Answered step by step

Verified Expert Solution

Question

1 Approved Answer

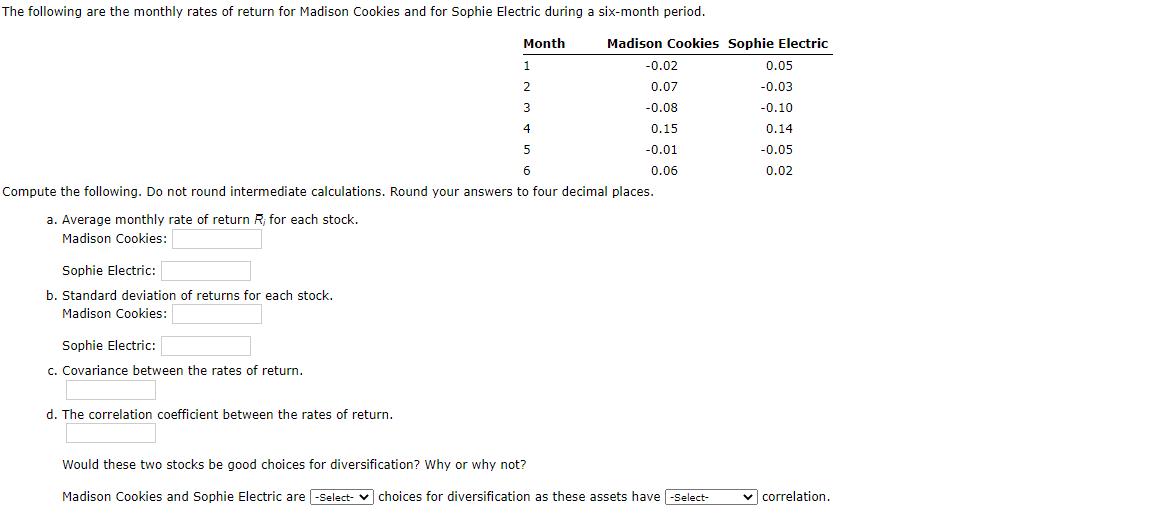

The following are the monthly rates of return for Madison Cookies and for Sophie Electric during a six-month period. Madison Cookies Sophie Electric Month

The following are the monthly rates of return for Madison Cookies and for Sophie Electric during a six-month period. Madison Cookies Sophie Electric Month 1 2 3 4 5 6 Compute the following. Do not round intermediate calculations. Round your answers to four decimal places. a. Average monthly rate of return R, for each stock. Madison Cookies: Sophie Electric: b. Standard deviation of returns for each stock. Madison Cookies: Sophie Electric: c. Covariance between the rates of return. d. The correlation coefficient between the rates of return. -0.02 0.07 -0.08 0.15 -0.01 0.06 Would these two stocks be good choices for diversification? Why or why not? Madison Cookies and Sophie Electric are -Select- choices for diversification as these assets have [-Select- 0.05 -0.03 -0.10 0.14 -0.05 0.02 correlation.

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Using excel formula to calculate Average Return B C 1 Month Madison Cookies Sophie Electric 2 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started