Question

Kyle Forman worked 45 hours during the week for Erickson Company at two different jobs. His pay rate was $13.75 for the first 40 hours,

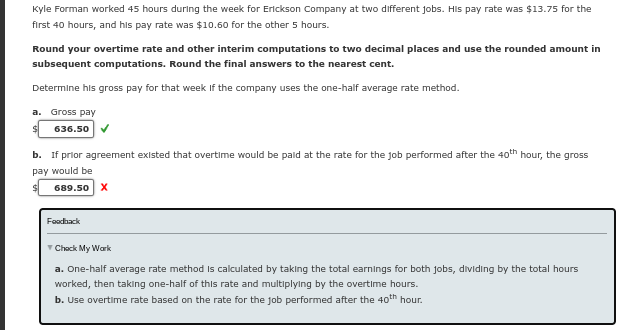

Kyle Forman worked 45 hours during the week for Erickson Company at two different jobs. His pay rate was $13.75 for the first 40 hours, and his pay rate was $10.60 for the other 5 hours.

Round your overtime rate and other interim computations to two decimal places and use the rounded amount in subsequent computations. Round the final answers to the nearest cent.

Determine his gross pay for that week if the company uses the one-half average rate method.

a. Gross pay

b. If prior agreement existed that overtime would be paid at the rate for the job performed after the 40th hour, the gross pay would be

Kyle Forman worked 45 hours during the week for Erickson Company at two different jobs. His pay rate was $13.75 for the first 40 hours, and his pay rate was $10.60 for the other 5 hours. Round your overtime rate and other interim computations to two decimal places and use the rounded amount in subsequent computations. Round the final answers to the nearest cent. Determine his gross pay for that week if the company uses the one-half average rate method. a. Gross pay $ 636.50 b. If prior agreement existed that overtime would be paid at the rate for the job performed after the 40th hour, the gross pay would be 689.50 X Foodback Check My Work a. One-half average rate method is calculated by taking the total earnings for both jobs, dividing by the total hours worked, then taking one-half of this rate and multiplying by the overtime hours. b. Use overtime rate based on the rate for the job performed after the 40th hour.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started