***u//:sdnu KPMG is not Upton Park Limited's (UPL) regular tax adviser. However, the KPMG tax partner has regularly met with the CFO Veronika Gruenholz,

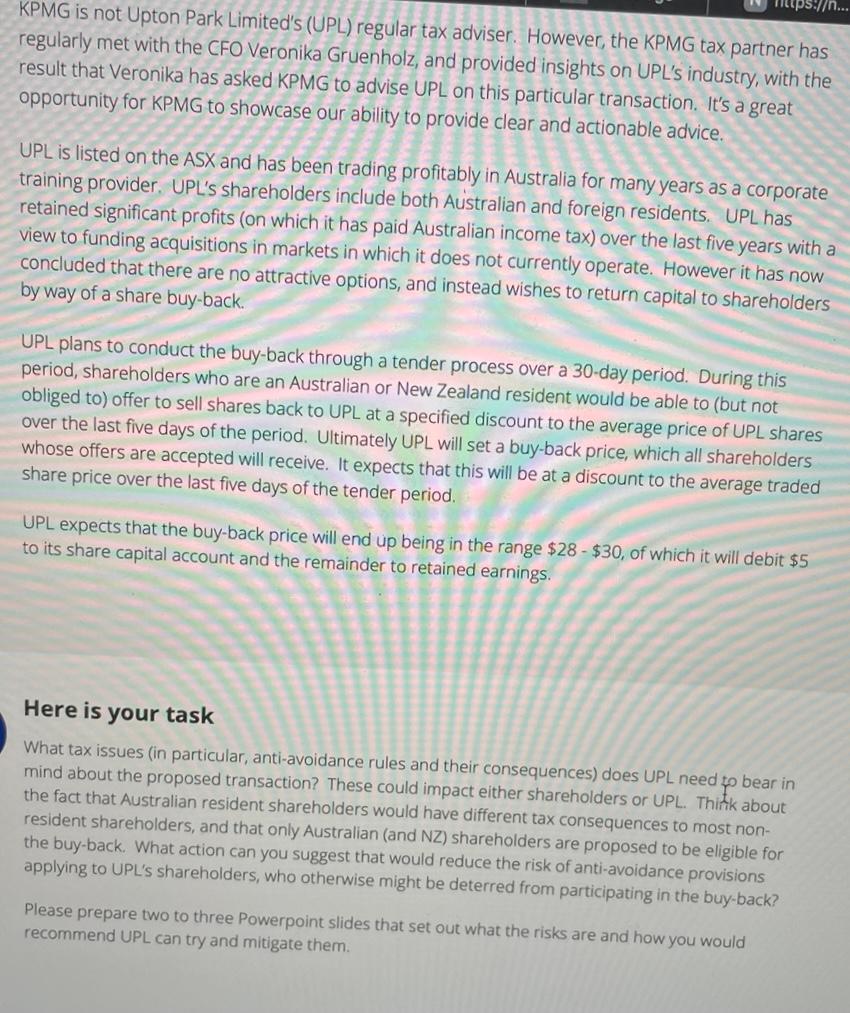

***u//:sdnu KPMG is not Upton Park Limited's (UPL) regular tax adviser. However, the KPMG tax partner has regularly met with the CFO Veronika Gruenholz, and provided insights on UPL's industry, with the result that Veronika has asked KPMG to advise UPL on this particular transaction. It's a great opportunity for KPMG to showcase our ability to provide clear and actionable advice. UPL is listed on the ASX and has been trading profitably in Australia for many years as a corporate training provider. UPL's shareholders include both Australian and foreign residents. UPL has retained significant profits (on which it has paid Australian income tax) over the last five years with a view to funding acquisitions in markets in which it does not currently operate. However it has now concluded that there are no attractive options, and instead wishes to return capital to shareholders by way of a share buy-back. UPL plans to conduct the buy-back through a tender process over a 30-day period. During this period, shareholders who are an Australian or New Zealand resident would be able to (but not obliged to) offer to sell shares back to UPL at a specified discount to the average price of UPL shares over the last five days of the period. Ultimately UPL will set a buy-back price, which all shareholders whose offers are accepted will receive. It expects that this will be at a discount to the average traded share price over the last five days of the tender period. UPL expects that the buy-back price will end up being in the range $28 - $30, of which it will debit $5 to its share capital account and the remainder to retained earnings. Here is your task What tax issues (in particular, anti-avoidance rules and their consequences) does UPL need to bear in mind about the proposed transaction? These could impact either shareholders or UPL. Think about the fact that Australian resident shareholders would have different tax consequences to most non- resident shareholders, and that only Australian (and NZ) shareholders are proposed to be eligible for the buy-back. What action can you suggest that would reduce the risk of anti-avoidance provisions applying to UPL's shareholders, who otherwise might be deterred from participating in the buy-back? Please prepare two to three Powerpoint slides that set out what the risks are and how you would recommend UPL can try and mitigate them.

Step by Step Solution

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

In this case UPLs tax avoidance could cause the risks on corporate tax payments This can be handled with a timely payment of the taxes The corporate a...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started