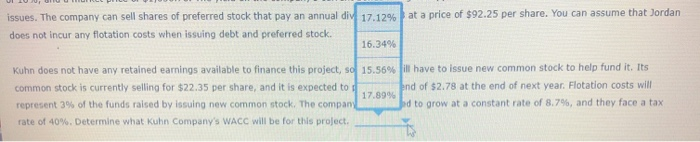

Kuhn does not have any retained earnings available to finance this project, so the firm will have to issue new common stock to help fund it. Its common stock is currently selling for $22.35 per share, and it is expected to pay a dividend of $2.78 at the end of next year. Flotation costs will represent 3% of the funds raised by Issuing new common stock. The company is projected to grow at a constant rate of 8.7%, and they face a tax rate of 40%. Determine what Kuhn Company's WACC will be for this project. at a price of $92.25 per share. You can assume that Jordan issues. The company can sell shares of preferred stock that pay an annual div 17.12% does not incur any flotation costs when issuing debt and preferred stock. 16.34% Kuhn does not have any retained earnings available to finance this project, so 15.56% common stock is currently selling for $22.35 per share, and it is expected to 117.89% represent 3% of the funds raised by issuing new common stock. The company rate of 40%. Determine what Kuhn Company's WACC will be for this project. ill have to issue new common stock to help fund it. Its n d of $2.78 at the end of next year. Flotation costs will had to grow at a constant rate of 8.7%, and they face a tax Kuhn does not have any retained earnings available to finance this project, so the firm will have to issue new common stock to help fund it. Its common stock is currently selling for $22.35 per share, and it is expected to pay a dividend of $2.78 at the end of next year. Flotation costs will represent 3% of the funds raised by Issuing new common stock. The company is projected to grow at a constant rate of 8.7%, and they face a tax rate of 40%. Determine what Kuhn Company's WACC will be for this project. at a price of $92.25 per share. You can assume that Jordan issues. The company can sell shares of preferred stock that pay an annual div 17.12% does not incur any flotation costs when issuing debt and preferred stock. 16.34% Kuhn does not have any retained earnings available to finance this project, so 15.56% common stock is currently selling for $22.35 per share, and it is expected to 117.89% represent 3% of the funds raised by issuing new common stock. The company rate of 40%. Determine what Kuhn Company's WACC will be for this project. ill have to issue new common stock to help fund it. Its n d of $2.78 at the end of next year. Flotation costs will had to grow at a constant rate of 8.7%, and they face a tax