Question

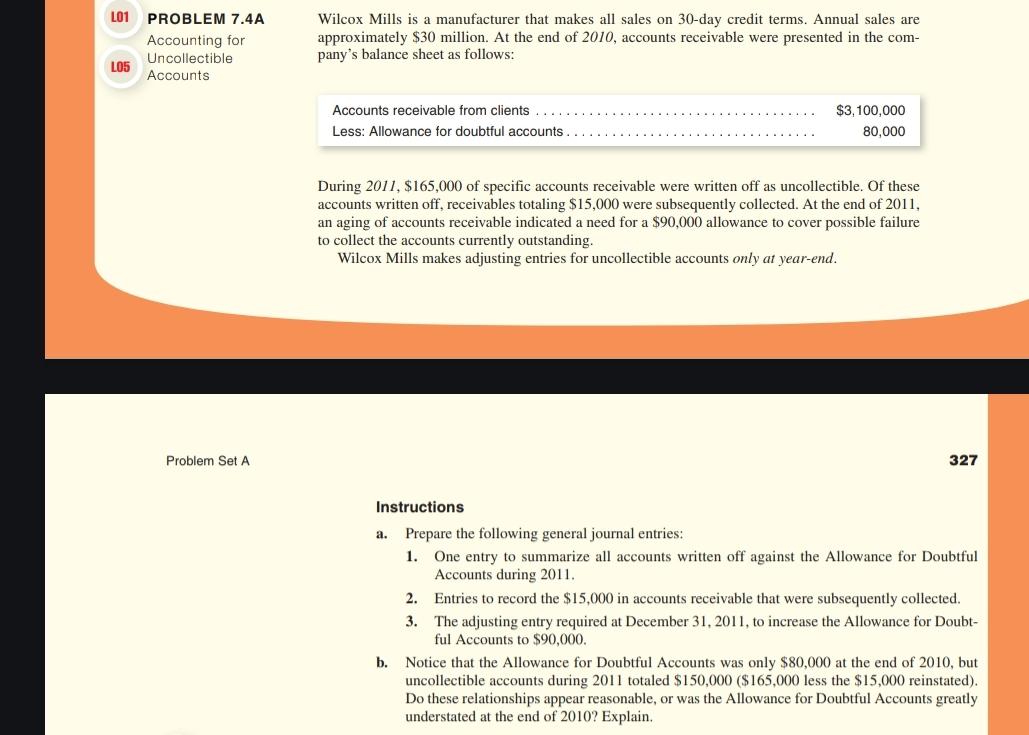

L01 PROBLEM 7.4A Wilcox Mills is a manufacturer that makes all sales on 30-day credit terms. Annual sales are Accounting for 105 Uncollectible approximately $30

L01 PROBLEM 7.4A Wilcox Mills is a manufacturer that makes all sales on 30-day credit terms. Annual sales are\ Accounting for\ 105\ Uncollectible approximately

$30million. At the end of 2010 , accounts receivable were presented in the company's balance sheet as follows:\ Accounts\ Accounts receivable from clients . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$3,100,000\ Less: Allowance for doubtful accounts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 80,000\ During 2011,

$165,000of specific accounts receivable were written off as uncollectible. Of these accounts written off, receivables totaling

$15,000were subsequently collected. At the end of 2011 , an aging of accounts receivable indicated a need for a

$90,000allowance to cover possible failure to collect the accounts currently outstanding.\ Wilcox Mills makes adjusting entries for uncollectible accounts only at year-end.\ Problem Set A\ 327\ Instructions\ a. Prepare the following general journal entries:\ One entry to summarize all accounts written off against the Allowance for Doubtful Accounts during 2011.\ Entries to record the

$15,000in accounts receivable that were subsequently collected.\ The adjusting entry required at December 31,2011 , to increase the Allowance for Doubtful Accounts to

$90,000.\ b. Notice that the Allowance for Doubtful Accounts was only

$80,000at the end of 2010 , but uncollectible accounts during 2011 totaled

$150,000(

$165,000less the

$15,000reinstated). Do these relationships appear reasonable, or was the Allowance for Doubtful Accounts greatly understated at the end of 2010 ? Explain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started