Answered step by step

Verified Expert Solution

Question

1 Approved Answer

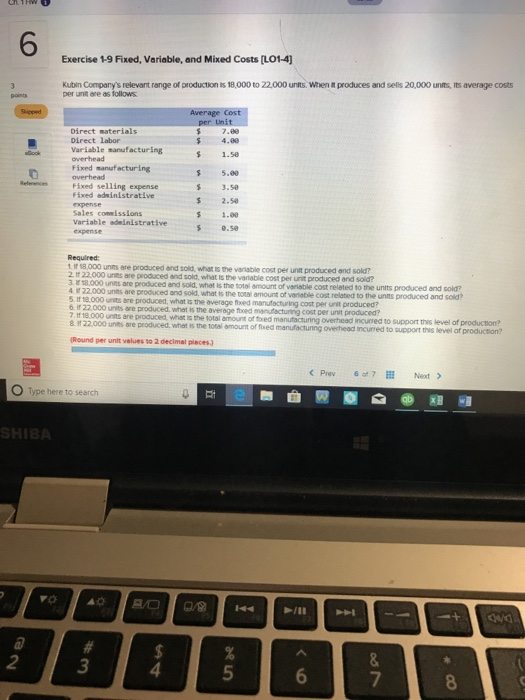

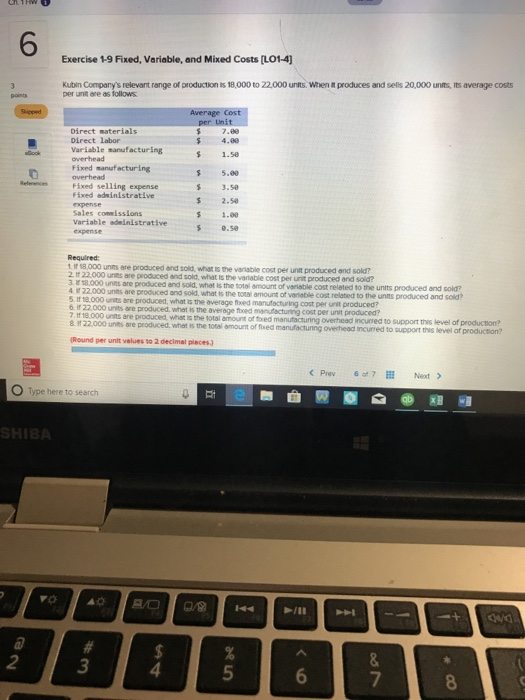

Kubin company relevant range of production is 18000 to 22000 units. When it produces and sells 20000 units, its average costs per unit are as

Kubin company relevant range of production is 18000 to 22000 units. When it produces and sells 20000 units, its average costs per unit are as follows.

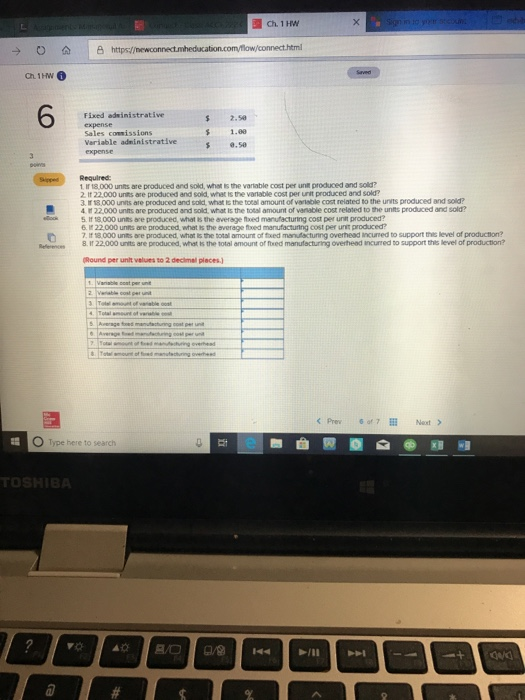

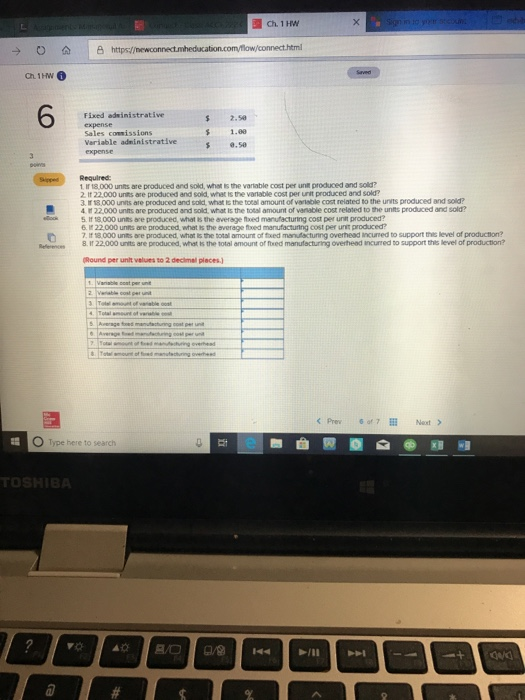

6 Exercise 1-9 Fixed, Variable, and Mixed Costs [LO1-4] Kubin Company's relevant range of production is 18,000 to 22000 units. When it produces and sells 20,000 unts, Its average costs per unit are as follows Direct materials Direct labor Variable sanufacturing $ 4.88 $ 1.se $ 5.00 Refeences Fixed selling expense Fixed adsinistrative Sales comeissions Variable administrative expense $ 2.50 $ 1.00 $0.5e 1. Ir 18,000 unns are produced and sold, what is the varisble cost per unt produced and sold? 2 If 22000 units are produced and sold, what is the vartable cost per unit produced and sold? 3 Ir 18,000 unins are produced and sold, what is the total amount of veriable cost related to the unts produced and sold? units are produced and sold, what is the tonal amount of vanable cost related to the unns produced and sold? 5 If 18,000 unts are produced, 6. Ir 22.000 units are produced, what is the average fhxed 7 It 18.000 unts are produced, what is the average fed whst is the total amount of txed manufacturing overhead incurred to support this level of producion? cost per unt produced? cost per unit produced? is the torsl amount of fsed manufacturing overhead incurred to support thes level of production? Round per unit values to 2 declmal places Type here to search 2 3 4 5 https:/ Fixed adinistrative expense Sales coenissions Variable administrative $ 2.5 1.00 8.50 Required 1 Ir 18,000 unts are produced and sold, what is the varlable cost per unit produced and sold? 2 It 22,000 units are produced and sold, whet is the vatable cost per unit produced and sold? Ir 13,000 units are produced and sold, what Is the total amount of vartsble cost related to the units produced and sold? 422,000 units are produced and sold what is the total amount or venace cost related to the units prodced and sold? ck 5 1f 18000 unts are produced, what s the average nxed manufacturing cost per unt produced? 22.000 unts are prodced what the verage ted manufacturing cost per unt produced? 7. I 18000 units are produced, what is the botal amount of fthxed manufacturing overhead incuned to support thie level of produchon? Reflerences8. If 22000 units are produced, what is the total amount of ftxed manufacturing overheed incurred bo support this level of production Round per unt velues to 2 declmal places) O Type here to search TO

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started