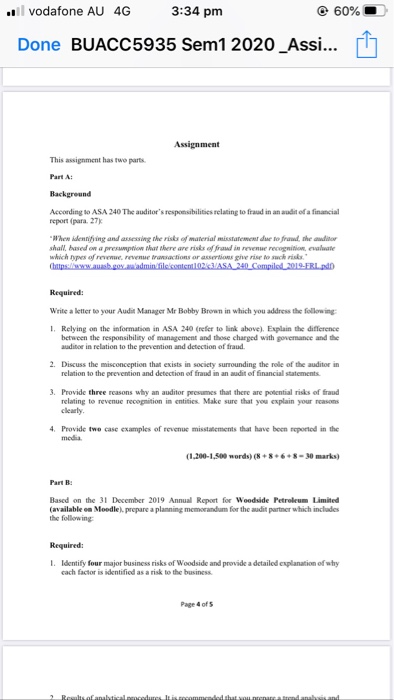

l vodafone AU 4G 3:34 pm 60% Done BUACC5935 Sem1 2020 _Assi... Assignment This assignment has two parts Purt Background According to ASA 240 The auditor's responsibilities relating to fraud in an audit of a financial report (para 27 When identifying and assessing the risks of material misstatement due to frond, the auditor shall based on a presumptiow that there are risks of fraud in revenue recognition, evaluate which pes of revenue revenue transactions or assertion give rise to such riske https://www.asb.gov.admin file contentO2c3/ASA 240_Compiled_2019-FRL.pd Required: Write a letter to your Audit Manager Mr Bobby Brown in which you address the following 1. Relying on the information in ASA 240 (refer to link above). Explain the difference between the responsibility of management and those charged with governance and the auditor in relation to the prevention and detection of fraud. 2. Discuss the misconception that exists in society surrounding the role of the auditor in relation to the prevention and detection of fraud in an audit of financial statements 3. Provide three reasons why an auditor presumes that there are potential risks of fraud relating to revenue recognition in entities. Make sure that you explain your reasons clearly 4. Provide two case examples of revenue misstatements that have been reported in the media (1,200-1,500 words)(8 +8+6+8 - 30 marks) Part B: Based on the 31 December 2019 Annual Report for Woodside Petroleum Limited (available on Moodle). prepare a planning memorandum for the audit partner which includes the following Required: 1. Identify four major business risks of Woodside and provide a detailed explanation of why cach factor is identified as a risk to the business Page 4 of 5 Recutafanubedugommododhuendanaand l vodafone AU 4G 3:34 pm 60% Done BUACC5935 Sem1 2020 _Assi... Assignment This assignment has two parts Purt Background According to ASA 240 The auditor's responsibilities relating to fraud in an audit of a financial report (para 27 When identifying and assessing the risks of material misstatement due to frond, the auditor shall based on a presumptiow that there are risks of fraud in revenue recognition, evaluate which pes of revenue revenue transactions or assertion give rise to such riske https://www.asb.gov.admin file contentO2c3/ASA 240_Compiled_2019-FRL.pd Required: Write a letter to your Audit Manager Mr Bobby Brown in which you address the following 1. Relying on the information in ASA 240 (refer to link above). Explain the difference between the responsibility of management and those charged with governance and the auditor in relation to the prevention and detection of fraud. 2. Discuss the misconception that exists in society surrounding the role of the auditor in relation to the prevention and detection of fraud in an audit of financial statements 3. Provide three reasons why an auditor presumes that there are potential risks of fraud relating to revenue recognition in entities. Make sure that you explain your reasons clearly 4. Provide two case examples of revenue misstatements that have been reported in the media (1,200-1,500 words)(8 +8+6+8 - 30 marks) Part B: Based on the 31 December 2019 Annual Report for Woodside Petroleum Limited (available on Moodle). prepare a planning memorandum for the audit partner which includes the following Required: 1. Identify four major business risks of Woodside and provide a detailed explanation of why cach factor is identified as a risk to the business Page 4 of 5 Recutafanubedugommododhuendanaand