Answered step by step

Verified Expert Solution

Question

1 Approved Answer

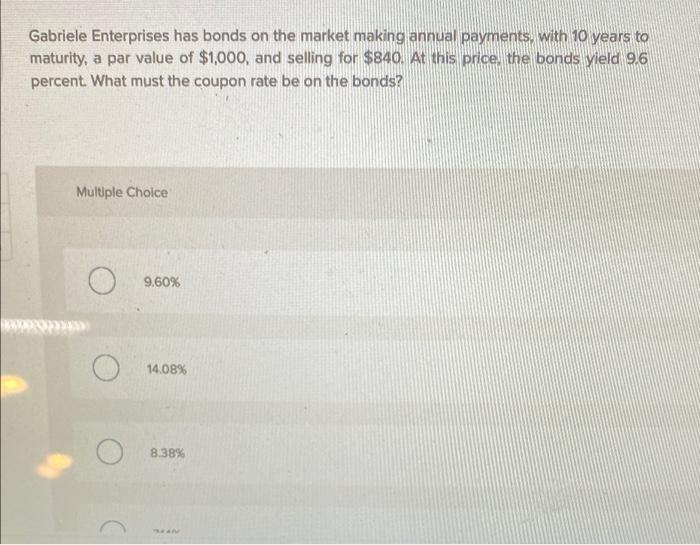

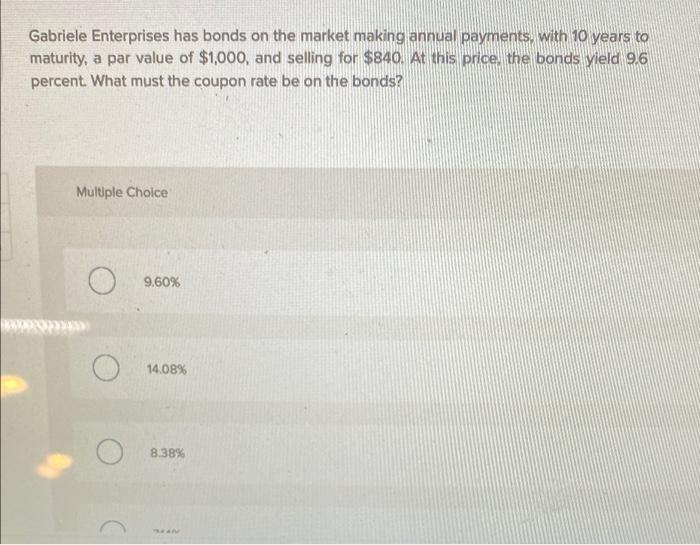

l Gabriele Enterprises has bonds on the market making annual payments with 10 years to maturity, a par value of $1,000, and selling for $840.

l

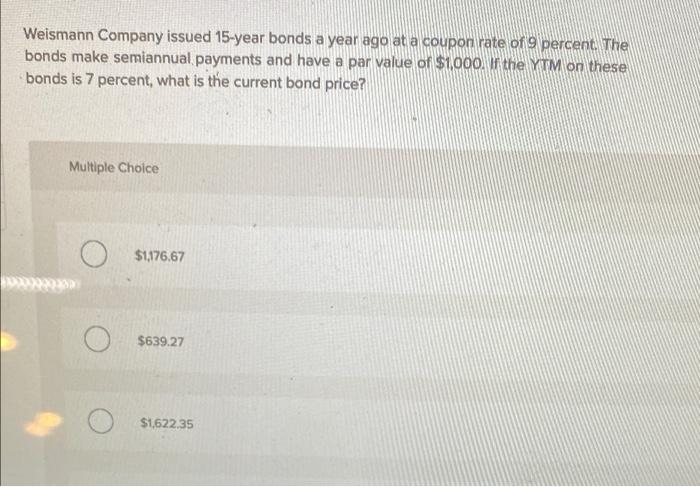

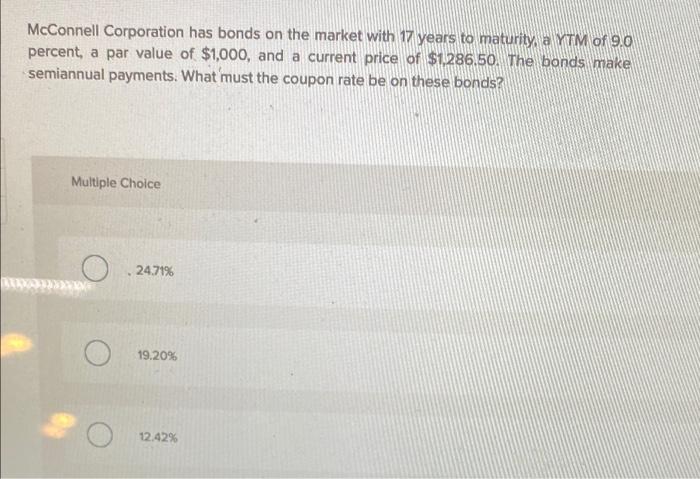

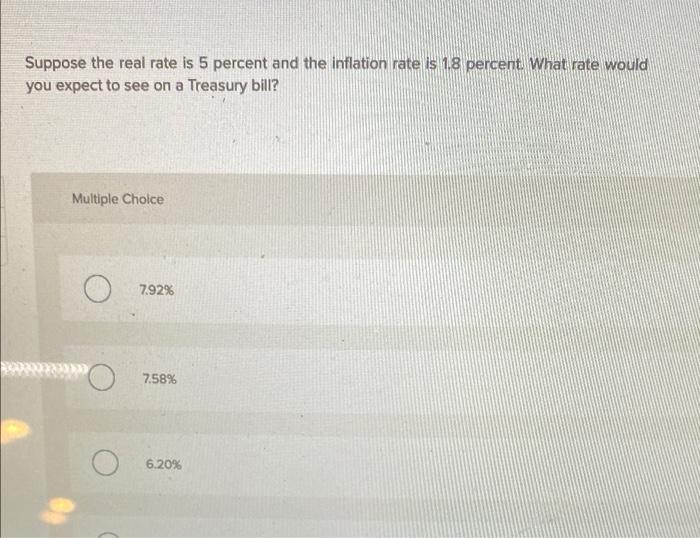

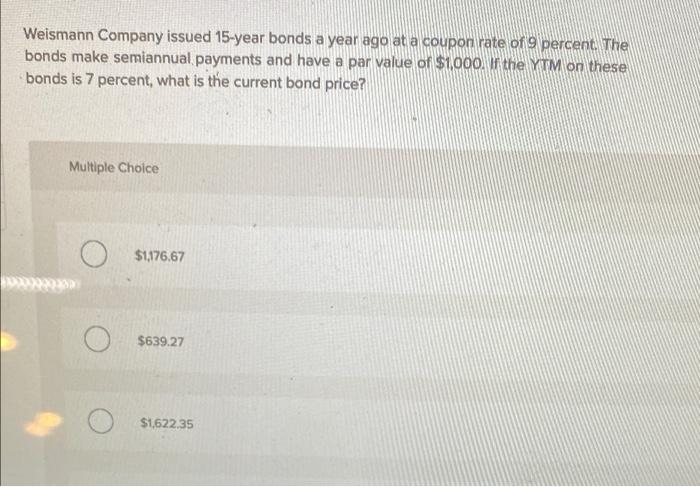

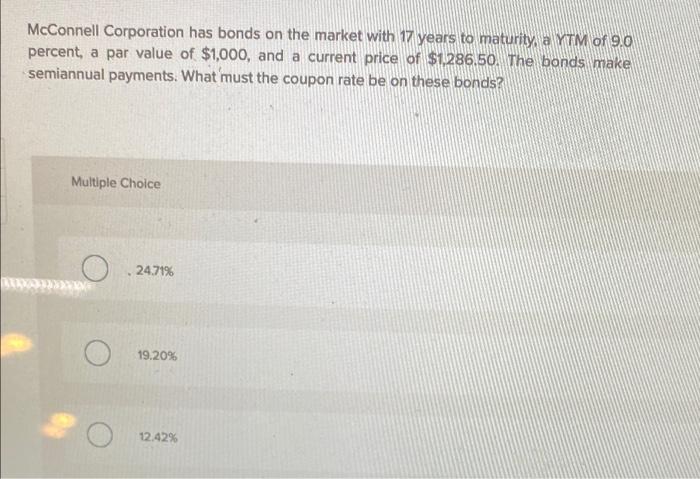

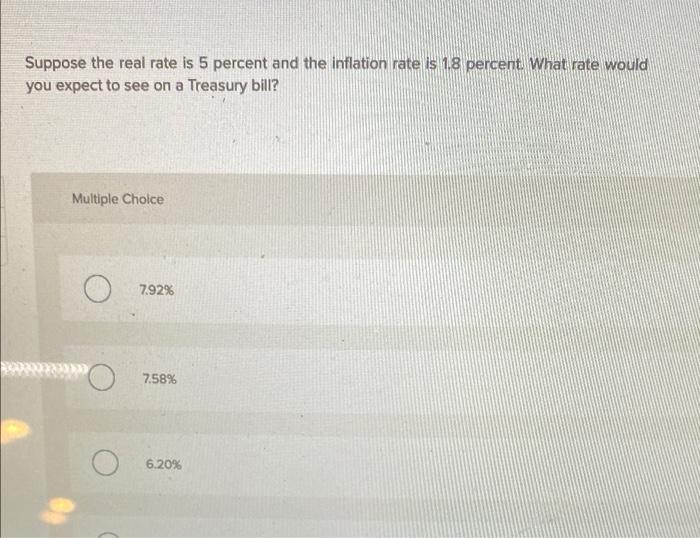

Gabriele Enterprises has bonds on the market making annual payments with 10 years to maturity, a par value of $1,000, and selling for $840. At this price the bonds yield 9.6 percent. What must the coupon rate be on the bonds? Multiple Choice 0 9.60% 14.08% 8.38% Weismann Company issued 15-year bonds a year ago at a coupon rate of 9 percent. The bonds make semiannual payments and have a par value of $1.000. If the YTM on these bonds is 7 percent, what is the current bond price? Multiple Choice O $1176.67 $639.27 $1,622.35 McConnell Corporation has bonds on the market with 17 years to maturity, a YTM of 9.0 percent, a par value of $1,000, and a current price of $1.286.50. The bonds make semiannual payments. What must the coupon rate be on these bonds? Multiple Choice 24.71% 19.20% 12.42% Suppose the real rate is 5 percent and the inflation rate is 1.8 percent. What rate would you expect to see on a Treasury bill? Multiple Choice 7.92% 7.58% 6.20%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started