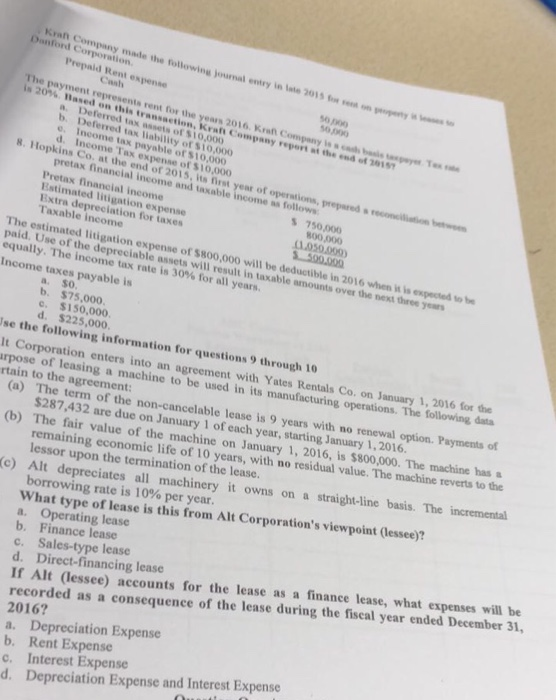

Krat Company made the followie journal entry in late 2015 Danford Corporation. se on peopety e Prepaid Rent expense s Cash 50 p00 50,000 The payment represents rent for the years 2016. Kraft Company is a cah basis tgyer is 20% Based on this transaetion, Kraft Company report at the end of 205 a. Deferred tax assets of S10,000 b. Deferred tax liabiity of $10,000 e. Income tax payable of $10,000 d. Income Tax expense of S10,000 Ten 8. Hopkins Co. at the end of 2015, ts first year of operstions, prepared s reconciliation betwo pretax financial income and taxable income as follows Pretax financial income Estimated litigation expense Extra depreciation for taxes Taxable income S 750,000 B00,000 (L050.000) S 500,000 The estimated litigation expense of $800,000 will be deductible in 2016 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts over the next three years equally. The income tax rate is 30% for all years. Income taxes payable is $0. b. $75,000. c. $150,000. d. $225,000. a. Use the following information for questions 9 through 10 It Corporation enters into an agreement with Yates Rentals Co. on January 1, 2016 for the arpose of leasing a machine to be used in its manufacturing operations. The following data rtain to the agreement: (a) The term of the non-cancelable lease is 9 years with no renewal option. Payments of $287,432 are due on January 1 of each year, starting January 1,2016. (b) The fair value of the machine on January 1, 2016, is $800,000. The machine has a remaining economic life of 10 years, with no residual value. The machine reverts to the lessor upon the termination of the lease. c) Alt depreciates all machinery it owns on a borrowing rate is 10 % per year. What type of lease is this from Alt Corporation's viewpoint (lessee)? a. Operating lease Finance lease straight-line basis. The incremental b Sales-type lease d. Direct-financing lease If Alt (lessee) accounts for the lease as a finance lease, what expenses will be recorded as a consequence of the lease during the fiscal year ended December 31, 2016? Depreciation Expense b. Rent Expense c. Interest Expense d. Depreciation Expense and Interest Expense c. a