Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kristoff is 75 years old. He is married to Iduna, who is 72 years old and severely disabled due to illness. Her only income

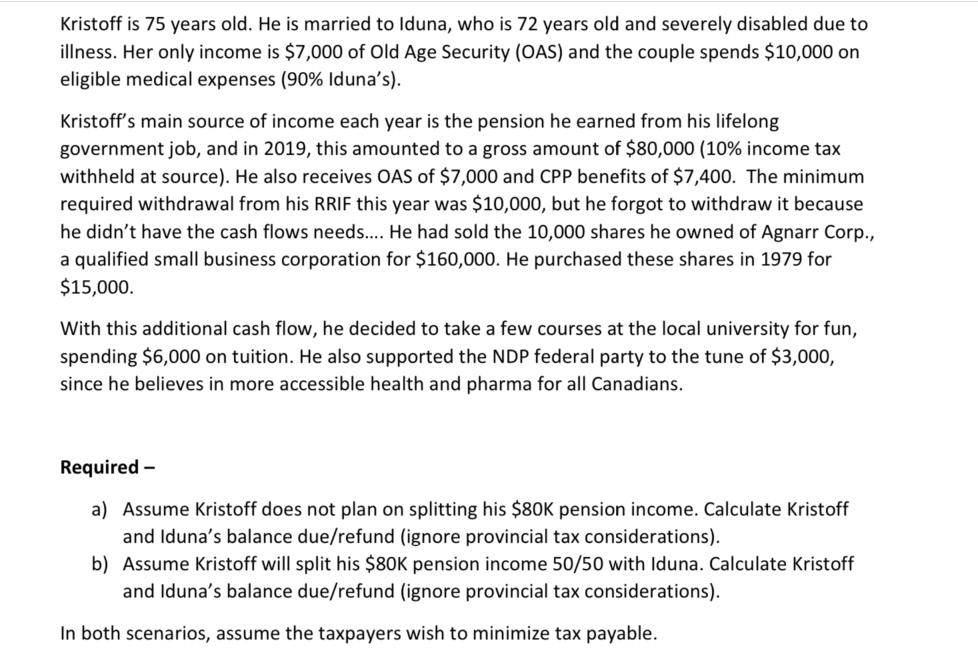

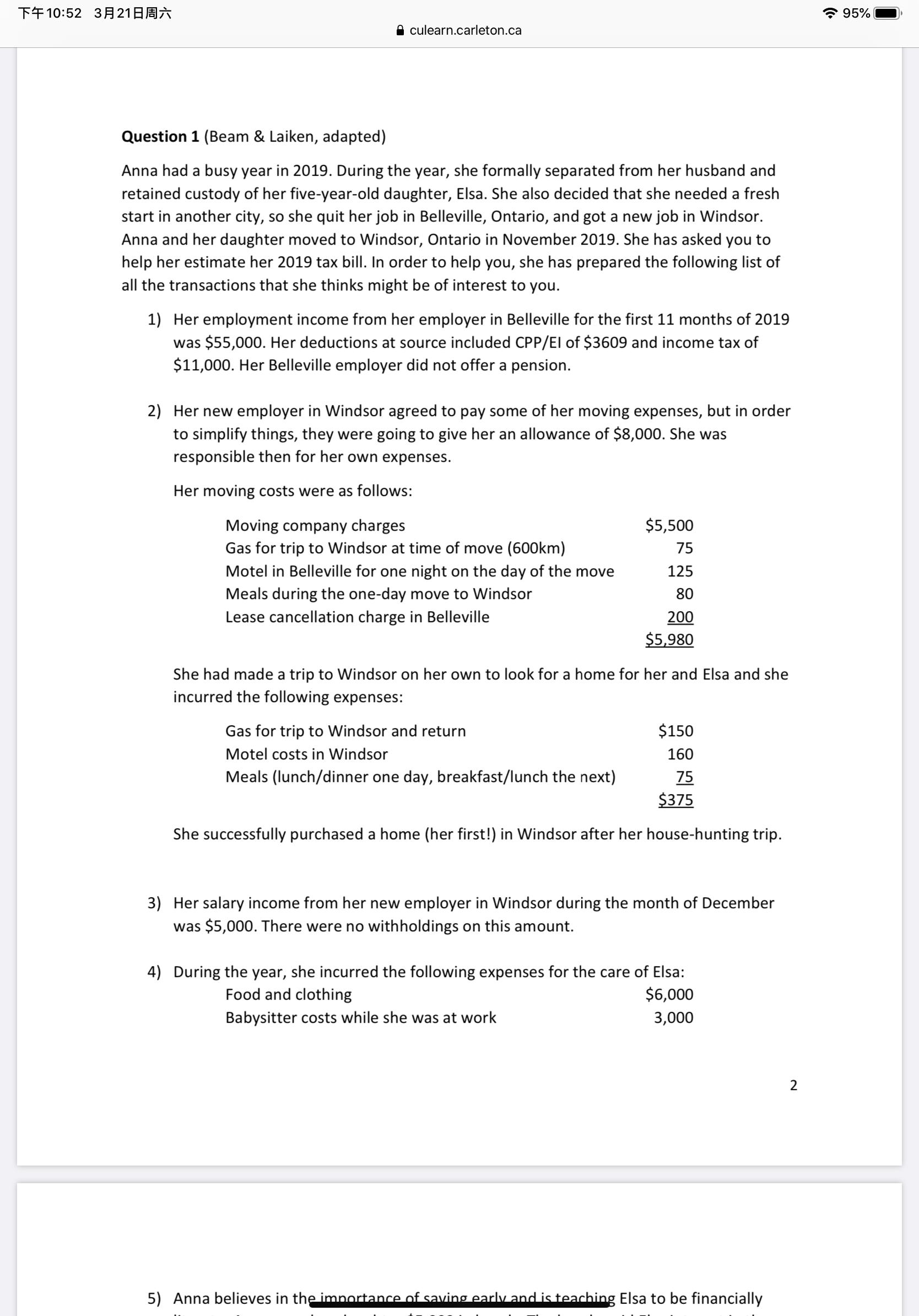

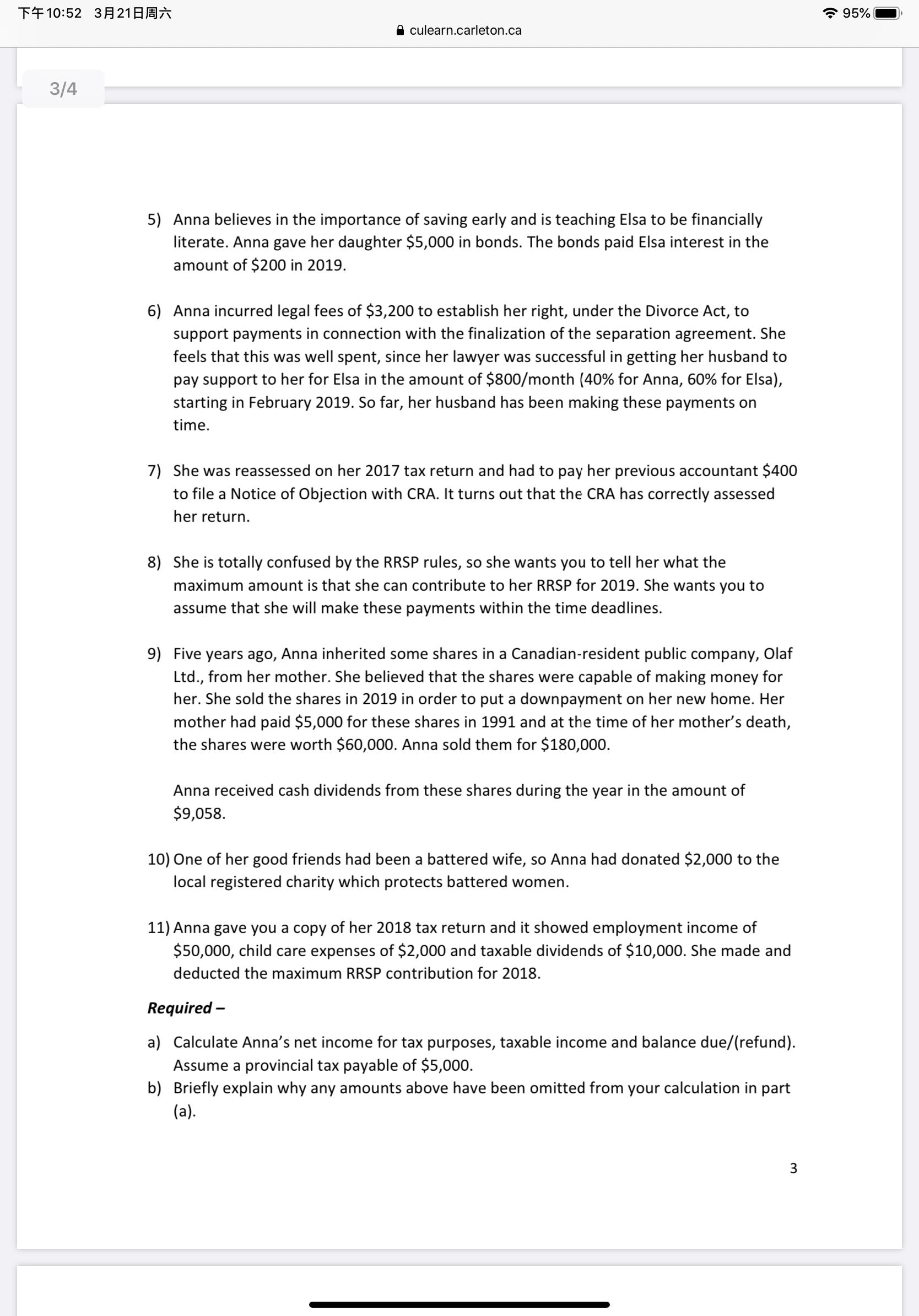

Kristoff is 75 years old. He is married to Iduna, who is 72 years old and severely disabled due to illness. Her only income is $7,000 of Old Age Security (OAS) and the couple spends $10,000 on eligible medical expenses (90% Iduna's). Kristoff's main source of income each year is the pension he earned from his lifelong government job, and in 2019, this amounted to a gross amount of $80,000 (10% income tax withheld at source). He also receives OAS of $7,000 and CPP benefits of $7,400. The minimum required withdrawal from his RRIF this year was $10,000, but he forgot to withdraw it because he didn't have the cash flows needs.... He had sold the 10,000 shares he owned of Agnarr Corp., a qualified small business corporation for $160,000. He purchased these shares in 1979 for $15,000. With this additional cash flow, he decided to take a few courses at the local university for fun, spending $6,000 on tuition. He also supported the NDP federal party to the tune of $3,000, since he believes in more accessible health and pharma for all Canadians. Required - a) Assume Kristoff does not plan on splitting his $80K pension income. Calculate Kristoff and Iduna's balance due/refund (ignore provincial tax considerations). b) Assume Kristoff will split his $80K pension income 50/50 with Iduna. Calculate Kristoff and Iduna's balance due/refund (ignore provincial tax considerations). In both scenarios, assume the taxpayers wish to minimize tax payable. T10:52 321 culearn.carleton.ca Question 1 (Beam & Laiken, adapted) Anna had a busy year in 2019. During the year, she formally separated from her husband and retained custody of her five-year-old daughter, Elsa. She also decided that she needed a fresh start in another city, so she quit her job in Belleville, Ontario, and got a new job in Windsor. Anna and her daughter moved to Windsor, Ontario in November 2019. She has asked you to help her estimate her 2019 tax bill. In order to help you, she has prepared the following list of all the transactions that she thinks might be of interest to you. 1) Her employment income from her employer in Belleville for the first 11 months of 2019 was $55,000. Her deductions at source included CPP/EI of $3609 and income tax of $11,000. Her Belleville employer did not offer a pension. 2) Her new employer in Windsor agreed to pay some of her moving expenses, but in order to simplify things, they were going to give her an allowance of $8,000. She was responsible then for her own expenses. Her moving costs were as follows: Moving company charges Gas for trip to Windsor at time of move (600km) Motel in Belleville for one night on the day of the move Meals during the one-day move to Windsor Lease cancellation charge in Belleville $5,500 75 125 80 200 $5,980 She had made a trip to Windsor on her own to look for a home for her and Elsa and she incurred the following expenses: Gas for trip to Windsor and return Motel costs in Windsor Meals (lunch/dinner one day, breakfast/lunch the next) $150 160 75 $375 She successfully purchased a home (her first!) in Windsor after her house-hunting trip. 3) Her salary income from her new employer in Windsor during the month of December was $5,000. There were no withholdings on this amount. 4) During the year, she incurred the following expenses for the care of Elsa: Food and clothing $6,000 3,000 Babysitter costs while she was at work 5) Anna believes in the importance of saving early and is teaching Elsa to be financially 2 95% TF10:52 321 3/4 culearn.carleton.ca 5) Anna believes in the importance of saving early and is teaching Elsa to be financially literate. Anna gave her daughter $5,000 in bonds. The bonds paid Elsa interest in the amount of $200 in 2019. 6) Anna incurred legal fees of $3,200 to establish her right, under the Divorce Act, to support payments in connection with the finalization of the separation agreement. She feels that this was well spent, since her lawyer was successful in getting her husband to pay support to her for Elsa in the amount of $800/month (40% for Anna, 60% for Elsa), starting in February 2019. So far, her husband has been making these payments on time. 7) She was reassessed on her 2017 tax return and had to pay her previous accountant $400 to file a Notice of Objection with CRA. It turns out that the CRA has correctly assessed her return. 8) She is totally confused by the RRSP rules, so she wants you to tell her what the maximum amount is that she can contribute to her RRSP for 2019. She wants you to assume that she will make these payments within the time deadlines. 9) Five years ago, Anna inherited some shares in a Canadian-resident public company, Olaf Ltd., from her mother. She believed that the shares were capable of making money for her. She sold the shares in 2019 in order to put a downpayment on her new home. Her mother had paid $5,000 for these shares in 1991 and at the time of her mother's death, the shares were worth $60,000. Anna sold them for $180,000. Anna received cash dividends from these shares during the year in the amount of $9,058. 10) One of her good friends had been a battered wife, so Anna had donated $2,000 to the local registered charity which protects battered women. 11) Anna gave you a copy of her 2018 tax return and it showed employment income of $50,000, child care expenses of $2,000 and taxable dividends of $10,000. She made and deducted the maximum RRSP contribution for 2018. Required - a) Calculate Anna's net income for tax purposes, taxable income and balance due/(refund). Assume a provincial tax payable of $5,000. b) Briefly explain why any amounts above have been omitted from your calculation in part (a). 3 95%

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Lets solve this stepbystep a Calculate Kristoff and Idunas balance duerefund assuming Kristoff does ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started