Answered step by step

Verified Expert Solution

Question

1 Approved Answer

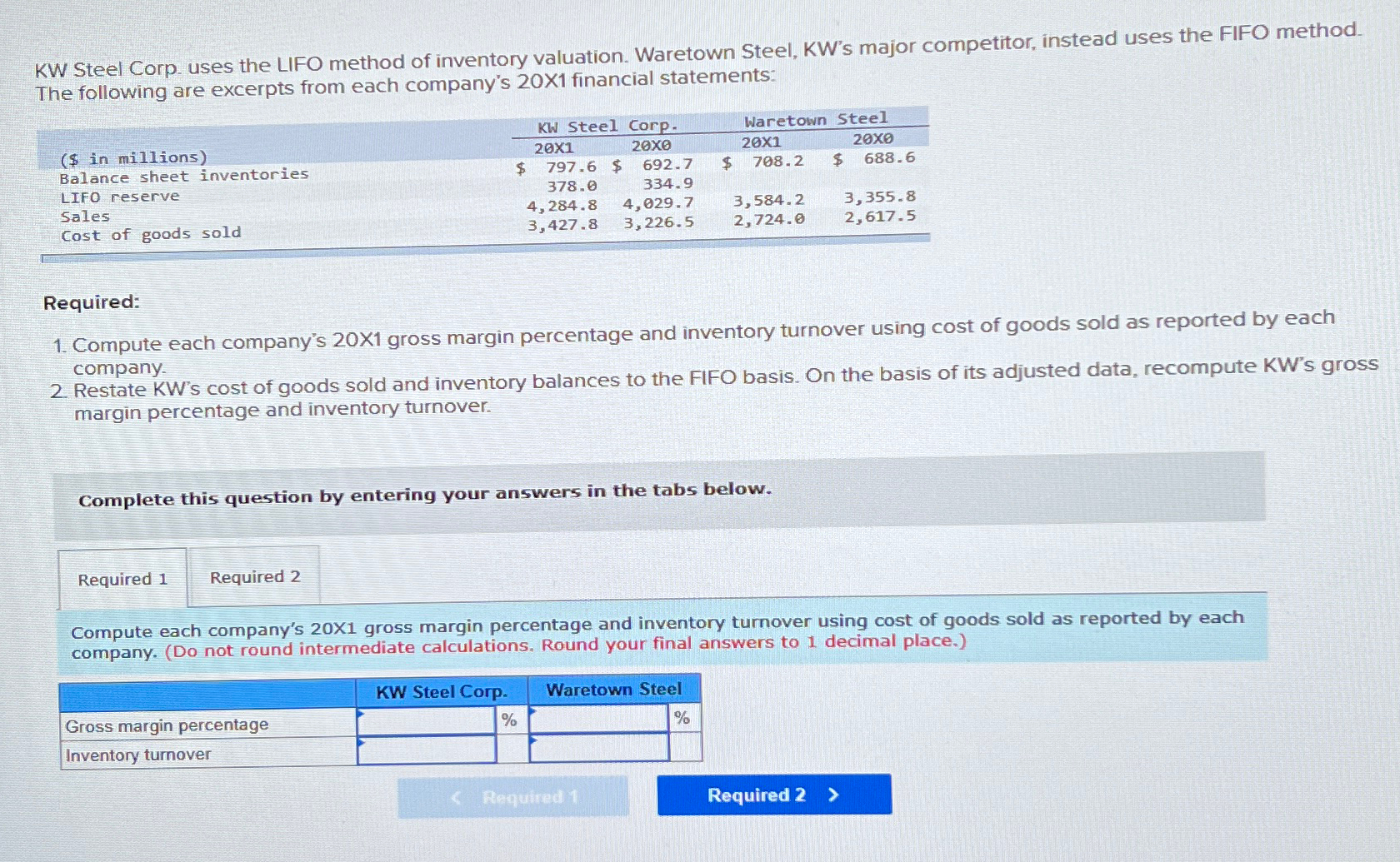

KW Steel Corp. uses the LIFO method of inventory valuation. Waretown Steel, KW's major competitor, instead uses the FIFO method. The following are excerpts

KW Steel Corp. uses the LIFO method of inventory valuation. Waretown Steel, KW's major competitor, instead uses the FIFO method. The following are excerpts from each company's 20X1 financial statements: ($ in millions) Balance sheet inventories LIFO reserve Sales Cost of goods sold $ KW Steel Corp. 20X1 Waretown Steel 20x1 20X0 20X0 797.6 $ 692.7 334.9 4,029.7 3,427.8 3,226.5 $ 708.2 $ 688.6 3,584.2 2,724.0 3,355.8 2,617.5 378.0 4,284.8 Required: 1. Compute each company's 20X1 gross margin percentage and inventory turnover using cost of goods sold as reported by each company. 2. Restate KW's cost of goods sold and inventory balances to the FIFO basis. On the basis of its adjusted data, recompute KW's gross margin percentage and inventory turnover. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute each company's 20X1 gross margin percentage and inventory turnover using cost of goods sold as reported by each company. (Do not round intermediate calculations. Round your final answers to 1 decimal place.) Gross margin percentage Inventory turnover KW Steel Corp. Waretown Steel % % < Required 1 Required 2 >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started