%. Calculate the operating cash flows for KOT using the table. Calculate KOT's weighted average cost of capital using the before tax cost of debt. What is the present value of KOT's cash flows? (Assume the cash flows are a perpetuity.) Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a b d e $1,000 $1,333 $1,500 $1,750 $2,000 KOT Industries Operating Cash Flows EBIT - Interest Earnings Before Tax - Taxes (@40%) Net Income OCF Net Income + Interest $217

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Financial Management

Authors: Eugene F. Brigham, Joel F. Houston

11th edition

324422870, 324422873, 978-0324302691

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App