Answered step by step

Verified Expert Solution

Question

1 Approved Answer

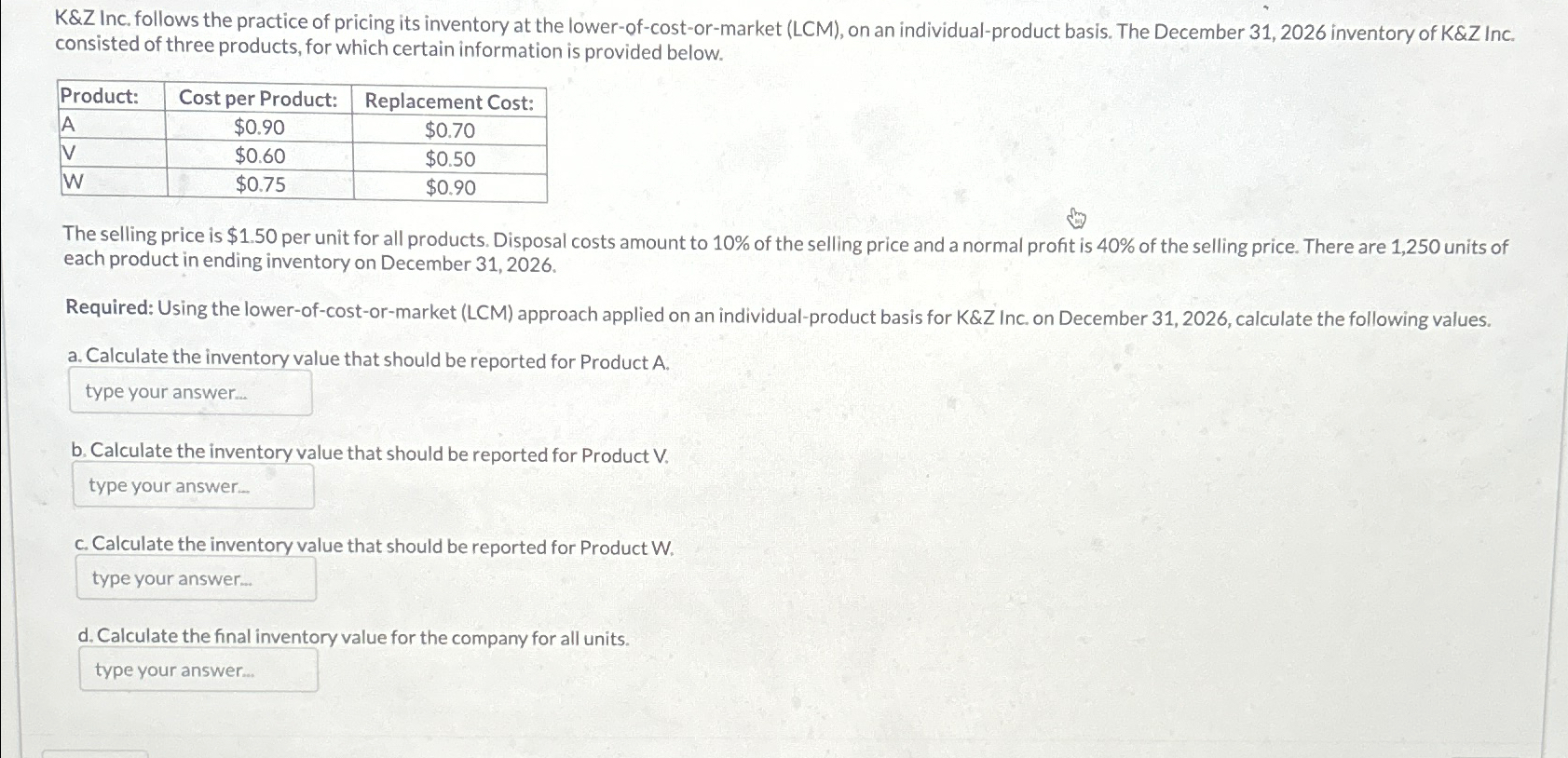

K&Z Inc. follows the practice of pricing its inventory at the lower-of-cost-or-market (LCM), on an individual-product basis. The December 31, 2026 inventory of K&Z

K&Z Inc. follows the practice of pricing its inventory at the lower-of-cost-or-market (LCM), on an individual-product basis. The December 31, 2026 inventory of K&Z Inc. consisted of three products, for which certain information is provided below. Product: Cost per Product: A $0.90 V Replacement Cost: $0.70 W $0.60 $0.75 $0.50 $0.90 The selling price is $1.50 per unit for all products. Disposal costs amount to 10% of the selling price and a normal profit is 40 % of the selling price. There are 1,250 units of each product in ending inventory on December 31, 2026. Required: Using the lower-of-cost-or-market (LCM) approach applied on an individual-product basis for K&Z Inc. on December 31, 2026, calculate the following values. a. Calculate the inventory value that should be reported for Product A. type your answer.... b. Calculate the inventory value that should be reported for Product V. type your answer.... c. Calculate the inventory value that should be reported for Product W. type your answer... d. Calculate the final inventory value for the company for all units. type your answer...

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Answer a To calculate the inventory value that should be reported for Product A we need to compare t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663deb3ad887d_961062.pdf

180 KBs PDF File

663deb3ad887d_961062.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started