Answered step by step

Verified Expert Solution

Question

1 Approved Answer

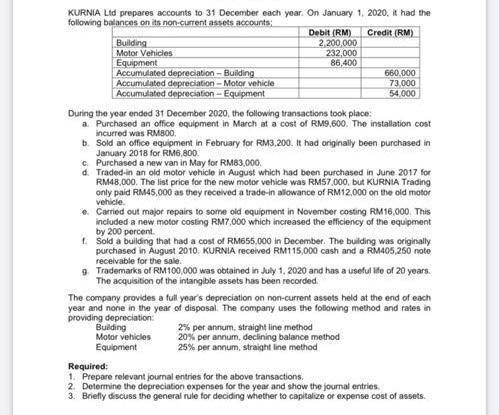

KURNIA Ltd prepares accounts to 31 December each year. On January 1, 2020, it had the following balances on its non-current assets accounts; Credit

KURNIA Ltd prepares accounts to 31 December each year. On January 1, 2020, it had the following balances on its non-current assets accounts; Credit (RM) Building Motor Vehicles Equipment Accumulated depreciation - Building Accumulated depreciation - Motor vehicle Accumulated depreciation - Equipment Debit (RM) 2,200,000 232,000 86,400 During the year ended 31 December 2020, the following transactions took place: a. Purchased an office equipment in March at a cost of RM9,600. The installation cost incurred was RM800. 660,000 73,000 54.000 b. Sold an office equipment in February for RM3,200. It had originally been purchased in January 2018 for RM6,800. c. Purchased a new van in May for RM83,000. d. Traded-in an old motor vehicle in August which had been purchased in June 2017 for RM48,000. The list price for the new motor vehicle was RM57,000, but KURNIA Trading only paid RM45,000 as they received a trade-in allowance of RM12,000 on the old motor vehicle. e. Carried out major repairs to some old equipment in November costing RM16,000. This included a new motor costing RM7,000 which increased the efficiency of the equipment by 200 percent. f. Sold a building that had a cost of RM655,000 in December. The building was originally purchased in August 2010. KURNIA received RM115,000 cash and a RM405,250 note receivable for the sale. Building Motor vehicles Equipment 9 Trademarks of RM100,000 was obtained in July 1, 2020 and has a useful life of 20 years. The acquisition of the intangible assets has been recorded. The company provides a full year's depreciation on non-current assets held at the end of each year and none in the year of disposal. The company uses the following method and rates in providing depreciation: 2% per annum, straight line method 20% per annum, declining balance method 25% per annum, straight line method Required: 1. Prepare relevant journal entries for the above transactions. 2. Determine the depreciation expenses for the year and show the journal entries. 3. Briefly discuss the general rule for deciding whether to capitalize or expense cost of assets.

Step by Step Solution

★★★★★

3.51 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Journal Entries a i Office Equipement Ac Dr 9600 RM To Bank Ac 9600 Rm ii Office Equipement Ac Dr 80...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started