Answered step by step

Verified Expert Solution

Question

1 Approved Answer

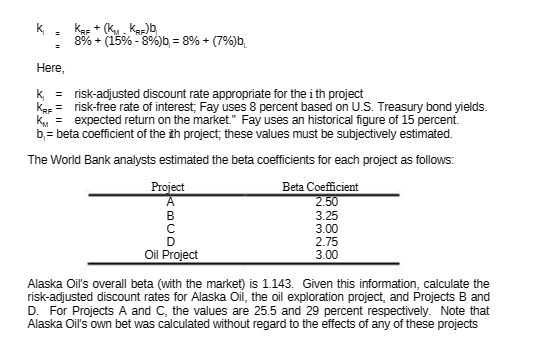

= = KRF + (KM.KRE) b 8% + (15%-8%) b, = 8% + (7%)b, Here, risk-adjusted discount rate appropriate for the i th project

= = KRF + (KM.KRE) b 8% + (15%-8%) b, = 8% + (7%)b, Here, risk-adjusted discount rate appropriate for the i th project k = KRF = risk-free rate of interest; Fay uses 8 percent based on U.S. Treasury bond yields. KM = expected return on the market." Fay uses an historical figure of 15 percent. b = beta coefficient of the ith project; these values must be subjectively estimated. The World Bank analysts estimated the beta coefficients for each project as follows: Beta Coefficient 2.50 3.25 3.00 2.75 3.00 Project A B Oil Project Alaska Oil's overall beta (with the market) is 1.143. Given this information, calculate the risk-adjusted discount rates for Alaska Oil, the oil exploration project, and Projects B and D. For Projects A and C, the values are 25.5 and 29 percent respectively. Note that Alaska Oil's own bet was calculated without regard to the effects of any of these projects

Step by Step Solution

★★★★★

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Here are the steps to calculate the riskadjusted discount rates for each project 1 Alaska Oil kI ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started