Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kris Inc., a technology company that specializes in social networking services and products, is considering entering the gaming business in a short venture. Kris

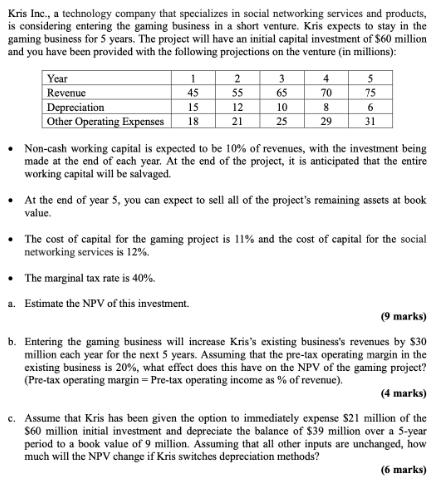

Kris Inc., a technology company that specializes in social networking services and products, is considering entering the gaming business in a short venture. Kris expects to stay in the gaming business for 5 years. The project will have an initial capital investment of $60 million and you have been provided with the following projections on the venture (in millions): Year Revenue Depreciation Other Operating Expenses 1 45 15 18 2 55 12 21 3 65 10 25 4 70 8 29 5 75 6 31 Non-cash working capital is expected to be 10% of revenues, with the investment being made at the end of each year. At the end of the project, it is anticipated that the entire working capital will be salvaged. At the end of year 5, you can expect to sell all of the project's remaining assets at book value. The cost of capital for the gaming project is 11% and the cost of capital for the social networking services is 12%. The marginal tax rate is 40%. a. Estimate the NPV of this investment. (9 marks) b. Entering the gaming business will increase Kris's existing business's revenues by $30 million each year for the next 5 years. Assuming that the pre-tax operating margin in the existing business is 20%, what effect does this have on the NPV of the gaming project? (Pre-tax operating margin = Pre-tax operating income as % of revenue). (4 marks) c. Assume that Kris has been given the option to immediately expense $21 million of the $60 million initial investment and depreciate the balance of $39 million over a 5-year period to a book value of 9 million. Assuming that all other inputs are unchanged, how much will the NPV change if Kris switches depreciation methods? (6 marks)

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a The NPV of this investment is 609 million NPV 60 45111 151112 651113 101114 701115 10 x 45 15 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started