Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kris's parents are considering two housing options for their son while he attends university. The first option is to rent a one bedroom apartment

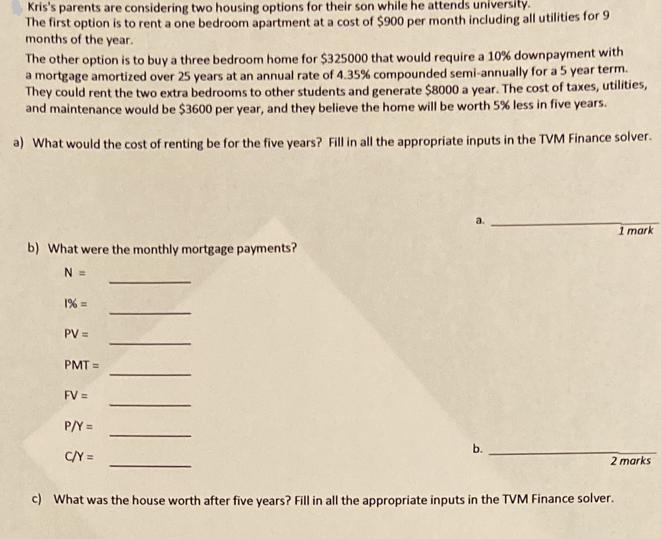

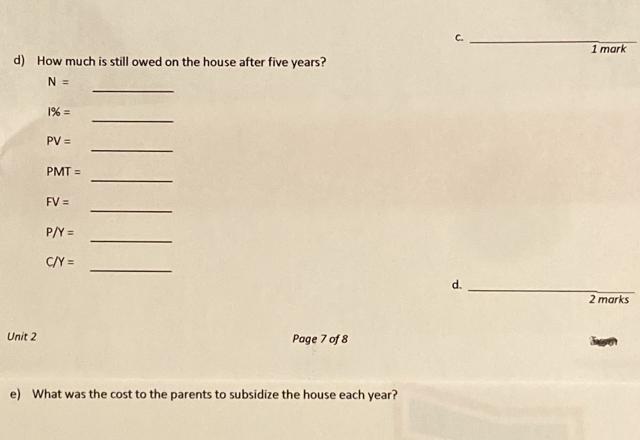

Kris's parents are considering two housing options for their son while he attends university. The first option is to rent a one bedroom apartment at a cost of $900 per month including all utilities for 9 months of the year. The other option is to buy a three bedroom home for $325000 that would require a 10% downpayment with a mortgage amortized over 25 years at an annual rate of 4.35% compounded semi-annually for a 5 year term. They could rent the two extra bedrooms to other students and generate $8000 a year. The cost of taxes, utilities, and maintenance would be $3600 per year, and they believe the home will be worth 5% less in five years. a) What would the cost of renting be for the five years? Fill in all the appropriate inputs in the TVM Finance solver. b) What were the monthly mortgage payments? N = 1% = PV = PMT= FV = P/Y = C/Y = 1 mark 2 marks c) What was the house worth after five years? Fill in all the appropriate inputs in the TVM Finance solver. d) How much is still owed on the house after five years? N = Unit 2 1% = PV = PMT= FV = P/Y = C/Y= Page 7 of 8 e) What was the cost to the parents to subsidize the house each year? 1 mark 2 marks Furth

Step by Step Solution

★★★★★

3.59 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the cost of renting for five years we need to multiply the monthly rent by the number ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started