Question

L. Eron and A. Pilott are partners who share income and losses in the ratio of 3:2 respectively. The balance in the Profit and

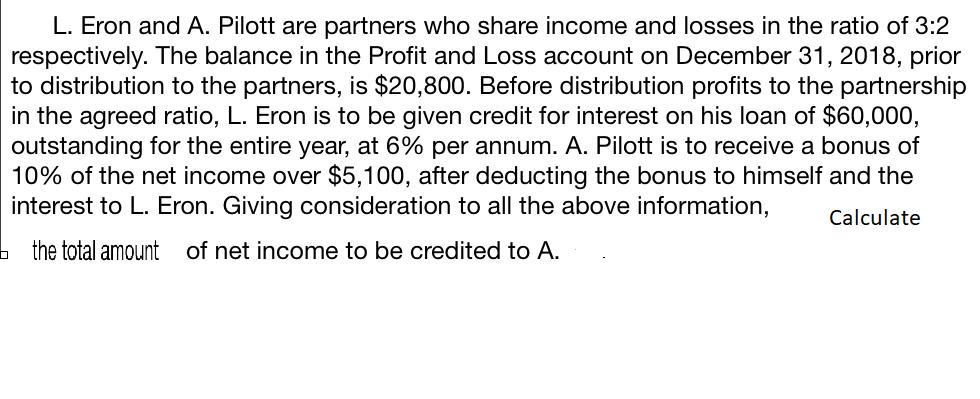

L. Eron and A. Pilott are partners who share income and losses in the ratio of 3:2 respectively. The balance in the Profit and Loss account on December 31, 2018, prior to distribution to the partners, is $20,800. Before distribution profits to the partnership in the agreed ratio, L. Eron is to be given credit for interest on his loan of $60,000, outstanding for the entire year, at 6% per annum. A. Pilott is to receive a bonus of 10% of the net income over $5,100, after deducting the bonus to himself and the interest to L. Eron. Giving consideration to all the above information, Calculate the total amount of net income to be credited to A.

Step by Step Solution

3.52 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Interest on L 600000061 3600 Bonus given ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Financial Accounting

Authors: Theodore E. Christensen, David M. Cottrell, Richard E. Baker

10th edition

78025621, 978-0078025624

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App