Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Krypton Partnership owns and operates an office building in the medical district of a large city. The property was contributed to the partnership several

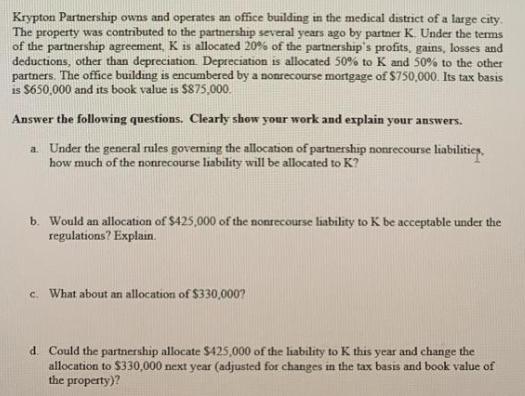

Krypton Partnership owns and operates an office building in the medical district of a large city. The property was contributed to the partnership several years ago by partner K. Under the terms of the partnership agreement, K is allocated 20% of the partnership's profits, gains, losses and deductions, other than depreciation. Depreciation is allocated 50% to K and 50% to the other partners. The office building is encumbered by a nonrecourse mortgage of $750,000. Its tax basis is $650,000 and its book value is $875,000. Answer the following questions. Clearly show your work and explain your answers. a. Under the general rules governing the allocation of partnership nonrecourse liabilities. how much of the nonrecourse liability will be allocated to K? b. Would an allocation of $425,000 of the nonrecourse liability to K be acceptable under the regulations? Explain. What about an allocation of $330,000? d. Could the partnership allocate $425,000 of the liability to K this year and change the allocation to $330,000 next year (adjusted for changes in the tax basis and book value of the property)?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Under the general rules governing the allocation of partnership nonrecourse liabilities the allocation is based on the partners share of profits In ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started