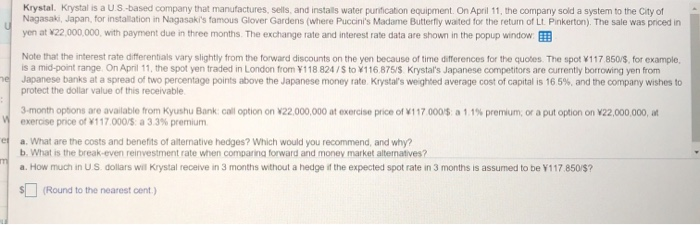

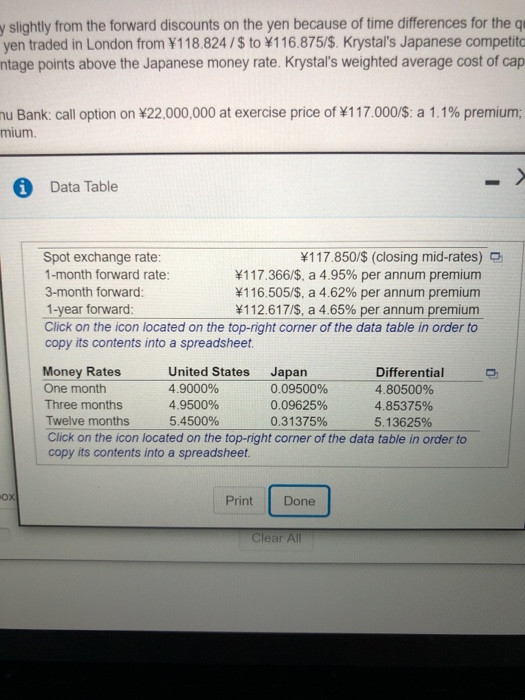

Krystal. Krystal is a US-based company that manufactures, sells and installs water purification equipment. On April 11, the company sold a system to the City of Nagasaki, Japan, for installation in Nagasaki's famous Glover Gardens (where Puccini's Madame Butterfly waited for the return of LL Pinkerton). The sale was priced in yen at 22,000,000, with payment due in three months. The exchange rate and interest rate data are shown in the popup window Note that the interest rate differentials vary slightly from the forward discounts on the yen because of time differences for the quotes. The spot 117 850/9, for example, is a mid-point range. On April 11, the spot yen traded in London from Y118 824/8 to 1116 875/5 Krystal's Japanese competitors are currently borrowing yen from Japanese banks at a spread of two percentage points above the Japanese money rate. Krystal's weighted average cost of capital is 16.5%, and the company wishes to protect the dollar value of this receivable 3-month options are available from Kyushu Bank call option on V22,000,000 at exercise price of 117 000 $ a 11% premium, or a put option on V22,000,000, exercise price of 117.000/: a 3.3% premium a. What are the costs and benefits of alternative hedges? Which would you recommend, and why? b. What is the break-even reinvestment rate when comparing forward and money market alternatives? a. How much in US dollars wil Krystal receive in 3 months without a hedge if the expected spot rate in 3 months is assumed to be Y117 850/$? $ (Round to the nearest cent.) y slightly from the forward discounts on the yen because of time differences for the a yen traded in London from 118.824/$ to $116.875/$. Krystal's Japanese competita intage points above the Japanese money rate. Krystal's weighted average cost of cap mu Bank: call option on 22,000,000 at exercise price of 117.000/$: a 1.1% premium; mium Data Table Spot exchange rate: 117.850/$ (closing mid-rates) 1-month forward rate: 117.366/$, a 4.95% per annum premium 3-month forward: 116.505/$, a 4.62% per annum premium 1-year forward: 112.617/$, a 4.65% per annum premium Click on the icon located on the top-right corner of the data table in order to copy its contents into a spreadsheet. Money Rates United States Japan Differential One month 4.9000% 0.09500% 4.80500% Three months 4.9500% 0.09625% 4.85375% Twelve months 5.4500% 0.31375% 5.13625% Click on the icon located on the top-right corner of the data table in order to copy its contents into a spreadsheet. 02 Print Done Clear All Krystal. Krystal is a US-based company that manufactures, sells and installs water purification equipment. On April 11, the company sold a system to the City of Nagasaki, Japan, for installation in Nagasaki's famous Glover Gardens (where Puccini's Madame Butterfly waited for the return of LL Pinkerton). The sale was priced in yen at 22,000,000, with payment due in three months. The exchange rate and interest rate data are shown in the popup window Note that the interest rate differentials vary slightly from the forward discounts on the yen because of time differences for the quotes. The spot 117 850/9, for example, is a mid-point range. On April 11, the spot yen traded in London from Y118 824/8 to 1116 875/5 Krystal's Japanese competitors are currently borrowing yen from Japanese banks at a spread of two percentage points above the Japanese money rate. Krystal's weighted average cost of capital is 16.5%, and the company wishes to protect the dollar value of this receivable 3-month options are available from Kyushu Bank call option on V22,000,000 at exercise price of 117 000 $ a 11% premium, or a put option on V22,000,000, exercise price of 117.000/: a 3.3% premium a. What are the costs and benefits of alternative hedges? Which would you recommend, and why? b. What is the break-even reinvestment rate when comparing forward and money market alternatives? a. How much in US dollars wil Krystal receive in 3 months without a hedge if the expected spot rate in 3 months is assumed to be Y117 850/$? $ (Round to the nearest cent.) y slightly from the forward discounts on the yen because of time differences for the a yen traded in London from 118.824/$ to $116.875/$. Krystal's Japanese competita intage points above the Japanese money rate. Krystal's weighted average cost of cap mu Bank: call option on 22,000,000 at exercise price of 117.000/$: a 1.1% premium; mium Data Table Spot exchange rate: 117.850/$ (closing mid-rates) 1-month forward rate: 117.366/$, a 4.95% per annum premium 3-month forward: 116.505/$, a 4.62% per annum premium 1-year forward: 112.617/$, a 4.65% per annum premium Click on the icon located on the top-right corner of the data table in order to copy its contents into a spreadsheet. Money Rates United States Japan Differential One month 4.9000% 0.09500% 4.80500% Three months 4.9500% 0.09625% 4.85375% Twelve months 5.4500% 0.31375% 5.13625% Click on the icon located on the top-right corner of the data table in order to copy its contents into a spreadsheet. 02 Print Done Clear All