Answered step by step

Verified Expert Solution

Question

1 Approved Answer

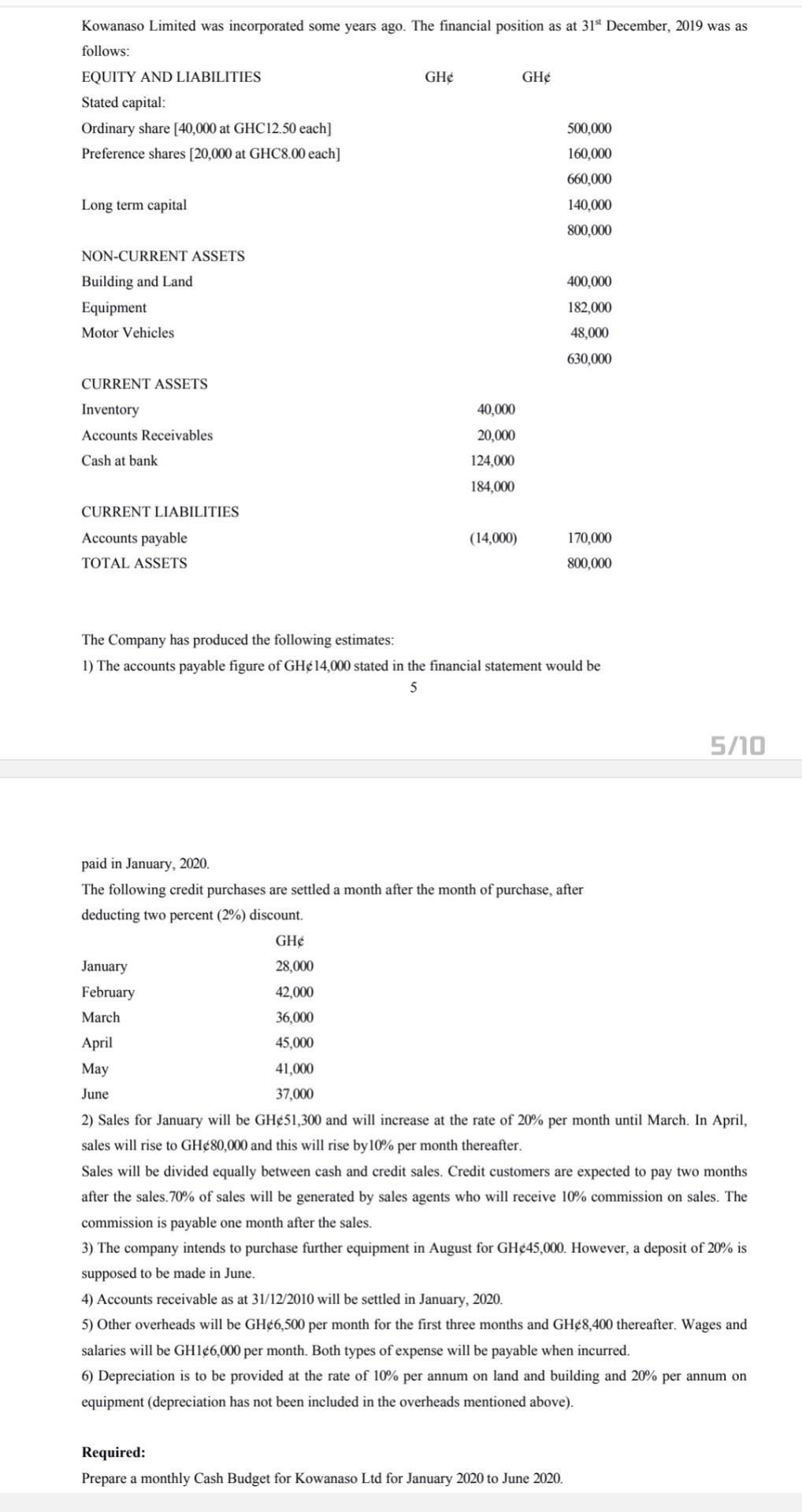

Kowanaso Limited was incorporated some years ago. The financial position as at 31st December, 2019 was as follows: EQUITY AND LIABILITIES Stated capital: Ordinary

Kowanaso Limited was incorporated some years ago. The financial position as at 31st December, 2019 was as follows: EQUITY AND LIABILITIES Stated capital: Ordinary share [40,000 at GHC12.50 each] Preference shares [20,000 at GHC8.00 each] Long term capital NON-CURRENT ASSETS Building and Land Equipment Motor Vehicles CURRENT ASSETS Inventory Accounts Receivables Cash at bank CURRENT LIABILITIES Accounts payable TOTAL ASSETS GH 40,000 20,000 124,000 184,000 (14,000) January February March April May June GH 500,000 160,000 660,000 140,000 800,000 400,000 182,000 48,000 630,000 The Company has produced the following estimates: 1) The accounts payable figure of GHe 14,000 stated in the financial statement would be 5 170,000 800,000 paid in January, 2020. The following credit purchases are settled a month after the month of purchase, after deducting two percent (2%) discount. Required: Prepare a monthly Cash Budget for Kowanaso Ltd for January 2020 to June 2020. GH 28,000 42,000 36,000 45,000 41,000 37,000 2) Sales for January will be GH51,300 and will increase at the rate of 20% per month until March. In April, sales will rise to GH 80,000 and this will rise by 10% per month thereafter. Sales will be divided equally between cash and credit sales. Credit customers are expected to pay two months after the sales.70% of sales will be generated by sales agents who will receive 10% commission on sales. The commission is payable one month after the sales. 3) The company intends to purchase further equipment in August for GH 45,000. However, a deposit of 20% is supposed to be made in June. 5/10 4) Accounts receivable as at 31/12/2010 will be settled in January, 2020. 5) Other overheads will be GH 6,500 per month for the first three months and GH 8,400 thereafter. Wages and salaries will be GH146,000 per month. Both types of expense will be payable when incurred. 6) Depreciation is to be provided at the rate of 10% per annum on land and building and 20% per annum on equipment (depreciation has not been included in the overheads mentioned above).

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started