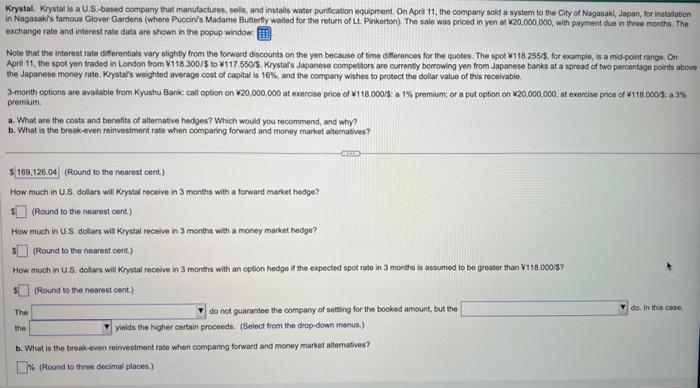

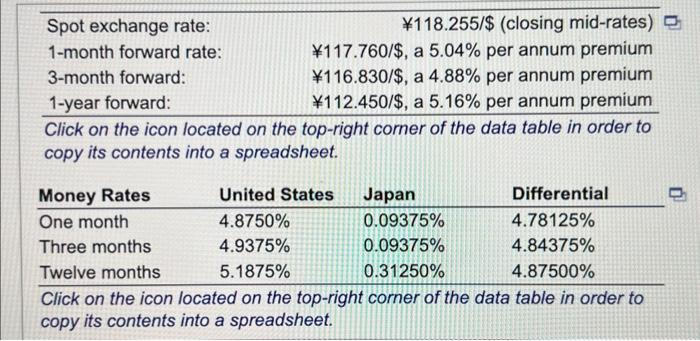

Krystal. Krystal is a U.S.based company that manufacturek, selk, and installs wator purification equipment. On April 11, the company sold a system to the City of Nogasaki, Japan, for instalabion in Nagasakis fumous Glover Gardens (where Puccin's Madame Buterfly waded for the return of Lt. Pinkerton). The sale was priced in yen at 20,000,000, with payment due in the me months. The exchange rate and interest rate dota are shewn in the popup window: Note that the interest rate dikerentials vary slightyy from the forward discounts on the yen because of time diflorences for the quotes. The spot Y118.255/5, for example, is a mid-point range. On Apri 11, the spot yen traded in London trom Y118. 300/15 to 1117.5505 . Krystars Japanese compettors are currenty borrowing yen from Japanese banks at a spread of two percentage points above the Japanese money rate. Krystars weighted average cost of capital is 16%, and the compony wishes to protect the dollar value of this receivabie. premism. a. What are the costs and benefits of altematve hedges? Which would you recommend, and why? b. What is the breokeven reinvestment rate when comparing forward and money market alternatives? (Round to the nearest cent) How much in US doliar will Krystal receive in 3 months with a forward maaket hedge? (Round to the newrest cent) How much in U.S. dollars will Krystal recelve in 3 menths with a money market hedge? (Round to the nearest cent) How much in U.S. dolars will Krystal receive in 3 months with an option hedge if the expected spot rato in 3 months is assumed to be greater than V118.000r? (Round to the nearest cent) The do not quarantee the company of setting for the booked amount, but the yieids the higher certain proceeds. (Select trem the dop-dowt menus.) the b. What is the break-even reimestment rate when comparing forward and monoy maket ahematwes? Click on the icon located on the top-right corner of the data table in order to copy its contents into a spreadsheet. Krystal. Krystal is a U.S.based company that manufacturek, selk, and installs wator purification equipment. On April 11, the company sold a system to the City of Nogasaki, Japan, for instalabion in Nagasakis fumous Glover Gardens (where Puccin's Madame Buterfly waded for the return of Lt. Pinkerton). The sale was priced in yen at 20,000,000, with payment due in the me months. The exchange rate and interest rate dota are shewn in the popup window: Note that the interest rate dikerentials vary slightyy from the forward discounts on the yen because of time diflorences for the quotes. The spot Y118.255/5, for example, is a mid-point range. On Apri 11, the spot yen traded in London trom Y118. 300/15 to 1117.5505 . Krystars Japanese compettors are currenty borrowing yen from Japanese banks at a spread of two percentage points above the Japanese money rate. Krystars weighted average cost of capital is 16%, and the compony wishes to protect the dollar value of this receivabie. premism. a. What are the costs and benefits of altematve hedges? Which would you recommend, and why? b. What is the breokeven reinvestment rate when comparing forward and money market alternatives? (Round to the nearest cent) How much in US doliar will Krystal receive in 3 months with a forward maaket hedge? (Round to the newrest cent) How much in U.S. dollars will Krystal recelve in 3 menths with a money market hedge? (Round to the nearest cent) How much in U.S. dolars will Krystal receive in 3 months with an option hedge if the expected spot rato in 3 months is assumed to be greater than V118.000r? (Round to the nearest cent) The do not quarantee the company of setting for the booked amount, but the yieids the higher certain proceeds. (Select trem the dop-dowt menus.) the b. What is the break-even reimestment rate when comparing forward and monoy maket ahematwes? Click on the icon located on the top-right corner of the data table in order to copy its contents into a spreadsheet