Answered step by step

Verified Expert Solution

Question

1 Approved Answer

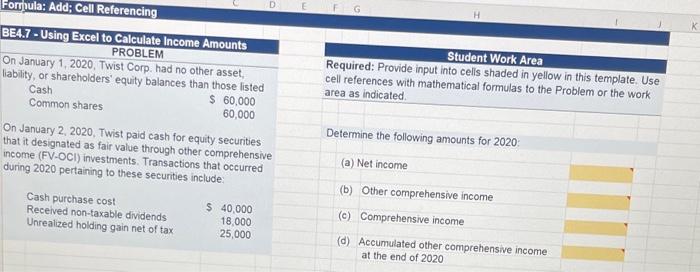

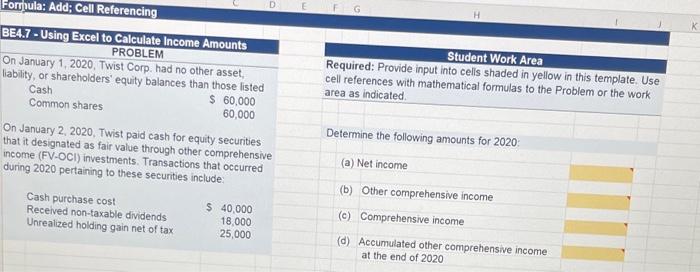

l Formula: Add; Cell Referencing BE4.7-Using Excel to Calculate Income Amounts PROBLEM On January 1, 2020, Twist Corp. had no other asset, liability, or shareholders'

l

Formula: Add; Cell Referencing BE4.7-Using Excel to Calculate Income Amounts PROBLEM On January 1, 2020, Twist Corp. had no other asset, liability, or shareholders' equity balances than those listed Cash $ 60,000 60,000 Common shares On January 2, 2020, Twist paid cash for equity securities that it designated as fair value through other comprehensive income (FV-OCI) investments. Transactions that occurred during 2020 pertaining to these securities include: Cash purchase cost Received non-taxable dividends Unrealized holding gain net of tax $ 40,000 18,000 25,000 D E Student Work Area Required: Provide input into cells shaded in yellow in this template. Use cell references with mathematical formulas to the Problem or the work area as indicated. Determine the following amounts for 2020: (a) Net income (b) Other comprehensive income (c) Comprehensive income (d) Accumulated other comprehensive income at the end of 2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started