Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kumar has been working for Dreamline Enterprises for 12 years. He has been a member of the company's defined benefit pension plan for the

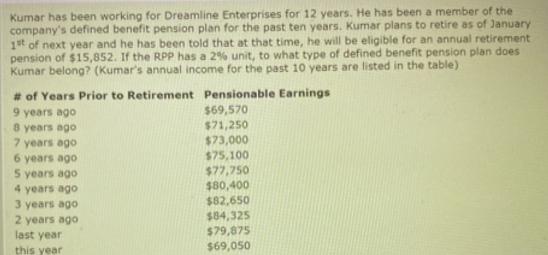

Kumar has been working for Dreamline Enterprises for 12 years. He has been a member of the company's defined benefit pension plan for the past ten years. Kumar plans to retire as of January 1st of next year and he has been told that at that time, he will be eligible for an annual retirement pension of $15,852. If the RPP has a 2% unit, to what type of defined benefit pension plan does Kumar belong? (Kumar's annual income for the past 10 years are listed in the table) # of Years Prior to Retirement Pensionable Earnings 9 years ago 8 years ago 7 years ago 6 years ago 5 years ago 4 years ago 3 years ago 2 years ago last year this year $69,570 $71,250 $73,000 $75,100 $77,750 $80,400 $82,650 $84,325 $79,875 $69,050

Step by Step Solution

★★★★★

3.56 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculate Kumars average annual pensionable earnings for the past 10 year...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started