Answered step by step

Verified Expert Solution

Question

1 Approved Answer

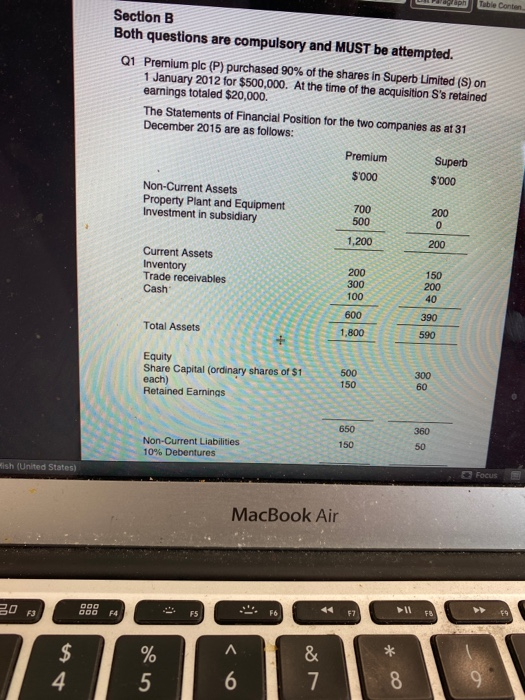

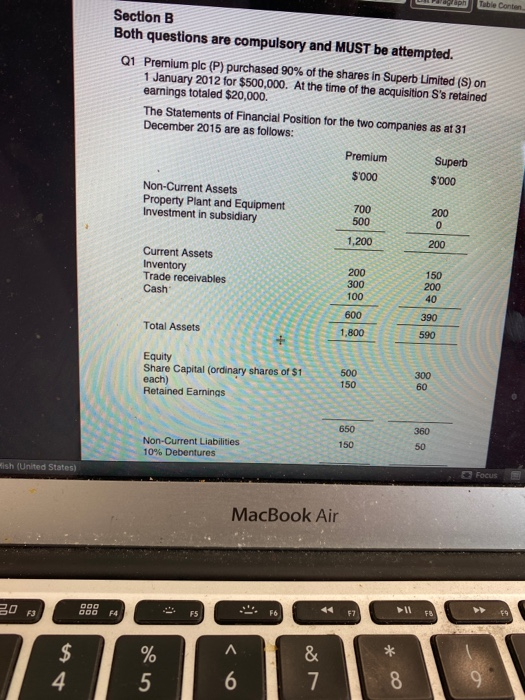

L a p Table Conten Section B Both questions are compulsory and MUST be attempted. Q1 Premium plc (P) purchased 90% of the shares in

L a p Table Conten Section B Both questions are compulsory and MUST be attempted. Q1 Premium plc (P) purchased 90% of the shares in Superb Limited (S) on 1 January 2012 for $500,000. At the time of the acquisition S's retained earnings totaled $20,000. The Statements of Financial Position for the two companies as at 31 December 2015 are as follows: Premium Superb $'000 $ 000 Non-Current Assets Property Plant and Equipment 700 200 Investment in subsidiary 500 1,200 200 Current Assets Inventory Trade receivables 300 200 Cash 100 600 Total Assets 1,800 200 Equity Share Capital (ordinary shares of $1 each) Retained Earnings 150 360 Non-Current Liabilities 10% Debentures 150 Wish (United States) Focus MacBook Air * F6 LA * O L a p Table Conten Section B Both questions are compulsory and MUST be attempted. Q1 Premium plc (P) purchased 90% of the shares in Superb Limited (S) on 1 January 2012 for $500,000. At the time of the acquisition S's retained earnings totaled $20,000. The Statements of Financial Position for the two companies as at 31 December 2015 are as follows: Premium Superb $'000 $ 000 Non-Current Assets Property Plant and Equipment 700 200 Investment in subsidiary 500 1,200 200 Current Assets Inventory Trade receivables 300 200 Cash 100 600 Total Assets 1,800 200 Equity Share Capital (ordinary shares of $1 each) Retained Earnings 150 360 Non-Current Liabilities 10% Debentures 150 Wish (United States) Focus MacBook Air * F6 LA * O

L a p Table Conten Section B Both questions are compulsory and MUST be attempted. Q1 Premium plc (P) purchased 90% of the shares in Superb Limited (S) on 1 January 2012 for $500,000. At the time of the acquisition S's retained earnings totaled $20,000. The Statements of Financial Position for the two companies as at 31 December 2015 are as follows: Premium Superb $'000 $ 000 Non-Current Assets Property Plant and Equipment 700 200 Investment in subsidiary 500 1,200 200 Current Assets Inventory Trade receivables 300 200 Cash 100 600 Total Assets 1,800 200 Equity Share Capital (ordinary shares of $1 each) Retained Earnings 150 360 Non-Current Liabilities 10% Debentures 150 Wish (United States) Focus MacBook Air * F6 LA * O L a p Table Conten Section B Both questions are compulsory and MUST be attempted. Q1 Premium plc (P) purchased 90% of the shares in Superb Limited (S) on 1 January 2012 for $500,000. At the time of the acquisition S's retained earnings totaled $20,000. The Statements of Financial Position for the two companies as at 31 December 2015 are as follows: Premium Superb $'000 $ 000 Non-Current Assets Property Plant and Equipment 700 200 Investment in subsidiary 500 1,200 200 Current Assets Inventory Trade receivables 300 200 Cash 100 600 Total Assets 1,800 200 Equity Share Capital (ordinary shares of $1 each) Retained Earnings 150 360 Non-Current Liabilities 10% Debentures 150 Wish (United States) Focus MacBook Air * F6 LA * O

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started