Answered step by step

Verified Expert Solution

Question

1 Approved Answer

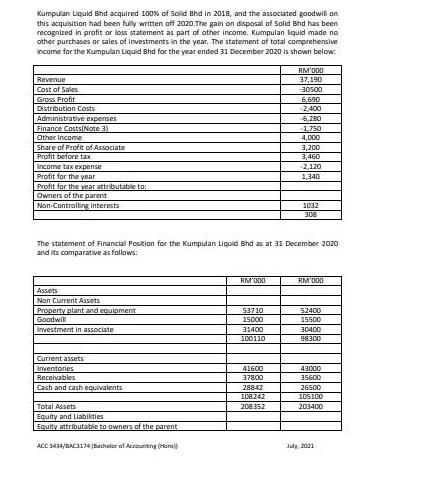

Kumpulan Liquid Bhd acquired 100% of Solid Bhd in 2018, and the associated goodwill on this acquisition had been fully written off 2020.The gain

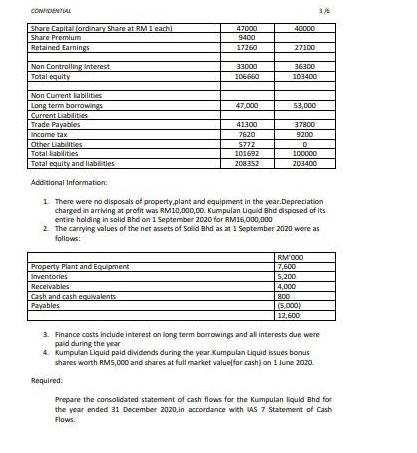

Kumpulan Liquid Bhd acquired 100% of Solid Bhd in 2018, and the associated goodwill on this acquisition had been fully written off 2020.The gain on disposal of Solid Bhd has been recognized in profit or loss statement as part of other income. Kumpulan liquid made no other purchases or sales of investments in the year. The statement of total comprehensive Income for the Kumpulan Liquid Bhd for the year ended 31 December 2020 is shown below: Revenue Cost of Sales Gross Profit Distribution Costs Administrative expenses Finance Costs Note 3) Other Income Share of Profit of Associate Profit before tax Income tax expense Profit for the year Profit for the year attributable to: Owners of the parent Non Controlling interests Assets Non Current Assets Property plant and equipment Goodwill Investment in associate Current assets Inventories Receivables Cash and cash equivalents The statement of Financial Position for the Kumpulan Liquid Bhd as at 31 December 2020 and its comparative as follows: Total Assets Equity and Liabilities Equity attributable to owners of the parent ACC 3434/BAC3174 (Bachelor of Accounting (om RM'000 53710 15000 31400 100110 41600 37800 RM'000 37,190 -30500 6,690 -2,400 6,280 -1,750 4,000 28842 108242 208352 3,200 3,460 -2,120 1,340 1032 308 RM'000 52400 15500 30400 98300 43000 35600 26500 105100 203400 July, 201 CONFIDENTIAL Share Capital (ordinary Share at RM 1 each) Share Premium Retained Earnings Non Controlling interest Total equity Non Current liabilities Long term borrowings Current Liabilities Trade Payables income tax Other Liabilities Total liabilities Total equity and liabilities Property Plant and Equipment Inventories Receivables Cash and cash equivalents Payables 47000 9400 17260 33000 106660 Required: 47,000 41300 7620 5772 101692 208352 40000 27100 36300 103400 53,000 37800 9200 0 100000 203400 Additional Information: 1 There were no disposals of property.plant and equipment in the year.Depreciation charged in arriving at profit was RM10,000,00. Kumpulan Liquid Bhd disposed of its entire holding in solid Bhd on 1 September 2020 for RM15,000,000 2. The carrying values of the net assets of Solid Bhd as at 1 September 2020 were as follows: 3/6 RM 000 7,600 5,200 4,000 800 (5,000) 12,600 3. Finance costs include interest on long term borrowings and all interests due were paid during the year 4. Kumpulan Liquid paid dividends during the year Kumpulan Liquid issues bonus shares worth RM5,000 and shares at full market value(for cash) on 1 June 2020. Prepare the consolidated statement of cash flows for the Kumpulan liquid Bhd for the year ended 31 December 2020, in accordance with IAS 7 Statement of Cash Flows.

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Statement of CashFlow as at 31st December 2021 Particulars Amount Amount Operating Activites Profit ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started